Phil's Blog

A Homeowner’s Net Worth is 36x Greater Than A Renter!

September 22, 2014

| A Homeowner’s Net Worth is 36x Greater Than A Renter! Posted: 22 Sep 2014 04:00 AM PDT  Over the last six years, homeownership has lost some of its allure as a financial investment. As homeowners suffered through the housing bust, more and more began to question whether owning a home was truly a good way to build wealth. The Federal Reserve conducts a Survey of Consumer Finances, every three years, and just released their latest edition this past week. Some of the findings revealed in their report: Over the last six years, homeownership has lost some of its allure as a financial investment. As homeowners suffered through the housing bust, more and more began to question whether owning a home was truly a good way to build wealth. The Federal Reserve conducts a Survey of Consumer Finances, every three years, and just released their latest edition this past week. Some of the findings revealed in their report:

Bottom LineThe Fed study found that homeownership is still a great way for a family to build wealth in America. ____________________________________________________________________ Members: Sign in now to set up |

5 Reasons to Hire a Real Estate Professional [INFOGRAPHIC]

September 19, 2014

| 5 Reasons to Hire a Real Estate Professional [INFOGRAPHIC] Posted: 19 Sep 2014 04:00 AM PDT  ___________________________________________________________________ ___________________________________________________________________ |

Home Sales Generate $52,205 Impact on Economy

September 18, 2014

| Home Sales Generate $52,205 Impact on Economy Posted: 18 Sep 2014 04:00 AM PDT  The National Association of Realtors (NAR) compiled data from research conducted by the Bureau of Economic Analysis & Macroeconomic Advisors on the economic impact of a home purchase. After reviewing the data, they concluded that the total economic impact of a typical home sale in the United States is an astonishing $52,205. Here is the breakdown of their report: The National Association of Realtors (NAR) compiled data from research conducted by the Bureau of Economic Analysis & Macroeconomic Advisors on the economic impact of a home purchase. After reviewing the data, they concluded that the total economic impact of a typical home sale in the United States is an astonishing $52,205. Here is the breakdown of their report:

Economic Contributions are derived from:

When a House is Sold in the United States:$15,912 of income is generated from real estate related industries. New homeowners spend an additional $4,429 on consumer items such as furniture, appliances, and remodeling. It generates an economic multiplier impact. There is a greater sense of community associated with owning a home; therefore there is greater spending at restaurants, sports games, and charity events. The size of this “multiplier” effect is estimated to be: $9,764 Additional home sales induce additional home production. Typically one new home is constructed for every 8 existing home sales. Therefore, for each existing home sale, 1/8 of new home value is added to the economy, which is estimated in the U.S. to be: $22,100When you add the numbers up it comes to $52,205!_______________________________________________________ Members: Sign in now to set up your Personalized Posts & start sharing today! Members: Sign in now to set up your Personalized Posts & start sharing today!Not a member yet? Click Here to learn more about KCM's newest feature, Personalized Posts. |

FSBO's Must Be Ready to Negotiate

September 17, 2014

| FSBO's Must Be Ready to Negotiate Posted: 17 Sep 2014 04:00 AM PDT  In a recovering market, some sellers might be tempted to try and sell their home on their own (FSBO) without using the services of a real estate professional. The real estate agent is a trained and experienced negotiator. In most cases, the seller is not. The seller must realize the ability to negotiate will determine whether they get the best deal for themselves and their family. Here is a list of some of the people with whom the seller must be prepared to negotiate if they decide to FSBO: In a recovering market, some sellers might be tempted to try and sell their home on their own (FSBO) without using the services of a real estate professional. The real estate agent is a trained and experienced negotiator. In most cases, the seller is not. The seller must realize the ability to negotiate will determine whether they get the best deal for themselves and their family. Here is a list of some of the people with whom the seller must be prepared to negotiate if they decide to FSBO:

Members: Sign in now to set up your Personalized Posts & start sharing today! Not a member yet? Click Here to learn more about KCM's newest feature, Personalized Posts. |

The Two Things You Don’t Need to Hear from Your Listing Agent

September 16, 2014

| The Two Things You Don’t Need to Hear from Your Listing Agent Posted: 16 Sep 2014 04:00 AM PDT  You’ve decided to sell your house. You begin to interview potential real estate agents to help you through the process. You need someone you trust enough to: You’ve decided to sell your house. You begin to interview potential real estate agents to help you through the process. You need someone you trust enough to:

An agent must be concerned first and foremost about you and your family in order to garner that degree of trust. Make sure this is the case.Be careful if the agent you are interviewing begins the interview by:

Agents: How would it sound if you could share this article with your clients using your own branded page? Agents: How would it sound if you could share this article with your clients using your own branded page?Members: Sign in now to set up your Personalized Posts & start sharing today! Not a member yet? Click Here to learn more about KCM's newest feature, Personalized Posts. |

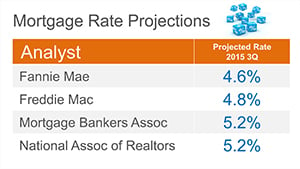

How Interest Rates Impact Family Wealth

September 15, 2014

| How Interest Rates Impact Family Wealth Posted: 15 Sep 2014 04:00 AM PDT  With interest rates still in the low 4%’s, many buyers may be on the fence as to whether to act now and purchase a new home, or wait until next year. If you look at what the experts are predicting for 2015, it may make the decision for you. With interest rates still in the low 4%’s, many buyers may be on the fence as to whether to act now and purchase a new home, or wait until next year. If you look at what the experts are predicting for 2015, it may make the decision for you.

Predictions for 2015 3Q:§ 4.6% - Fannie Mae§ 4.8% - Freddie Mac§ 5.2% - Mortgage Bankers Association§ 5.2% - National Association of RealtorsEven an increase of half a percentage point can put a dent in your family’s net worth.Let’s look at it this way…The monthly payment (principal & interest only) on a $250,000 home today, with the current 4.1% interest rate would be $1,208. If we take that same home a year later, the Home Price Expectation Survey projects that prices will rise about 4% making that home cost $10,000 more at $260,000. If we take Freddie Mac’s rate projection of 4.8%, the monthly mortgage payment climbs to $1,364. Some buyers might not think that an extra $156 a month is that bad. But over the course of 30-year mortgage you have spent an additional $56,160 by waiting a year. _______________________________________________________________________ Agents: KCM provides you with the visuals you need to simply & effectively explain a complex housing market to your clients. Start your 14-day free trial today to see the difference KCM can make to your business. Agents: KCM provides you with the visuals you need to simply & effectively explain a complex housing market to your clients. Start your 14-day free trial today to see the difference KCM can make to your business. |

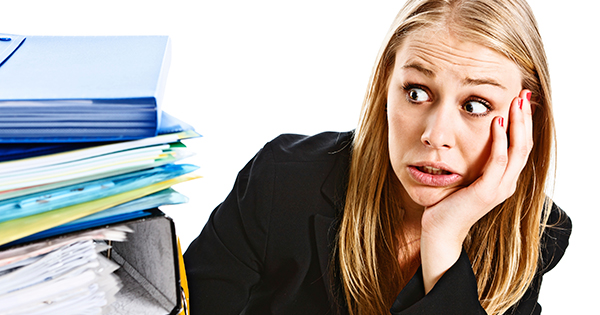

Getting A Mortgage: Why So Much Paperwork?

September 11, 2014

| Getting A Mortgage: Why So Much Paperwork? Posted: 11 Sep 2014 04:00 AM PDT  We are often asked why there is so much paperwork mandated by the bank for a mortgage loan application when buying a home today. It seems that the bank needs to know everything about us and requires three separate sources to validate each and every entry on the application form. Many buyers are being told by friends and family that the process was a hundred times easier when they bought their home ten to twenty years ago. There are two very good reasons that the loan process is much more onerous on today’s buyer than perhaps any time in history. We are often asked why there is so much paperwork mandated by the bank for a mortgage loan application when buying a home today. It seems that the bank needs to know everything about us and requires three separate sources to validate each and every entry on the application form. Many buyers are being told by friends and family that the process was a hundred times easier when they bought their home ten to twenty years ago. There are two very good reasons that the loan process is much more onerous on today’s buyer than perhaps any time in history.

Bottom LineInstead of concentrating on the additional paperwork required, let’s be thankful that we are able to buy a home at historically low rates. __________________________________________________________________ |

Buying a Home is 38% Less Expensive than Renting!

September 10, 2014

| Buying a Home is 38% Less Expensive than Renting! Posted: 10 Sep 2014 04:00 AM PDT  In Trulia’s 2014 Rent vs. Buy Report, they explained that homeownership remains cheaper than renting throughout the 100 largest metro areas in the United States; ranging from an average of 5% in Honolulu, all the way to 66% in Detroit, and 38% Nationwide! The other interesting findings in the report include: In Trulia’s 2014 Rent vs. Buy Report, they explained that homeownership remains cheaper than renting throughout the 100 largest metro areas in the United States; ranging from an average of 5% in Honolulu, all the way to 66% in Detroit, and 38% Nationwide! The other interesting findings in the report include:Even though prices increased sharply in many markets over the past year, low mortgage rates have kept homeownership from becoming more expensive than renting. Some markets might tip in favor of renting later this year as prices continue to rise faster than rents and if – as most economists expect – mortgage rates rise, due both to the strengthening economy and Fed tapering. Nationally, rates would have to rise to 10.6% for renting to be cheaper than buying – and rates haven’t been that high since 1989. Bottom LineBuying a home makes sense. Rental costs have historically increased at a higher rate of inflation. Lock in a mortgage payment now before home prices and mortgage rates rise as experts expect they will. |

You Need A Professional When Buying A Home

September 9, 2014

You Need A Professional When Buying A Home |

| You Need A Professional When Buying A Home Posted: 09 Sep 2014 04:00 AM PDT  Many people wonder whether they should hire a real estate professional to assist them in buying their dream home or if they should first try to go it on their own. In today’s market: you need an experienced professional! You Need an Expert Guide if you are Traveling a Dangerous PathThe field of real estate is loaded with land mines. You need a true expert to guide you through the dangerous pitfalls that currently exist. Finding a home that is priced appropriately and ready for you to move in to can be tricky. An agent listens to your wants and needs, and can sift out the homes that do not fit within the parameters of your “dream home”.A great agent will also have relationships with mortgage professionals and other experts that you will need in securing your dream home. You Need a Skilled NegotiatorIn today’s market, hiring a talented negotiator could save you thousands, perhaps tens of thousands of dollars. Each step of the way – from the original offer, to the possible renegotiation of that offer after a home inspection, to the possible cancellation of the deal based on a troubled appraisal – you need someone who can keep the deal together until it closes.Realize that when an agent is negotiating their commission with you, they are negotiating their own salary; the salary that keeps a roof over their family’s head; the salary that puts food on their family’s table. If they are quick to take less when negotiating for themselves and their families, what makes you think they will not act the same way when negotiating for you and your family? If they were Clark Kent when negotiating with you, they will not turn into Superman when negotiating with the buyer or seller in your deal. Bottom LineFamous sayings become famous because they are true. You get what you pay for. Just like a good accountant or a good attorney, a good agent will save you money…not cost you money.____________________________________________________________________ |

4 Reasons to Buy Before Winter

September 8, 2014

| 4 Reasons to Buy Before Winter Posted: 08 Sep 2014 04:00 AM PDT  It's that time of year, the seasons are changing and with them bring thoughts of the upcoming holidays, family get togethers, and planning for a new year. Those who are on the fence about whether now is the right time to buy don't have to look much farther to find four great reasons to consider buying a home now, instead of waiting. 1. Prices Will Continue to RiseThe Home Price Expectation Survey polls a distinguished panel of over 100 economists, investment strategists, and housing market analysts. Their most recent report released recently projects appreciation in home values over the next five years to be between 11.2% (most pessimistic) and 27.8% (most optimistic).The bottom in home prices has come and gone. Home values will continue to appreciate for years. Waiting no longer makes sense. 2. Mortgage Interest Rates Are Projected to IncreaseAlthough Freddie Mac’s Primary Mortgage Market Survey shows that interest rates for a 30-year mortgage have softened recently, most experts predict that they will begin to rise later this year. The Mortgage Bankers Association, Fannie Mae, Freddie Mac and the National Association of Realtors are in unison projecting that rates will be up almost a full percentage point by the end of next year.An increase in rates will impact YOUR monthly mortgage payment. Your housing expense will be more a year from now if a mortgage is necessary to purchase your next home. 3. Either Way You are Paying a MortgageAs a recent paper from the Joint Center for Housing Studies at Harvard University explains: “Households must consume housing whether they own or rent. Not even accounting for more favorable tax treatment of owning, homeowners pay debt service to pay down their own principal while households that rent pay down the principal of a landlord plus a rate of return. That’s yet another reason owning often does—as Americans intuit—end up making more financial sense than renting.”4. It’s Time to Move On with Your LifeThe ‘cost’ of a home is determined by two major components: the price of the home and the current mortgage rate. It appears that both are on the rise. But, what if they weren’t? Would you wait? Look at the actual reason you are buying and decide whether it is worth waiting. Whether you want to have a great place for your children to grow up, you want your family to be safer or you just want to have control over renovations, maybe it is time to buy.Bottom LineIf the right thing for you and your family is to purchase a home this year, buying sooner rather than later could lead to substantial savings._________________________________________________________________________ |

The Cost of Renting vs. Buying [INFOGRAPHIC]

September 5, 2014

| The Cost of Renting vs. Buying [INFOGRAPHIC] Posted: 05 Sep 2014 04:00 AM PDT ![The Cost of Renting vs. Buying [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2014/09/Rent-vs.-Buy-1500.jpg) |

5 Questions You Should Ask Your Real Estate Agent

September 4, 2014

| 5 Questions You Should Ask Your Real Estate Agent Posted: 04 Sep 2014 04:00 AM PDT  Whether you are buying or selling a home, the process can be challenging. That is why we always suggest that you take on the services of a real estate professional when embarking on a potential home move. However, not all real estate agents are the same. A family must make sure they hire someone who truly understands the current housing market and, not only that, knows how to connect the dots to explain how market conditions may impact your decision. How can you make sure you have an agent who meets these requirements? Here are just a few questions every real estate professional should be able to answer for their clients and customers: Whether you are buying or selling a home, the process can be challenging. That is why we always suggest that you take on the services of a real estate professional when embarking on a potential home move. However, not all real estate agents are the same. A family must make sure they hire someone who truly understands the current housing market and, not only that, knows how to connect the dots to explain how market conditions may impact your decision. How can you make sure you have an agent who meets these requirements? Here are just a few questions every real estate professional should be able to answer for their clients and customers:

|

5 Reasons to Sell BEFORE Winter Hits

September 3, 2014

| 5 Reasons to Sell BEFORE Winter Hits Posted: 03 Sep 2014 04:00 AM PDT  People across the country are beginning to think about what their life will look like next year. It happens every Fall. We ponder whether we should relocate to a different part of the country to find better year round weather or perhaps move across the state for better job opportunities. Homeowners in this situation must consider whether they should sell their house now or wait. If you are one of these potential sellers, here are five important reasons to do it now versus the dead of winter. People across the country are beginning to think about what their life will look like next year. It happens every Fall. We ponder whether we should relocate to a different part of the country to find better year round weather or perhaps move across the state for better job opportunities. Homeowners in this situation must consider whether they should sell their house now or wait. If you are one of these potential sellers, here are five important reasons to do it now versus the dead of winter.

1. Demand is StrongFoot traffic refers to the number of people out actually physically looking at home right now. The latest foot traffic numbers show that there are more prospective purchasers currently looking at homes than at any other time in the last twelve months which includes the latest spring buyers’ market. These buyers are ready, willing and able to buy…and are in the market right now! As we get later into the year, many people have other things (weather, holidays, etc.) that distract them from searching for a home. Take advantage of the buyer activity currently in the market.2. There Is Less Competition NowHousing supply is still under the historical number of 6 months’ supply. This means that, in many markets, there are not enough homes for sale to satisfy the number of buyers in that market. This is good news for home prices. However, additional inventory is about to come to market. There is a pent-up desire for many homeowners to move as they were unable to sell over the last few years because of a negative equity situation. Homeowners are now seeing a return to positive equity as real estate values have increased over the last two years. Many of these homes will be coming to the market in the near future. Also, new construction of single-family homes is again beginning to increase. A recent study by Harris Poll revealed that 41% of buyers would prefer to buy a new home while only 21% prefer an existing home (38% had no preference). The choices buyers have will continue to increase over the next few months. Don’t wait until all this other inventory of homes comes to market before you sell.3. The Process Will Be QuickerOne of the biggest challenges of the 2014 housing market has been the length of time it takes from contract to closing. Banks are requiring more and more paperwork before approving a mortgage. Any delay in the process is always prolonged during the winter holiday season. Getting your house sold and closed before those delays begin will lend itself to a smoother transaction.4. There Will Never Be a Better Time to Move-UpIf you are moving up to a larger, more expensive home, consider doing it now. Prices are projected to appreciate by over 19% from now to 2018. If you are moving to a higher priced home, it will wind-up costing you more in raw dollars (both in down payment and mortgage payment) if you wait. You can also lock-in your 30 year housing expense with an interest rate in the low 4’s right now. Rates are projected to be over 5% by this time next year.5. It’s Time to Move On with Your LifeLook at the reason you decided to sell in the first place and determine whether it is worth waiting. Is money more important than being with family? Is money more important than your health? Is money more important than having the freedom to go on with your life the way you think you should? Only you know the answers to the questions above. You have the power to take back control of the situation by putting your home on the market. Perhaps, the time has come for you and your family to move on and start living the life you desire. That is what is truly important.____________________________________________________________ As the seasons change, so do your clients' needs.Join us tomorrow for our FREE Webinar at 2pm ET to learn How to Answer the Top 10 Questions Your Clients are Asking. Be the expert your clients deserve. |

The Most Important Report in Real Estate?

September 2, 2014

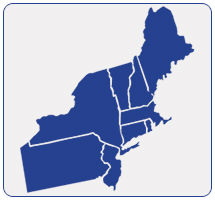

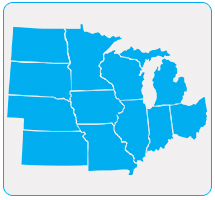

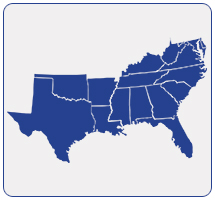

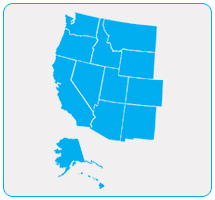

| The Most Important Report in Real Estate? Posted: 02 Sep 2014 04:00 AM PDT  Many people report on the National Association of Realtors’ (NAR) Existing Home Sales Report which quantifies the number of closed sales of single-family homes, townhomes, condominiums and co-ops. However, there is another report that NAR releases each month that may be even more important - the Pending Home Sales Report which reveals the current Pending Home Sales Index. According to NAR, the Pending Home Sales Index (PHSI) is Many people report on the National Association of Realtors’ (NAR) Existing Home Sales Report which quantifies the number of closed sales of single-family homes, townhomes, condominiums and co-ops. However, there is another report that NAR releases each month that may be even more important - the Pending Home Sales Report which reveals the current Pending Home Sales Index. According to NAR, the Pending Home Sales Index (PHSI) is“a leading indicator for the housing sector, based on pending sales of existing homes. A sale is listed as pending when the contract has been signed but the transaction has not closed, though the sale usually is finalized within one or two months of signing.” The PHSI generally leads Existing Home Sales by a month or two and therefore is a more current pulse on home sales. How is the PHSI calculated?According to NAR:“An index of 100 is equal to the average level of contract activity during 2001, which was the first year to be examined. By coincidence, the volume of existing-home sales in 2001 fell within the range of 5.0 to 5.5 million, which is considered normal for the current U.S. population”. What does the PHSI look like right now?The most recent report showed that the PHSI climbed 3.3 percent to 105.9 in July from 102.5 in June. The index is at its highest level since August 2013 (107.1) and is above 100 – considered an average level of contract activity – for the third consecutive month. Looking at the PHSI at a regional level, we can see the comparative strength of each market.

This region includes the states of Connecticut, Maine, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, and Vermont. The PHSI in the Northeast jumped 6.2 percent to 89.2 in July, and is 8.3 percent above a year ago.

|

© All Rights Reserved

NORTHEAST

NORTHEAST MIDWEST

MIDWEST SOUTH

SOUTH WEST

WEST