Phil's Blog

NAR's Existing Home Sales Report [INFOGRAPHIC]

August 29, 2014

| NAR's Existing Home Sales Report [INFOGRAPHIC] Posted: 29 Aug 2014 04:00 AM PDT ![NAR's Existing Home Sales Report [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2014/08/Existing-Home-Sales-Report-July.jpg) |

Immigration & Its Impact on the Housing Market

August 28, 2014

| Immigration & Its Impact on the Housing Market Posted: 28 Aug 2014 04:00 AM PDT  Today we are pleased to have the VP of Spanish KCM, Jeymy Gonzalez, as our guest blogger. Jeymy has personal experience with the challenges Hispanics may face during the real estate process and works to assist this community with guidance and education. Enjoy! - The KCM Crew There are many hot topics right now and immigration is definitely one of them. Whether we agree or disagree on what is going on at this moment, the history of immigration starting around 1600 shows us the United States has been a country that always received immigrants. Several organizations have done research on the impact immigrants can have on housing demand. Let’s look at some of those results: Research done by the National Association of Home Builders (NAHB) in 2012 states: “Assuming net immigration of 1.2 million (the low end Census Bureau projection for 2010) persists for 10 years, the model estimates that after 10 years new immigrants will:

Need for Continued ResearchIn this month’s edition of Fannie Mae’s Housing Insights, they source the American Community Survey in stating that there were 18.8 million immigrant renters in the country in 2012. Fannie Mae goes on to say that these numbers represent “a large reservoir of potential future homeownership demand”. They conclude with:“Continued study of how these and future immigrants advance into homeownership as they reside longer in the U.S. may provide valuable insights into future prospects for the country’s housing market.” A More Localized Look at the ImpactFor those looking for local data, a research study performed by AS/COA and Partnership for a New American Economy, provides an interactive map showing “the net change in a county’s immigrant population from 2000 to 2010 and the corresponding effect on median home values.”Bottom LineIf we look at the conclusions made by multiple sources, we see that they agree that immigrants will revitalize less desirable neighborhoods and support the housing market.Each group is seeking greater economic opportunities just like the immigrants in past decades that came to United States. The question is: are we prepared to help them with their real estate needs? |

Don’t Get Caught in the ‘Renter’s Trap’

August 27, 2014

| Don’t Get Caught in the ‘Renter’s Trap’ Posted: 27 Aug 2014 04:00 AM PDT  In a recent press release, Zillow stated that the affordability of the nation’s rental inventory is currently much worse than affordability of the country’s home sale inventory. The release revealed two things:

Don’t Become TrappedIf you are currently renting you could get caught up in a cycle where increasing rents continue to make it impossible for you to save for a necessary down payment. Zillow Chief Economist Dr. Stan Humphries explains:"The affordability of for-sale homes remains strong, which is encouraging for those buyers that can save for a down payment and capitalize on low mortgage interest rates… As rents keep rising, along with interest rates and home values, saving for a down payment and attaining homeownership becomes that much more difficult for millions of current renters.” Know Your OptionsPerhaps you already have saved enough to buy your first home. HousingWire recently reported that analysts at Nomura believe:“It’s not that Millennials and other potential homebuyers aren’t qualified in terms of their credit scores or in how much they have saved for their down payment. It’s that they think they’re not qualified or they think that they don’t have a big enough down payment.” (emphasis added) Freddie Mac came out with comments on this exact issue:

Bottom LineDon’t get caught in the trap so many renters are currently in. If you are ready and willing to buy a home, find out if you are able. Have a professional help you determine if you are eligible to get a mortgage.________________________________________________________________________  Agents: Do you have the visuals you need to educate your clients on how much of a down payment is REALLY necessary now? The latest edition of KCM provides multiple slides with the explanations you need to be able to help your clients make the right decision for themselves. Agents: Do you have the visuals you need to educate your clients on how much of a down payment is REALLY necessary now? The latest edition of KCM provides multiple slides with the explanations you need to be able to help your clients make the right decision for themselves.Not a member yet? Sign up for your 14-day free trial today and see the difference KCM can make to your business! |

14,109 Houses Sold Yesterday! Did Yours?

August 26, 2014

| 14,109 Houses Sold Yesterday! Did Yours? Posted: 26 Aug 2014 04:00 AM PDT  There are some homeowners that have been waiting for months to get a price they hoped for when they originally listed their house for sale. The only thing they might want to consider is... If it hasn't sold over the summer, maybe it's not priced properly. After all 14,109 houses sold yesterday, 14,109 will sell today and 14,109 will sell tomorrow. 14,109! That is the average number of homes that sell each and every day in this country according to the National Association of Realtors’ (NAR) latest Existing Home Sales Report. NAR reported that sales are at an annual rate of 5.15 million. Divide that number by 365 (days in a year) and we can see that, on average, over 14,000 homes sell every day. Sales are at the highest pace of 2014 and have risen for four consecutive months. We realize that you want to get the fair market value for your home. However, if it hasn't sold in today's active real estate market, perhaps you should reconsider your current asking price. _______________________________________________________________  ATTENTION: If you are a real estate agent looking for more information to simply and effectively explain to your clients why now is a great time to act, sign up for a Free 14 Day Trial of KCM and download the Summer Edition of our 11-page eGuide,Things to Consider When Selling Your House. ATTENTION: If you are a real estate agent looking for more information to simply and effectively explain to your clients why now is a great time to act, sign up for a Free 14 Day Trial of KCM and download the Summer Edition of our 11-page eGuide,Things to Consider When Selling Your House. |

A ‘Soft’ Housing Market? We Beg to Differ!

August 25, 2014

| A ‘Soft’ Housing Market? We Beg to Differ! Posted: 25 Aug 2014 04:00 AM PDT  There are some pundits lamenting the softness of the 2014 housing market. We can’t understand why. Though it is true that the early part of the year disappointed because of a myriad of reasons (ex. weather, lack of inventory, less distressed sales), the recent housing news is extremely encouraging. Let’s give some examples: Spring Home Buying Season is Healthiest in 3 YearsMove, Inc. just last week revealed that this spring’s housing market finished stronger than any time in the last three years. In the report, Jonathan Smoke, chief economist for realtor.com explained:"This is the first time, since the beginning of the recovery that we expect to see positive momentum throughout the second half of the year. While seasonal patterns are emerging in July month-to-month comparisons, all other metrics point to fundamental market health and a build-up of momentum." Existing Home Sales are UpIn their latest Existing Home Sales Report, the National Association of Realtors (NAR) announced existing-home sales increased in July to their highest annual pace of the year. That is even though distressed property sales fell to 9%, the first time they were in the single-digits since NAR started tracking the category in October 2008. Lawrence Yun, chief economist for NAR explained:“The number of houses for sale is higher than a year ago and tamer price increases are giving prospective buyers less hesitation about entering the market. More people are buying homes compared to earlier in the year and this trend should continue.” New Construction SurgingAccording to an article on Market Watch, new constructing is surging:“Construction on new U.S. homes jumped 15.7% in July to the highest level in eight months and starts were revised up sharply for June, indicating a pickup in home building after an early-year lull. Housing starts climbed to an annual rate of 1.09 million last month…Economists surveyed by MarketWatch had expected starts to climb to a seasonally adjusted 975,000 in July.” Foot Traffic at Year High NumbersFoot traffic (the number of people out actually physically looking at homes) has a strong correlation with future contracts and home sales, so it can be viewed as a peek ahead at sales trends two to three months into the future.The latest foot traffic numbers show that there are more prospective purchasers currently looking at homes than at any other time in the last twelve months which includes the latest spring buyers’ market. Bottom LineThe spring market finished stronger than any time in the last three years. Home sales are at year long highs. New construction is beating estimates. There are more buyers out than at any time in the last twelve months.We think the housing market is doing just fine. _________________________________________________________________________  Agents: How do you present yourself as a Market Expert to your potential clients? Keeping Current Matters prepares you to discuss the current factors impacting real estate RIGHT NOW! Agents: How do you present yourself as a Market Expert to your potential clients? Keeping Current Matters prepares you to discuss the current factors impacting real estate RIGHT NOW!Start your 14-day free trial today to see the difference KCM can make. |

National Foreclosure Inventory [INFOGRAPHIC]

August 22, 2014

| National Foreclosure Inventory [INFOGRAPHIC] Posted: 22 Aug 2014 04:00 AM PDT ![National Foreclosure Inventory [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2014/08/20140822-Corelogic-Foreclosure-Infographic.jpg) |

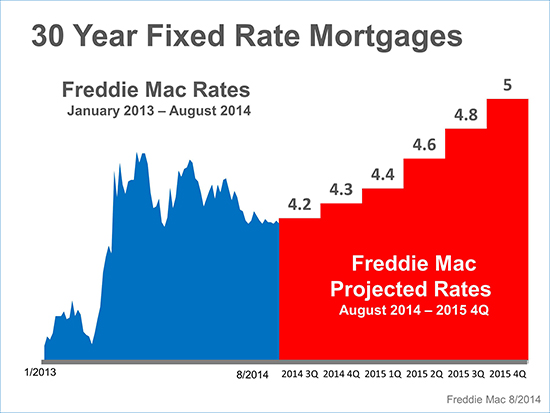

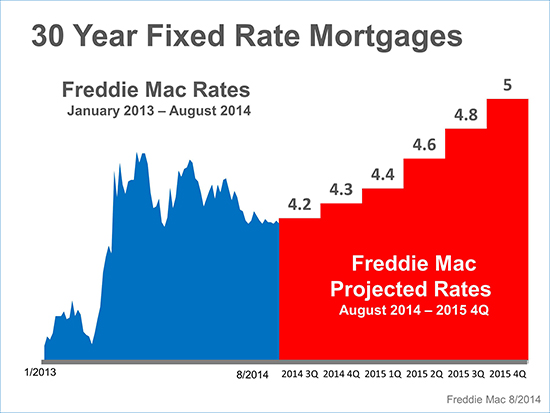

Where Are Mortgage Rates Headed?

August 21, 2014

| Where Are Mortgage Rates Headed? Posted: 21 Aug 2014 04:00 AM PDT  The interest rate you pay on your home mortgage has a direct impact on your monthly payment. The higher the rate the greater the payment will be. That is why it is important to look at where rates are headed when deciding to buy now or wait until next year. According to a recent article in Kiplinger, 30 year mortgage rates are about to increase: “Now around 4.1%, rates will edge slowly toward 4.4% by the end of this year. Then they’ll follow the Treasury bond rate’s upward move in early 2015. Thirty-year home loans should end 2015 at around 5.1%, still low by historical standards.” Here is a graph created by using interest rate projections in Freddie Mac’s August 2014 U.S. Economic & Housing Market Outlook:

How will this impact a mortgage payment?Research released this month by Zillow reveals:“We examined how a 1 percentage point rise in mortgage rates would impact monthly payments for the typical home in 35 metro areas, and found that the difference this year versus next year varies dramatically from market to market. In the San Jose/Silicon Valley area, for example, potential buyers should expect to see a monthly payment increase of more than $700 if they waited a year to buy the same home they were considering today. By contrast, in St. Louis, the difference is only $65 per month.” (emphasis added) Bottom LineAgain, we turn to the Zillow research:“As rates rise, new home buyers will confront higher financing costs and monthly mortgage payments. For many, this will mean tightening their budgets and sacrificing some luxuries they may take for granted today.” _____________________________________________________________________  Agents: Would this chart help you put today’s interest rate environment in perspective when you’re meeting with buyers? How about a few more showing rate projections and the impact this would have on your buyer’s purchasing power? Agents: Would this chart help you put today’s interest rate environment in perspective when you’re meeting with buyers? How about a few more showing rate projections and the impact this would have on your buyer’s purchasing power?Start your 14-day trial of KCM to get these and many more visuals to educate your clients. |

5 Reasons You Shouldn’t For Sale by Owner

August 18, 2014

| 5 Reasons You Shouldn’t For Sale by Owner Posted: 18 Aug 2014 04:00 AM PDT  Some homeowners consider trying to sell their home on their own, known in the industry as a For Sale by Owner (FSBO). We think there are several reasons this might not be a good idea for the vast majority of sellers. Here are five of our reasons:1. There Are Too Many People to Negotiate WithHere is a list of some of the people with whom you must be prepared to negotiate if you decide to FSBO.

2. Exposure to Prospective PurchasersRecent studies have shown that 92% of buyers search online for a home. That is in comparison to only 28% looking at print newspaper ads. Most real estate agents have an extensive internet strategy to promote the sale of your home. Do you?3. Actual Results also come from the InternetWhere do buyers find the home they actually purchased?

4. FSBOing has Become More and More DifficultThe paperwork involved in selling and buying a home has increased dramatically as industry disclosures and regulations have become mandatory. This is one of the reasons that the percentage of people FSBOing has dropped from 19% to 9% over the last 20+ years.5. You Net More Money when Using an AgentMany homeowners believe that they will save the real estate commission by selling on their own. Realize that the main reason buyers look at FSBOs is because they also believe they can save the real commission. The seller and buyer can’t both save the same commission.Studies have shown that the typical house sold by the homeowner sells for $184,000 while the typical house sold by an agent sells for $230,000. This doesn’t mean that an agent can get $46,000 more for your home as studies have shown that people are more likely to FSBO in markets with lower price points. However, it does show that selling on your own might not make sense. Bottom LineBefore you decide to take on the challenges of selling your house on your own, sit with a real estate professional in your marketplace and see what they have to offer._________________________________________________________________________  Agents: How do you present yourself as a Market Expert to your potential clients? Keeping Current Matters prepares you to discuss the current factors impacting real estate RIGHT NOW! Agents: How do you present yourself as a Market Expert to your potential clients? Keeping Current Matters prepares you to discuss the current factors impacting real estate RIGHT NOW!Start your 14-day free trial today to see the difference KCM can make. |

Home Prices…Where are they Headed?

August 6, 2014

| Home Prices…Where are they Headed? Posted: 06 Aug 2014 04:00 AM PDT  Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number. The results of their latest survey

_______________________________________________________________  ATTENTION: If you are a real estate agent looking for more information to simply and effectively explain to your clients why now is a great time to act, sign up for a Free 14 Day Trial of KCM and download the Summer Edition of our 11-page eGuide, Things to Consider When Buying A Home. ATTENTION: If you are a real estate agent looking for more information to simply and effectively explain to your clients why now is a great time to act, sign up for a Free 14 Day Trial of KCM and download the Summer Edition of our 11-page eGuide, Things to Consider When Buying A Home. |

Bigger Ads Don't Make Dumber Buyers

August 5, 2014

| Bigger Ads Don't Make Dumber Buyers Posted: 05 Aug 2014 04:00 AM PDT  Being 'in and around' the real estate business for over 30 years, we are still confused about the importance both sellers and real estate agents put on advertising. Decades ago, advertising a home was important to attract a buyer because there was no other way for an individual real estate office to announce to the world that a house was now on the market. But times have changed. With the development of the Multiple Listing Systems (MLS), as soon as a listing is taken the entire agent population of that area or region is informed. Instantly! Every agent working every buyer is put on notice that a new opportunity to sell a home is here. In many cases, through new technologies, the buyers are directly informed of the new listing before the agent can even reach out to them. Buyers already in the market will know the home is up for sale immediately. No ad is required to do this. You may ask - what about the buyer who is not yet actively engaging an agent in search of a home? Those future buyers are searching the internet months before they are ready to commit. In most areas, once a home is placed on the MLS system, the listing populates a plethora of real estate internet sites where a buyer can easily find it. Why are no buyers looking at the house? I will argue that it is probably not because they are unaware of the listing. In 99% of the cases, it is about pricing. They know of it and, for some reason, have decided it is not worth seeing. The value was not there for them. Look at the PriceYou may think there are just no buyers in the market for your type of home at the present time. Well, let's take a step back and ask a question. Would someone buy it at $1? How about $100? $1,000? $10,000? $100,000? Of course!! But, that proves our point. There is a price that buyers will pay for each and every home that is for sale today. You must decide if you are willing to take what the current value of your property is. That is entirely your decision.But, let's not believe the house hasn't sold because it wasn't advertised more aggressively. You could put it on the front page of your large, regional paper for the next 365 straight days. If it is not priced right, a buyer will not buy it. Does that mean that you don't need an agent to sell your home? Actually, we are saying the exact opposite. You need a well-informed real estate professional who knows the proper price for your house and has the courage to tell you the truth. It was great to see that a recent survey by the National Association of Realtors revealed that the number one benefit a seller wants from their agent is assistance in setting a competitive price. That truly is the most important thing an agent can deliver to a seller in this market. Bottom LineGet a great agent. Price your home appropriately. And don't believe that running more ads will create a group of buyers that don't understand value!! |

The Importance of Using an Agent when Selling Your Home

August 4, 2014

| The Importance of Using an Agent when Selling Your Home Posted: 04 Aug 2014 04:00 AM PDT  When a homeowner decides to sell their house, they obviously want the best possible price with the least amount of hassles. However, for the vast majority of sellers, the most important result is to actually get the home sold. In order to accomplish all three goals, a seller should realize the importance of using a real estate professional. We realize that technology has changed the purchaser’s’ behavior during the home buying process. Today, 92% of all buyers use the internet in their home search according to the National Association of Realtors’ 2013 Profile of Home Buyers & Sellers. However, the report also revealed that 96% percent of buyers that used the internet when searching for a home purchased their home through either a real estate agent/broker or from a builder or builder’s agent. Only 2% purchased their home directly from a seller whom the buyer didn’t know. Buyers search for a home online but then depend on the agent to find the actual home they will buy (52%) or to help them handle the paperwork (24%) or understand the process (24%). It is true that the percentage of buyers that are using the internet to search for homes and information on the home buying process has increased dramatically over the last decade. But the plethora of information now available has also resulted in an increase in the percentage of buyers that reach out to real estate professionals to “connect the dots”. This is obvious as the percentage of overall buyers who used an agent to buy their home has steadily increased from 69% in 2001. BOTTOM LINEIf you are thinking of selling your home, don’t underestimate the role a real estate professional can play in the process. |

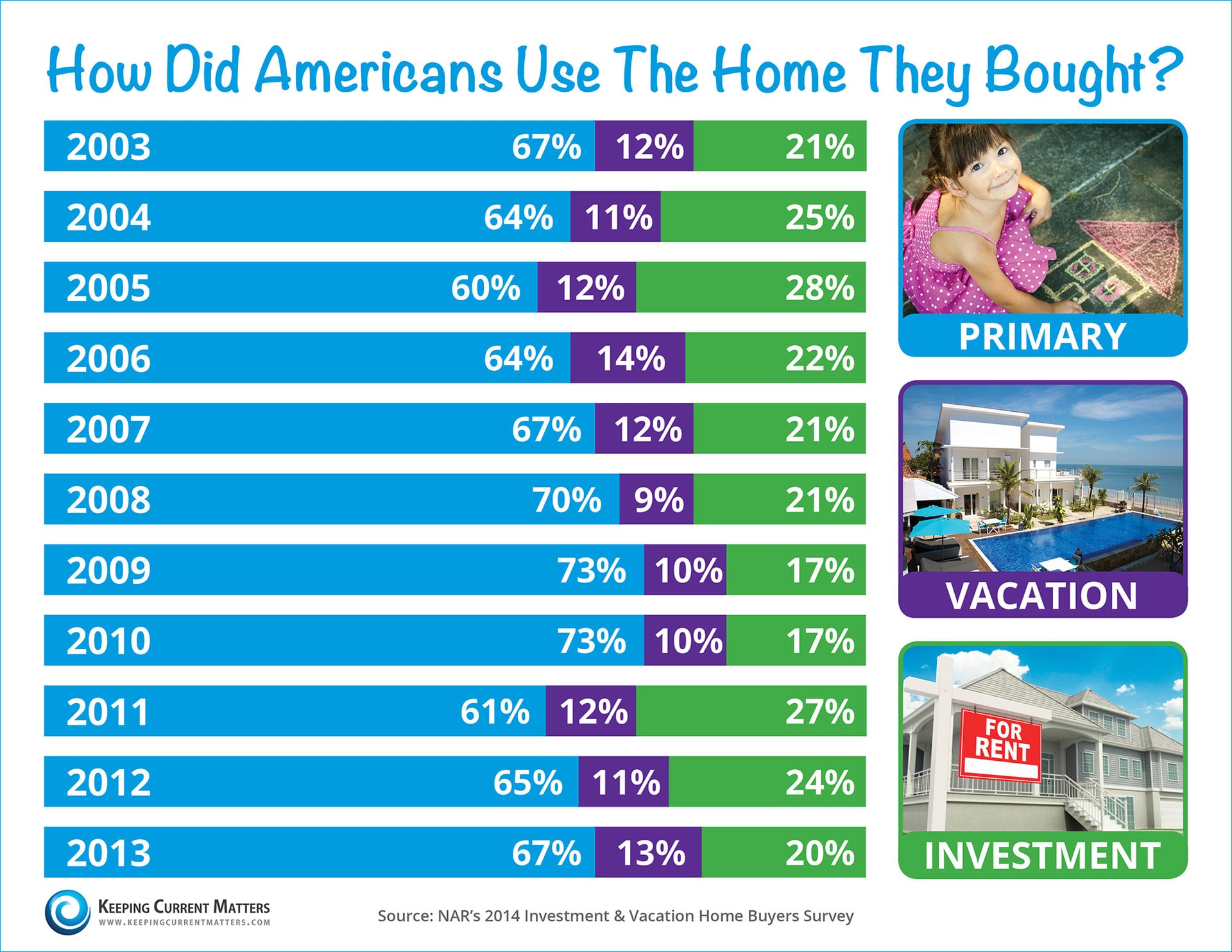

How Did Americans Use The Home They Bought?

August 1, 2014

| How Did Americans Use The Home They Bought? Posted: 01 Aug 2014 04:00 AM PDT  |

© All Rights Reserved