Phil's Blog

Cost Across Time [INFOGRAPHIC]

May 30, 2014

| Cost Across Time [INFOGRAPHIC] Posted: 30 May 2014 04:00 AM PDT ![Cost Across Time [INFOGRAPHIC] | The KCM Crew](http://www.keepingcurrentmatters.com/wp-content/uploads/2014/05/Cost-across-the-decades-1500.jpg) |

Create Wealth: Move Up Now!!

May 28, 2014

| Create Wealth: Move Up Now!! Posted: 28 May 2014 04:00 AM PDT  Many experts are currently discussing a variety of topics such as real estate as an investment, the movement on mortgage interest rates and reasons to buy now instead of waiting. It is important that we realize that this does not apply solely to the first time home buyer. The opportunity that exists in real estate today is there for everyone. However, the family that already owns a home might be thinking that, if they wait, their home could be worth more next year than it is now. And that may cause them to delay moving up to the home of their dreams thinking it makes good financial sense. Actually, the opposite is true. This is the best chance a family has to buy up into the home that makes sense for their family right now. We must realize that whatever percentage of value we gain on our house will also be gained on our dream home. Let’s assume your current home is worth $500,000. Your house will be worth $520,000 next year if prices rise by 4% over that time (a number projected by the Home Price Expectation Survey). However, the $750,000 home you are hoping to move into will also appreciate by about that same 4%. That means next year it will be valued at $780,000. You wouldn’t make $20,000 by waiting. You would actually be losing $10,000 ($30,000 - $20,000). And, you will pay a lower interest rate on the mortgage than you probably will next year. Plug in the numbers that apply to your house and the home you are longing to buy and see what the bottom line turns out to be for you. That is how wealth is built in this country - by purchasing real estate at the right time, at the right price and at the right terms. Go out and find your family's dream house and buy it! Ten years from now, you will be glad you did! |

Moving Up? Do it Now!

May 27, 2014

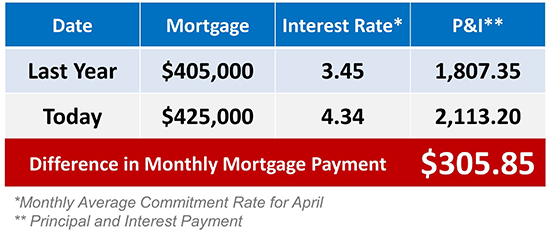

| Moving Up? Do it Now! Posted: 27 May 2014 04:00 AM PDT  A recent study revealed that the number of existing home owners planning to buy a home this year is about to increase dramatically. Some are moving up, some are downsizing and others are making a lateral move. Another study shows that over 75% of these buyers will, in fact, be in that first category: a move-up buyer. We want to address this group of buyers in today’s blog post. There is no way for us to predict the future but we can look at what happened over the last year. Let’s look at buyers that considered moving up last year but decided to wait instead. Assume they had a home worth $300,000 and were looking at a home for $450,000 (putting 10% down they would get a mortgage of $405,000). By waiting, their house appreciated by approximately 10% over the last year (based on the Case Shiller Pricing Index). Their home could now sell for $330,000. That would mean an additional $30,000 in equity assuming they didn’t incur any expenses in selling the home. But, the $450,000 home would now be worth $495,000. Adding the original 10% down payment ($45,000) to the additional equity ($30,000), they would now have a $75,000 down payment. That would still need a mortgage of $425,000. Here is a table showing what additional monthly cost would be incurred by waiting:  According to the Home Price Expectation Survey, home prices are projected to appreciate by approximately 6% over the next eighteen months. Interest rates are also expected to rise by as much as another full percentage point in that same time period according to FreddieMac. If your family plans to move-up to a nicer or bigger home, it may make sense to move now rather than later. |

Millennials: Diversify with Housing

May 22, 2014

| Millennials: Diversify with Housing Posted: 22 May 2014 04:00 AM PDT We are excited to have Justin DeCesare back as our guest blogger today. Justin is the CEO of Middleton & Associates Real Estate, one of the largest independently owned Brokerages in coastal San Diego. - The KCM Crew  A recent article written by Kelley Holland of CNBC titled “Retirement trumps home ownership for millennials” references a National Endowment for Financial Education study that claims only 13% of Millennials see home ownership as a top priority. Half of the same sample claimed retirement saving was their primary goal. To me, as both a Millennial and a Real Estate Broker/CEO, the answers to this survey stem from the perception of what home ownership is. The last decade, or the fail decade as it is known by MSNBC’s Chris Hayes, has wiped out countless sums of home equity. Even in the gains of the last two years, we are not back at the record highs of 2005 and 2006. The correlation here is that this decline in home prices is when Millennials have come of age. We have grown up in a time when people began treating home ownership like they would a swing trade. It became the same as renting, but with the possibility for a quick return. Pride of ownership left the picture and Real Estate was turned into another get rich quick scheme. The free-market economics of the Real Estate Market took over when the bubble was too full, and for most of the average Millennials adult life they have heard nothing but Real Estate negativity in the media. As the market rebounds, and the understanding that home ownership provides for long term wealth takes over the perception of how retirement savings can be made, I am sure future results of this study will change. 1994 was 20 years ago.Go back in the public records (or your MLS if it reaches two decades ago) and find some homes that were sold and have remained with one owner since. Even considering the plummeting values of the late 2000s, the home values and retirement savings are still there.As Agents and Brokers, it is our duty to help our clients and not simply act as a salesman. My suggestion to you is that as you are breaking down the monthly payments of your young clients’ mortgage, help them see how the home itself is more than a dwelling and how it will play into the diversity of their retirement plans. |

Future House Prices: A Look into the Crystal Ball Posted: 21 May 2014

May 21, 2014

| Future House Prices: A Look into the Crystal Ball Posted: 21 May 2014 04:00 AM PDT  Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number. Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.The results of their latest survey

|

FSBO Millionaires Use Real Estate Agents Posted: 20 May 2014 04:00 AM

May 20, 2014

| FSBO Millionaires Use Real Estate Agents Posted: 20 May 2014 04:00 AM PDT We at KCM pride ourselves on the quality of real estate information we deliver each and every day. We try to gather empirical evidence to validate the positions we take. We do not use just an anecdotal story to make a point. We also do not get caught up in the sensationalism of the moment. However, today will be different.

This adage could be no truer today after it has been reported, in a recent Herald Tribune article, that when it came to selling his Florida mansion, Al Bennati, the longtime chief executive of BuyOwner.com, has chosen to list his home with a local real estate agent. |

Selling a House? FannieMae Suggests You Use an Agent Posted: 19 May 2

May 19, 2014

| Selling a House? FannieMae Suggests You Use an Agent Posted: 19 May 2014 04:00 AM PDT We have often talked of the advantages a homeowner has when they use a real estate professional to help sell their home. It’s good to know that FannieMae agrees. Here is a quote directly from the Know Your Options section of their website.  |

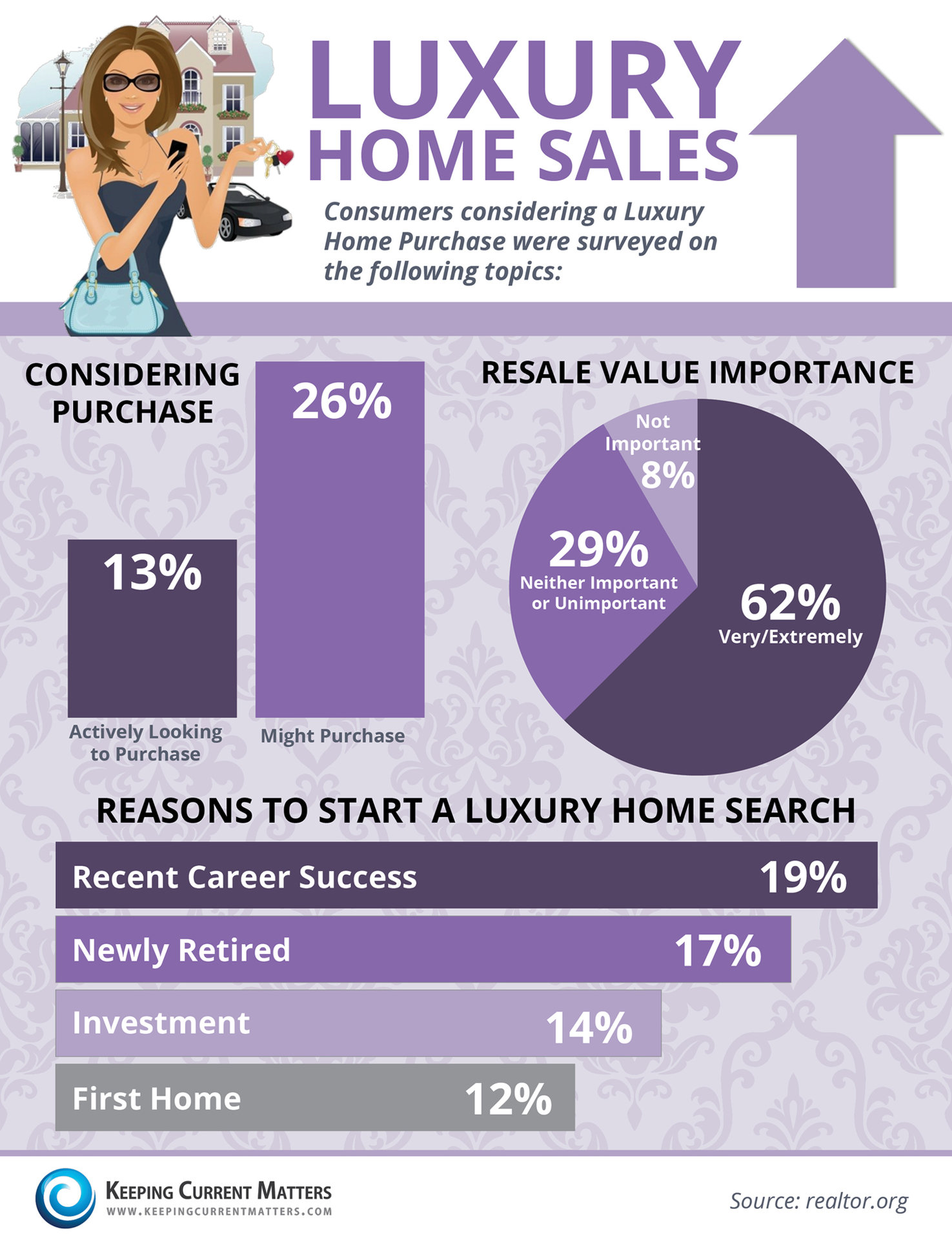

Luxury Homes Sales [INFOGRAPHIC] Posted: 16 May 2014 04:00 AM PDT

May 16, 2014

| Luxury Homes Sales [INFOGRAPHIC] Posted: 16 May 2014 04:00 AM PDT  |

The Importance of the Latino Community to Today's Real Estate Market

May 16, 2014

| The Importance of the Latino Community to Today's Real Estate Market Posted: 15 May 2014 04:00 AM PDT  The Hispanic community was hit hardest by the housing crash. Now that the market is recovering, many of these families have the opportunity to either buy a home again, or those that lost home value during those years, are seeing equity return allowing them to sell and move to the home that they always wanted. These buyers are ready, but according to a recent survey done by NAHREP (the National Association of Hispanic Real Estate Professionals) there are barriers that do not allow these buyers to enter the market right now. As real estate professionals is our duty to remove some of these barriers, if possible, and help as many families as we can become homeowners if they are ready, willing and able. The Hispanic community is becoming a very important part of today’s real estate market, “The number of Hispanic households has grown to 14.7 million in 2013 and today a Hispanic youth turns 18 every minute of every day,” according to the 2013 State of Hispanic Homeownership Report. 4 out of 10 new households in the United States are expected to be Hispanic in 2014. This is a major opportunity for real estate professionals. If you would like to get more information about the opportunity that exists, join Jeymy and KCM today at 2:00 P.M. EST for our free webinar “The Importance of the Latino Community to Today’s Real Estate Market”. |

5 Reasons to Hire a Real Estate Professional

May 14, 2014

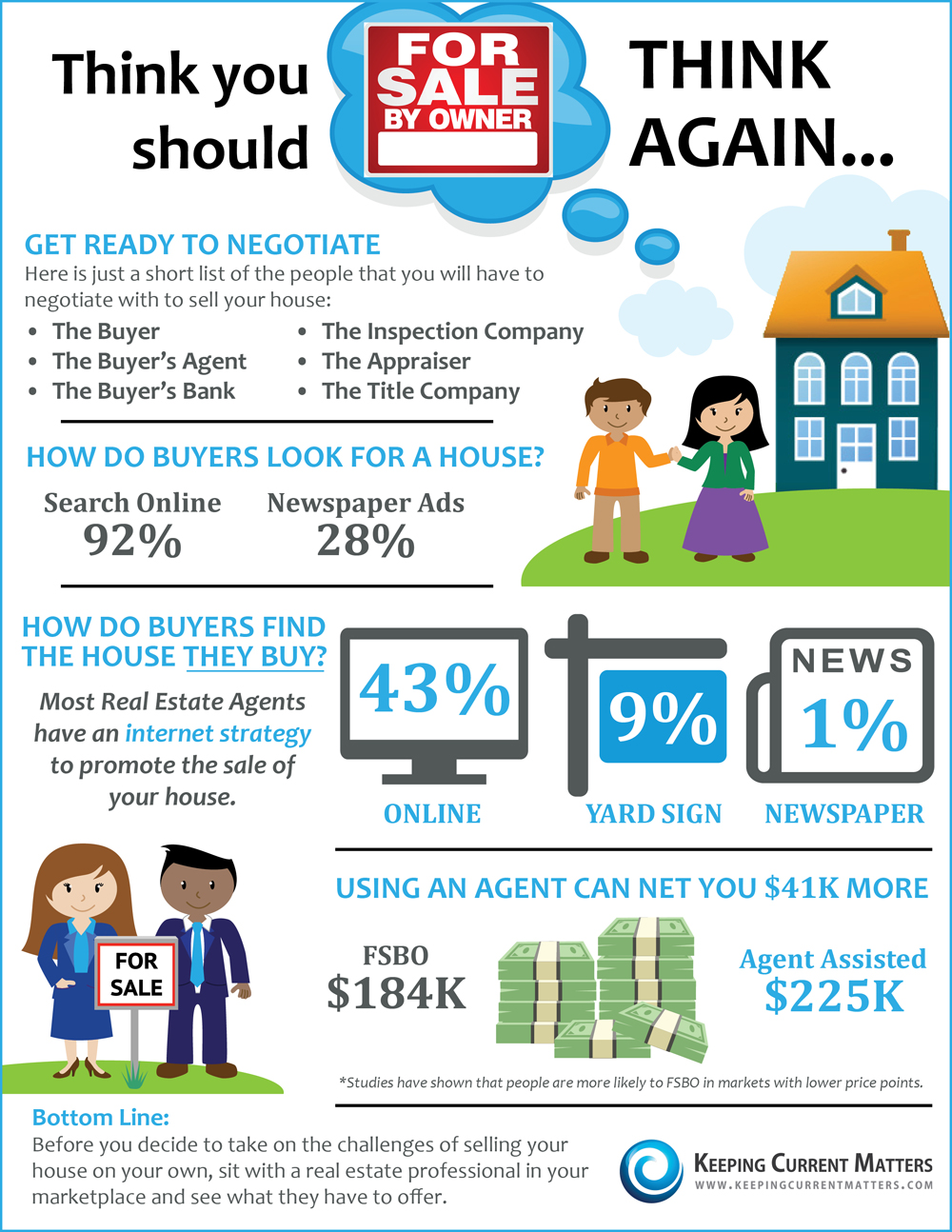

| 5 Reasons to Hire a Real Estate Professional Posted: 14 May 2014 04:00 AM PDT  Whether you are buying or selling a home, you need an experienced Real Estate Professional to lead you toward your ultimate goal. In this world of instant gratification and Internet searches, many sellers think that they can For Sale by Owner or FSBO. Whether you are buying or selling a home, you need an experienced Real Estate Professional to lead you toward your ultimate goal. In this world of instant gratification and Internet searches, many sellers think that they can For Sale by Owner or FSBO.The 5 Reasons You NEED a Real Estate Professional in your corner haven’t changed, but rather have been strengthened in recent months due to rising interest rates & home prices as the market recovers. 1. What do you do with all this paperwork?Each state has different regulations regarding the contracts required for a successful sale, and these regulations are constantly changing. A true Real Estate Professional is an expert in their market and can guide you through the stacks of paperwork necessary to make your dream a reality.2. Ok, so you found your dream house, now what?According to the Orlando Regional REALTOR Association, there are over 230 possible actions that need to take place during every successful real estate transaction. Don’t you want someone who has been there before, who knows what these actions are to make sure that you acquire your dream?3. Are you a good negotiator?So maybe you’re not convinced that you need an agent to sell your home. However, after looking at the list of parties that you need to be prepared to negotiate with, you’ll realize the value in selecting a Real Estate Professional. From the buyer (who wants the best deal possible), to the home inspection companies, to the appraiser, there are at least 11 different people that you will have to be knowledgeable with and answer to, during the process.4. What is the home you’re buying/selling really worth?Not only is it important for your home to be priced correctly from the start, to attract the right buyers and shorten the time that it’s on the market, but you also need someone who is not emotionally connected to your home, to give you the truth as to your home’s value.According to the National Association of REALTORS, “the typical FSBO home sold for $184,000 compared to $230,000 among agent-assisted home sales.” Get the most out of your transaction by hiring a professional. 5. Do you know what’s really going on in the market?There is so much information out there on the news and the Internet about home sales, prices, mortgage rates; how do you know what’s going on specifically in your area? Who do you turn to, to tell you how to competitively price your home correctly at the beginning of the selling process? How do you know what to offer on your dream home without paying too much, or offending the seller with a low-ball offer?“When getting help with money, whether it’s insurance, real estate or investments, you should always look for someone with the heart of a teacher, not the heart of a salesman.” – Dave Ramsey Hiring an agent who has their finger on the pulse of the market will make your buying/selling experience an educated one. You need someone who is going to tell you the truth, not just what they think you want to hear. Bottom Line:You wouldn’t hike up Kilimanjaro without a Sherpa, or replace the engine in your car without a trusted mechanic, why would you make one of your most important financial decisions of your life without hiring a Real Estate Professional? Agents: How are you preparing for Real Estate's New Market Reality? Download KCM's FREE 18-page eGuide, "Unlocking the Secrets of Real Estate's New Market Reality" to learn the steps you need to take to succeed in today's market. Agents: How are you preparing for Real Estate's New Market Reality? Download KCM's FREE 18-page eGuide, "Unlocking the Secrets of Real Estate's New Market Reality" to learn the steps you need to take to succeed in today's market. |

Harvard: 5 Financial Reasons to Buy a Home Posted: 13 May 2014 04:00

May 13, 2014

| Harvard: 5 Financial Reasons to Buy a Home Posted: 13 May 2014 04:00 AM PDT  Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also currently serves on the editorial board of the Journal of Housing Research and Housing Policy Debate. Last year he released a paper on homeownership - The Dream Lives On: the Future of Homeownership in America. In his paper, Belsky reveals five financial reasons people should consider buying a home. Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also currently serves on the editorial board of the Journal of Housing Research and Housing Policy Debate. Last year he released a paper on homeownership - The Dream Lives On: the Future of Homeownership in America. In his paper, Belsky reveals five financial reasons people should consider buying a home.Here are the five reasons, each followed by an excerpt from the study: 1.) Housing is typically the one leveraged investment available. “Few households are interested in borrowing money to buy stocks and bonds and few lenders are willing to lend them the money. As a result, homeownership allows households to amplify any appreciation on the value of their homes by a leverage factor. Even a hefty 20 percent down payment results in a leverage factor of five so that every percentage point rise in the value of the home is a 5 percent return on their equity. With many buyers putting 10 percent or less down, their leverage factor is 10 or more.” 2.) You're paying for housing whether you own or rent. “Homeowners pay debt service to pay down their own principal while households that rent pay down the principal of a landlord.” 3.) Owning is usually a form of “forced savings”. “Since many people have trouble saving and have to make a housing payment one way or the other, owning a home can overcome people’s tendency to defer savings to another day.” 4.) There are substantial tax benefits to owning. “Homeowners are able to deduct mortgage interest and property taxes from income...On top of all this, capital gains up to $250,000 are excluded from income for single filers and up to $500,000 for married couples if they sell their homes for a gain.” 5.) Owning is a hedge against inflation. “Housing costs and rents have tended over most time periods to go up at or higher than the rate of inflation, making owning an attractive proposition.” Bottom LineWe realize that homeownership makes sense for many Americans for many social and family reasons. It also makes sense financially.----------------- Agents interested in gaining a better understanding of the financial and social advantages to homeownership should consider becoming a member of Keeping Current Matters. You can sign-up for a free 14 day trial here. |

41% of Americans Would Prefer to Build their Home Posted: 12 May 2014

May 12, 2014

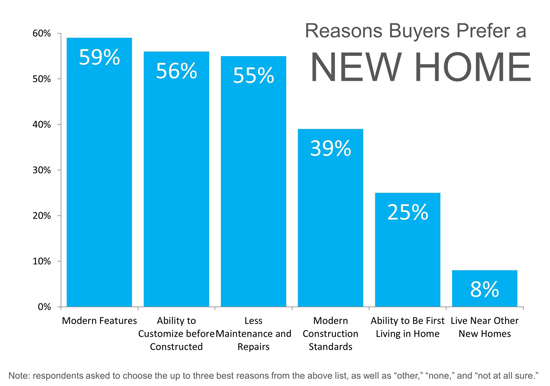

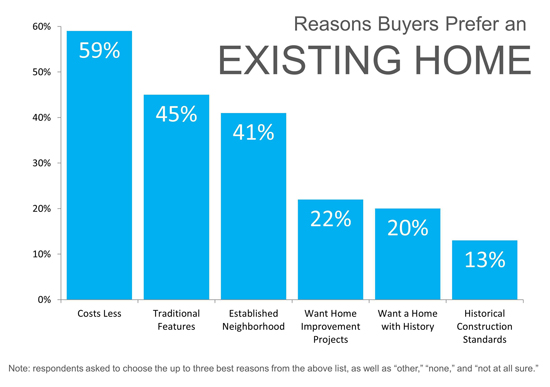

| 41% of Americans Would Prefer to Build their Home Posted: 12 May 2014 04:00 AM PDT  A recent study by Harris Poll revealed that, for the same price, forty one percent of Americans would prefer to buy a newly built home instead of an existing home. Twenty one percent prefer an existing home while thirty eight percent didn’t have a preference. A recent study by Harris Poll revealed that, for the same price, forty one percent of Americans would prefer to buy a newly built home instead of an existing home. Twenty one percent prefer an existing home while thirty eight percent didn’t have a preference.However, those desiring a new home may not be prepared to ante-up the difference in price. Only forty six percent of those who strongly prefer a new home are willing to pay at least 20 percent extra* to purchase a new home versus a comparable existing home. *Trulia estimates “that new homes built in 2013 or 2014 are typically priced 20 percent higher than older homes of a similar size and location.” Why People Prefer a New Home?  Why People Prefer an Existing Home?  |

Americans Believe Real Estate is BEST Long-Term Investment

May 9, 2014

| Americans Believe Real Estate is BEST Long-Term Investment [INFOGRAPHIC] Posted: 09 May 2014 04:00 AM PDT  |

A Great Reason to Sell Now

May 8, 2014

| A Great Reason to Sell Now Posted: 08 May 2014 04:00 AM PDT  The price of any item (including residential real estate) is determined by ‘supply and demand’. If many people are looking to buy an item and the supply of that item is limited, the price of that item increases. The price of any item (including residential real estate) is determined by ‘supply and demand’. If many people are looking to buy an item and the supply of that item is limited, the price of that item increases.According to the National Association of Realtors (NAR), the supply of homes for sale is still below the normal 6 month level of inventory. That means less competition. However, a recent study revealed that 71% of current homeowners are considering selling their home this year. Putting your home on the market now instead of waiting for this increased competition to come to the market might make a lot of sense. Buyers currently in the market are motivated purchasers. They want to buy now. With limited inventory available in most markets, a seller will be in a great position to negotiate their best possible price. __________________________________________________________________  For more great information you can share with your clients about the opportunities available this spring, start your 14-day free trial of KCM and download our 10 page eGuide, "Things to Consider When Selling Your House". For more great information you can share with your clients about the opportunities available this spring, start your 14-day free trial of KCM and download our 10 page eGuide, "Things to Consider When Selling Your House". |

Difference Between a ‘White Lie’ and Lying

May 7, 2014

| Difference Between a ‘White Lie’ and Lying Posted: 07 May 2014 04:00 AM PDT  Growing up it seemed ‘white lies’ were okay while lying was a sin. As children, we sometimes had difficulty understanding where the line was. As we matured, we realized there most definitely was a difference. Growing up it seemed ‘white lies’ were okay while lying was a sin. As children, we sometimes had difficulty understanding where the line was. As we matured, we realized there most definitely was a difference.If a husband or wife asks if it is okay to invite their parents over for dinner, the spouse would probably say ‘sure’ even if it wasn’t 100% the truth. That was a ‘white lie’. If a young boy dresses up as a monster on Halloween and asks his father if he looks ‘really scary’, it was okay for his dad to say ‘YES’! That was a ‘white lie’. In both cases, the person telling the ‘white lie’ was saying what the other person wanted to hear. In both cases, there was no harm in not telling the 100% truth. In both cases, it was a ‘white lie’. However, if we are not telling the 100% truth in order to save someone’s feelings AND IT HURTS THEM, we are lying. What does this have to do with real estate?We believe there are some in the real estate industry more worried about a homeowner’s feelings than they are about telling the truth about the current value of their home. These agents are not necessarily malicious. They just realize they may disappoint a seller at a listing appointment by telling the truth about what the house will sell for. They find it difficult to deliver tough news. To make sellers feel better, they lie.Good agents can deliver good news. Great agents know how to deliver tough news.In today’s real estate market, you need an agent that will tell you the truth, even when you don’t want to hear it. You need an agent more worried about your family than they are about your feelings. You need an agent who can get the house sold!What this means to youIf you are interviewing potential listing agents, demand they tell you the truth. Don’t hire the agent that tells you what you want to hear. Hire the agent that tells you what you need to know. Reward their honesty. |

Homeownership: This Time the Wall Street Journal Got it Wrong

May 6, 2014

| Homeownership: This Time the Wall Street Journal Got it Wrong Posted: 06 May 2014 04:00 AM PDT Our founder, Steve Harney, occasionally asks to do a personal post on what he sees as important to our industry. Today is one of those days. Enjoy! – The KCM Crew  I have been a subscriber to the Wall Street Journal (WSJ) for as long as I can remember. In my opinion, it is the single greatest source of financial information and insights available. I don’t always agree with their analysis but I always respect their position. I have been a subscriber to the Wall Street Journal (WSJ) for as long as I can remember. In my opinion, it is the single greatest source of financial information and insights available. I don’t always agree with their analysis but I always respect their position.However, in an article this past weekend, The New Math of Renting vs. Buying, they flat out got it wrong. Below are a few excerpts from the article and the reason why I believe the analysis to be incorrect. The Cost of Renting is Lower than the Cost of OwningIn the article, they discuss that homeownership is more expensive than renting in many large metropolitan areas."The monthly cost of renting was lower than buying in 20 large metropolitan areas at the end of last year, the most recent period for which data are available, according to figures provided exclusively to The Wall Street Journal by Deutsche Bank. That is up from 15 large metropolitan areas a year earlier.” The challenge is that more recent data from two very reliable sources has shown that not to be the case. Among the 35 largest metro areas analyzed by Zillow in the first quarter, every metro showed it would be cheaper to buy than rent if you plan to live in the home for at least 4.2 years. According to a study by Trulia: “Homeownership remains cheaper than renting nationally and in all of the 100 largest metro areas. Rising mortgage rates and home prices have narrowed the gap over the past year, though rates have recently dropped and price gains are slowing. Now, at a 30-year fixed rate of 4.5%, buying is 38% cheaper than renting nationally.” (emphasis added) Renters Don’t Have All the Expenses of HomeownersThe article goes on to explain that as a renter you have many less expenses than you would have as a homeowner:"Renters, for example, don't pay property taxes, homeowner's insurance and, in most cases, maintenance costs. These expenses can cost homeowners about 3% of the price of their home annually, experts say. While those costs can be folded into monthly rent, apartment renters often pay a smaller share as landlords spread the costs among many tenants, says Stijn Van Nieuwerburgh, director of the Center for Real Estate Finance Research at New York University. If a window breaks or the toilet plugs up, your landlord—not you—pays for the repairs." Don’t kid yourself – the landlord does not pay the taxes nor pay for repairs. The tenant does. It is incorporated in the rent. It is true, if it is an apartment building, that the property taxes are shared by all tenants. However, realize that the amount of property taxes for an apartment building with “many tenants” will be far greater than a single family residence. We think this situation is best explained by Eric Belsky, Managing Director of the Joint Center of Housing Studies at Harvard University, in his paper on homeownership - The Dream Lives On: the Future of Homeownership in America: “Households must consume housing whether they own or rent. Not even accounting for more favorable tax treatment of owning, homeowners pay debt service to pay down their own principal while households that rent pay down the principal of a landlord plus a rate of return. That’s yet another reason owning often does—as Americans intuit—end up making more financial sense than renting.” (emphasis is mine) Investing the Difference in Payments Will Net a Renter More MoneyThe WSJ article claims that, if a renter invests the difference between their rent payment and a potential mortgage payment had they purchased, they would be better off financially in the long run."Renters don't end up with a valuable asset, as buyers do when they pay off a mortgage. But renters might be able to make more money by investing the monthly savings, as well as the cash they would otherwise use for a down payment, he says." They go on to explain their reasoning as follows: "The value of the average single-family home increased by 3.6% a year in the three decades through 2013, compounded annually, according to mortgage giant Freddie Mac. By contrast, the compound annual return on the S&P 500 over that period was 11.1%, according to Chicago-based investment-research firm Morningstar." As to the idea that the return on investment would be greater by investing in the stock market rather than purchase a home, I think the article in the WSJ forgot that housing is a leveraged investment. Belsky, in his paper, explains: “Few households are interested in borrowing money to buy stocks and bonds and few lenders are willing to lend them the money. As a result, homeownership allows households to amplify any appreciation on the value of their homes by a leverage factor. Even a hefty 20 percent down payment results in a leverage factor of five so that every percentage point rise in the value of the home is a 5 percent return on their equity. With many buyers putting 10 percent or less down, their leverage factor is 10 or more.” That 3.6% average annual appreciation is really an 18% return on cash to a home buyer putting down 20%. They also assume the renter will save any difference in housing expense. However, that does not happen in reality. In their ongoing research for their paper, Beer and Cookies Impact on Homeowners’ Wealth Accumulation, Eli Beracha and Ken H. Johnson reveal that homeownership creates a ‘forced savings’ plan: “It appears that homeownership creates extra wealth mainly through its ability to force owners to save rather than through property appreciation. Thus, homeownership appears to be a self-imposed savings plan, which through time leads to greater wealth accumulation as compared to comparable renters. In short, buying a home makes Americans save.” And Belsky from Harvard agrees: “Since many people have trouble saving and have to make a housing payment one way or the other, owning a home can overcome people’s tendency to defer savings to another day.” To further make this point, we can look at a study by the Federal Reserve which showed that the net worth of a homeowner ($174,500) is 30 times greater than that of renter ($5,100). Bottom LineLooking at financial advantages of homeownership from every angle still reveals that it is a much better investment than renting. |

3 Reasons to Sell Your Home this Spring

May 5, 2014

| 3 Reasons to Sell Your Home this Spring Posted: 05 May 2014 04:00 AM PDT  Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are three of those reasons. 1. Demand is about to skyrocketMost people realize that the housing market is hottest from April through June. The most serious buyers are well aware of this and, for that reason, come out in early spring in order to beat the heavy competition. We also have a pent-up demand as many buyers pushed off their home search this winter because of extreme weather. Sellers in markets where seasonal weather is never an issue must realize that buyers relocating to their region will increase dramatically this spring as these purchasers finally decide to escape the freezing temperatures of the winters in the north.These buyers are ready, willing and able to buy…and are in the market right now! 2. There Is Less Competition - For NowHousing supply always grows from the spring through the early summer. Also, there has been a growing desire for many homeowners to move as they were unable to sell over the last few years because of a negative equity situation. Homeowners have seen a return to positive equity as prices increased over the last eighteen months. Many of these homes will be coming to the market in the near future.The choices buyers have will continue to increase over the next few months. Don’t wait until all the other potential sellers in your market put their homes up for sale. 3. There Will Never Be a Better Time to Move-UpIf you are moving up to a larger, more expensive home, consider doing it now. Prices are projected to appreciate by approximately 4% this year and 8% by the end of 2015. If you are moving to a higher priced home, it will wind-up costing you more in raw dollars (both in down payment and mortgage payment) if you wait. You can also lock-in your 30 year housing expense with an interest rate at about 4.5% right now. Freddie Mac projects rates to be 5.1% by this time next year and 5.7% by the fourth quarter of 2015.Moving up to a new home will be less expensive this spring than later this year or next year. __________________________________________________________________  For more great information you can share with your clients about the opportunities available this spring, start your 14-day free trial of KCM and download our 10 page eGuide, "Things to Consider When Selling Your House". For more great information you can share with your clients about the opportunities available this spring, start your 14-day free trial of KCM and download our 10 page eGuide, "Things to Consider When Selling Your House". |

Think you should For Sale By Owner? THINK AGAIN... [INFOGRAPHIC]

May 2, 2014

| Think you should For Sale By Owner? THINK AGAIN... [INFOGRAPHIC] Posted: 02 May 2014 04:00 AM PDT  Sources: NAR's 2013 Profile of Home Buyers and Sellers & KCM's "Things to Consider When Selling Your House" Spring 2014 |

Rethinking the 55+ Market

May 1, 2014

| Rethinking the 55+ Market Posted: 01 May 2014 04:00 AM PDT We are excited to have Nikki Buckelew back as our guest blogger for today. Nikki is considered a leading authority on seniors real estate and housing. - The KCM Crew  Someone said to me recently, “Sixty-five is the new forty-five.” We chuckled, but the more I thought about it, the more I found myself in full agreement. Someone said to me recently, “Sixty-five is the new forty-five.” We chuckled, but the more I thought about it, the more I found myself in full agreement.With more and more people working beyond traditional retirement age and the advances in modern medicine, the lines between middle and late adulthood are becoming a bit blurred. What makes this relevant in the world of real estate?As our population ages, we will see more and more organizations dedicating their marketing efforts toward the “senior” demographic. You have read previous KCM blogs about the various designations agents can earn for this specific purpose, and undoubtedly you have already seen real estate professionals in your market professing to “specialize”.Reality check — not all seniors are the same.Just as with using any label, we run the risk of putting people into a category when they may or may not actually belong there. This is especially true of the senior segment.Despite the label of “senior,” there are 3 distinct types of moves you may encounter as a real estate professional — all three involve seniors, but they aren’t based necessarily on age. You see, age is not a good predictor of relocation. Instead, people generally make changes in residence based on life circumstances. Listed below are the three primary types of moves made by those labeled as seniors: Move #1: Amenity-basedThese individuals and/or couples are seeking a certain type of lifestyle and their home is only one component of a much larger picture. When looking to sell, they are usually transferring their equity from one home to the next and can usually either pay cash or put a significant down payment towards their purchase. Depending upon employment status, they may be moving across the country for more appealing climates or seeking a place near an airport making it easier to commute. Some are moving closer to kids and grandkids, while others are moving to destination locations where the family can enjoy visiting.Social engagement, including quality family and friend connectedness, are key decision-making elements. Move #2: Anticipatory / PlanningAs people age, they may begin to experience changes in personal health status or become the caregiver of a spouse requiring additional care. When this occurs, people may find their current home unmanageable or no longer suited for their current situation. Moving means simplifying and making preparations for future care needs and support. With this type of move, seniors are typically looking to either buy or lease a property with minimal maintenance, accessibility features, and in close proximity to quality healthcare. Family members and adult children may be called upon at this stage to assist, and will often have some influence in the relocation process.Access to formal and informal support, as well as low maintenance and accessibility features, are primary decision-making factors. Move #3: Needs-basedWhile most people intend to live independently until they die, unfortunately, this reality isn’t always possible. As health declines to the point where more support is needed than can be provided for within the person’s home and community, relocation is necessary. This move may involve selling the personal residence and relocating to a senior living community or into the home of a family member. In many cases, needs-based moves involve caregivers and/or family members as additional decision makers. Late-life moves involving frail elderly or those experiencing illnesses or disease processes can be highly emotionally charged and necessitate a level of empathy in addition to real estate competency.Timing, health status, and caregiver support are keys to decision-making. As you can see from these various different types of moves, not all seniors share the same housing needs and goals. And while specializing in the 55+ housing market appeals to many, there are actually many sub-niche opportunities within the senior segment worth exploring. Regardless of whether you choose to make working with mature home buyers and sellers a part of your overall business plan, with at least 1 in 4 home sellers over the age of 65, there is little doubt you will work with older adults in the course of your general real estate practice. When encountering these opportunities, it will serve you well to consider the three types of moves listed here and evaluate your value proposition accordingly, so that you can be the very best agent possible for your mature clients. |

© All Rights Reserved

Do as I Say… not as I Do

Do as I Say… not as I Do