Phil's Blog

Gallup Poll: Real Estate Best Long Term Investment

April 28, 2014

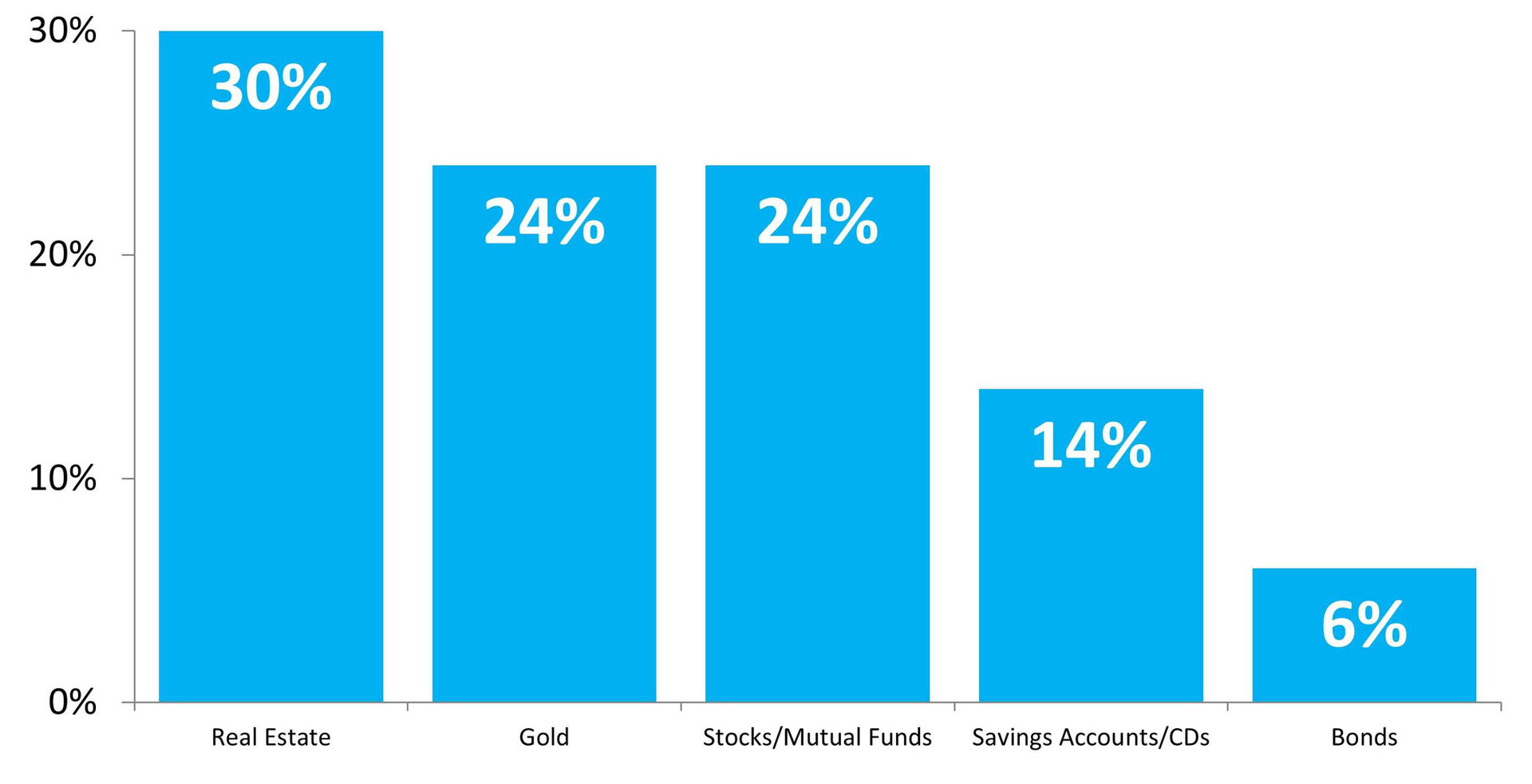

| Gallup Poll: Real Estate Best Long Term Investment Posted: 28 Apr 2014 04:00 AM PDT  The Gallup organization just released their April Economy and Personal Finances Poll which asked Americans to choose the best option for long term investment. It was no surprise to us that real estate returned to the top position over other investment categories (gold, stocks/mutual funds, savings accounts/CDs and bonds). The Gallup organization just released their April Economy and Personal Finances Poll which asked Americans to choose the best option for long term investment. It was no surprise to us that real estate returned to the top position over other investment categories (gold, stocks/mutual funds, savings accounts/CDs and bonds).Back in 2011, gold was the most popular long-term investment among Americans. However, with the housing market improving across the U.S. and home prices rising, more Americans now consider real estate the best option for long-term investments.  The poll also revealed that real estate was considered to be the best long term investment by all four subgroups by age and two out of three by income:  ________________________________________________________________  Attention Industry Professionals: Want to learn how homeownership impacts a family’s net worth? Sign up for a 14 Day Free Trial of KCM and download our 10 page eGuide, Things to Consider When Buying a Home. Attention Industry Professionals: Want to learn how homeownership impacts a family’s net worth? Sign up for a 14 Day Free Trial of KCM and download our 10 page eGuide, Things to Consider When Buying a Home. |

The State of Hispanic Homeownership

April 25, 2014

| The State of Hispanic Homeownership Posted: 24 Apr 2014 04:00 AM PDT  This month the National Association of Hispanic Real Estate Professionals (NAHREP) released their annual State of Hispanic Homeownership Report for 2013. A 35 page report designed to highlight “the homeownership growth and household formation rates of Hispanics as well as their educational achievements, entrepreneurial endeavors, labor force profile, and purchasing power in the United States”. This month the National Association of Hispanic Real Estate Professionals (NAHREP) released their annual State of Hispanic Homeownership Report for 2013. A 35 page report designed to highlight “the homeownership growth and household formation rates of Hispanics as well as their educational achievements, entrepreneurial endeavors, labor force profile, and purchasing power in the United States”.This report is full of great information and you should download it and read all 35 pages. In this blog post, I will mention a few facts that, in my opinion, are relevant to all of us: Household formation

We must learn how to work with the Hispanic community. Don’t know how? Download our 10-page eGuide “An Agent's Guide to Working with the Latino Community” that will provide an introduction on how to work with the Latino community and offer more information on this often overlooked demographic. |

12,575 Houses Sold Yesterday!

April 23, 2014

| 12,575 Houses Sold Yesterday! Posted: 23 Apr 2014 04:00 AM PDT  If you read certain headlines, you might be led to believe that the housing recovery has come to a screeching halt. Naysayers are claiming that rising mortgage rates and a lack of consumer confidence are keeping Americans on the fence when it comes to purchasing real estate. That is actually far from reality. After all, 12,575 houses sold yesterday, 12,575 will sell today and 12,575 will sell tomorrow. 12,575! That is the average number of homes that sell each and every day in this country according to the National Association of Realtors’ (NAR) latest Existing Home Sales Report. According to the report, annualized sales now stand at 4.59 million. Divide that number by 365 (days in a year) and we can see that, on average, over 12,500 homes sell every day. If you are considering whether or not to put your house up for sale, don't let the headlines scare you. There are purchasers in the market and they are buying - to the tune of 12,575 homes a day. ______________________________________________________ If you read certain headlines, you might be led to believe that the housing recovery has come to a screeching halt. Naysayers are claiming that rising mortgage rates and a lack of consumer confidence are keeping Americans on the fence when it comes to purchasing real estate. That is actually far from reality. After all, 12,575 houses sold yesterday, 12,575 will sell today and 12,575 will sell tomorrow. 12,575! That is the average number of homes that sell each and every day in this country according to the National Association of Realtors’ (NAR) latest Existing Home Sales Report. According to the report, annualized sales now stand at 4.59 million. Divide that number by 365 (days in a year) and we can see that, on average, over 12,500 homes sell every day. If you are considering whether or not to put your house up for sale, don't let the headlines scare you. There are purchasers in the market and they are buying - to the tune of 12,575 homes a day. ______________________________________________________ Are you ready for Real Estate's New Market Reality? Download our free 18-page eGuide that talks to the headlines you see every day: Unlocking the Secrets of Real Estate's New Market Reality. Are you ready for Real Estate's New Market Reality? Download our free 18-page eGuide that talks to the headlines you see every day: Unlocking the Secrets of Real Estate's New Market Reality. |

Either Way, You’re Still Paying a Mortgage

April 21, 2014

| Either Way, You’re Still Paying a Mortgage Posted: 21 Apr 2014 04:00 AM PDT  There are some people that have not purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with our parents rent free, you are paying a mortgage - either your mortgage or your landlord’s. There are some people that have not purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with our parents rent free, you are paying a mortgage - either your mortgage or your landlord’s.As a recent paper from the Joint Center for Housing Studies at Harvard University explains: “Households must consume housing whether they own or rent. Not even accounting for more favorable tax treatment of owning, homeowners pay debt service to pay down their own principal while households that rent pay down the principal of a landlord plus a rate of return. That’s yet another reason owning often does—as Americans intuit—end up making more financial sense than renting.” Also, if you purchase with a 30-year fixed rate mortgage, your ‘housing expense’ is locked in over the thirty years for the most part. If you rent, the one guarantee you will have is that your rent will increase over that same thirty year time period. Whether you are looking for a primary residence for the first time or are considering a vacation home on the shore, owning might make more sense than renting since prices and interest rates are still at bargain prices. _____________________________________________________________________  If you are a real estate agent looking for more information to share with your buyers as to why now is a great time to purchase, sign up for a 14 Day Free Trial of KCM and download our 10 page eGuide, Things to Consider When Buying A Home. If you are a real estate agent looking for more information to share with your buyers as to why now is a great time to purchase, sign up for a 14 Day Free Trial of KCM and download our 10 page eGuide, Things to Consider When Buying A Home. |

Real Estate: This Spring Will Be Different

April 17, 2014

| Real Estate: This Spring Will Be Different Posted: 17 Apr 2014 04:00 AM PDT  Just like May flowers, every spring the housing market blossoms as buyers come out ready to purchase their dream house. This spring, we believe we are going to see the strongest purchasing market we have seen in a decade. Just like May flowers, every spring the housing market blossoms as buyers come out ready to purchase their dream house. This spring, we believe we are going to see the strongest purchasing market we have seen in a decade.Why are we so bullish on the housing market this spring? Here are a few reasons: MILLENNIALSContrary to many reports, this age demographic is READY, WILLING and ABLE to become homeowners. As a matter of fact, the latest National Association of Realtors’ gender study revealed that the Millennial generation has recently accounted for a greater percentage of all buyers than any other generation.BABY BOOMERSAs prices have risen, so has the equity in many homes across American. Homeowners, having been shackled to their house because of low or negative equity for the last several years, are again free to make a move without worrying about bringing cash to a closing table in order to sell. We believe this new-found freedom will release a pent-up demand of sellers who want to move-up to the home they’ve always dreamed of or want to downsize their primary residence and also purchase a second home they can use for vacation, retirement or both.BOTH PRICES and MORTGAGE RATES are on the RISEAs the economy improves, more and more Americans are regaining faith that their own personal finances are headed in a positive direction. With this new confidence, they want to take advantage of the opportunity that presents itself with real estate still undervalued in most parts of the country and mortgage rates being well below historic numbers.If you are a professional in the industry and want to learn how to leverage this opportunity and optimize your business during this spring’s real estate market, please join us today at 2PM (EST) on our FREE webinar, Spring Ahead in 2014: KCM’s Action Plan for Dominating this Buyers’ Season. |

Thinking of Buying a Vacation/Retirement Home? Why Wait?

April 16, 2014

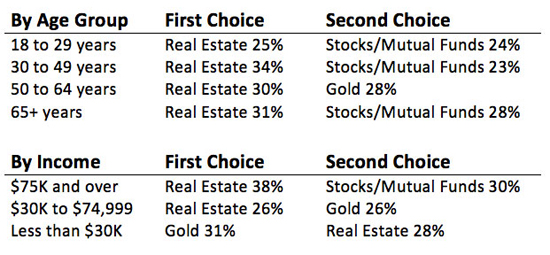

| Thinking of Buying a Vacation/Retirement Home? Why Wait? Posted: 15 Apr 2014 04:00 AM PDT  The sales of vacation homes skyrocketed last year. A recent study also revealed that 25% of those surveyed said they’d likely buy a second home, such as a vacation or beach house, to use during retirement. For many Baby Boomers, the idea of finally purchasing that vacation home (that they may eventually use in retirement) makes more and more sense as the economy improves and the housing market recovers. The sales of vacation homes skyrocketed last year. A recent study also revealed that 25% of those surveyed said they’d likely buy a second home, such as a vacation or beach house, to use during retirement. For many Baby Boomers, the idea of finally purchasing that vacation home (that they may eventually use in retirement) makes more and more sense as the economy improves and the housing market recovers.If your family is thinking about purchasing that second home, now may be the perfect time. Prices are still great. If you decide to lease the property until you’re ready to occupy it full time, the rental market in most areas is very strong. And you can still get a great mortgage interest rate. But current mortgage rates won’t last forever…According to FreddieMac, the interest rate for a 30 year fixed rate mortgage at the beginning of April was 4.4%. However, FreddieMac predicts that mortgage rates will steadily climb over the next six quarters.Let’s assume you want to purchase a home for $500,000 with a 20% down payment ($100,000). That would leave you with a $400,000 mortgage. What happens if you wait to buy this dream house? Prices are projected to increase over the next year and a half. However, for this example, let’s assume prices remain the same. Your mortgage payment will still increase as mortgage rates climb to more historically normal levels. This table shows how a principal and interest payment is impacted by a rise in interest rates:  If you are a real estate professional and want a deeper understanding of how market conditions will impact buyers this spring, please join us Thursday at 2PM ET for a free webinar entitled: Spring Ahead in 2014: KCM's Action Plan for Dominating the Spring Buyers' Season. |

Real Estate: We are NOT the Only Ones Saying You Should Buy

April 16, 2014

| Real Estate: We are NOT the Only Ones Saying You Should Buy Posted: 16 Apr 2014 04:00 AM PDT  We have never hid our belief in homeownership. That does not mean we think EVERYONE should run out and buy a house. However, if a person or family is ready, willing and able to purchase a home, we believe that owning is much better than renting. And we believe that now is a great time to buy. We have never hid our belief in homeownership. That does not mean we think EVERYONE should run out and buy a house. However, if a person or family is ready, willing and able to purchase a home, we believe that owning is much better than renting. And we believe that now is a great time to buy.We are not the only ones that think owning has massive benefits or that now is a sensational time to plunge into owning your own home. Here are a few others: Benefits of OwningJoint Center for Housing Studies, Harvard University“Homeowners pay debt service to pay down their own principal while households that rent pay down the principal of a landlord…Having to make a housing payment one way or the other, owning a home can overcome people’s tendency to defer savings.” The Federal Reserve “Renters have much lower median and mean net worth than homeowners in any survey year.” Benefits of Buying NowTrulia“Buying costs less than renting in all 100 large U.S. metros… Now, at a 30-year fixed rate of 4.5%, buying is 38% cheaper than renting nationally.” Freddie Mac "One thing seems certain: we are not likely to see average 30-year fixed mortgage rates return to the historic lows experienced in 2012…Yes, rates are higher than they were a year ago – and certainly higher than two years ago. But if you look at the averages over the last four decades, today's rates remain historically low." True real estate professionals have information like this at their fingertips. If you want to be seen as the go-to agent in your marketplace, watch a free replay of our recent webinar, Becoming the Industry Expert in Your Market. |

"Want to Sell Your House? Price it Right!" and more

April 14, 2014

| Want to Sell Your House? Price it Right! Posted: 14 Apr 2014 04:00 AM PDT  The housing market is recovering nicely. Prices have increased nationally by double digits over the last twelve months. Competition from the shadow inventory of lower priced distressed properties (foreclosures and short sales) is diminishing rapidly. Now may be the perfect time to sell your home and move to the dream house or beautiful location your family has always talked about. The housing market is recovering nicely. Prices have increased nationally by double digits over the last twelve months. Competition from the shadow inventory of lower priced distressed properties (foreclosures and short sales) is diminishing rapidly. Now may be the perfect time to sell your home and move to the dream house or beautiful location your family has always talked about.The one suggestion we would definitely offer: DON’T OVERPRICE IT!! Even though prices have increased by more than 10% over the last year, the acceleration of appreciation has slowed dramatically over the last few months. As an example, in their April Home Price Index Report, CoreLogic revealed that home prices actually depreciated by .08% this month as compared to last month’s report. What concerns us is that Trulia just reported that asking prices are still continuing to increase. Because investor purchases are declining and there are more listings coming onto the market, we believe that sellers should be very cautious when they price their house. The alternative might be that you could lose money by overpricing your home at the start as explained in a research study on the matter. Bottom Line Though it is a great time to sell your house, pricing it right is crucial. Get guidance from a real estate professional in your marketplace to ensure you get the best deal possible.  |

Vacation Home Property Sales Surge

April 10, 2014

| Vacation Home Property Sales Surge Posted: 10 Apr 2014 04:00 AM PDT

The National Association of Realtors analysis of U.S. Census Bureau data shows there are approximately 8 million vacation homes in the U.S. Their 2014 Investment and Vacation Home Buyers Survey shows vacation home sales improved substantially in 2013. |

A Home’s Cost vs. Price Explained

April 7, 2014

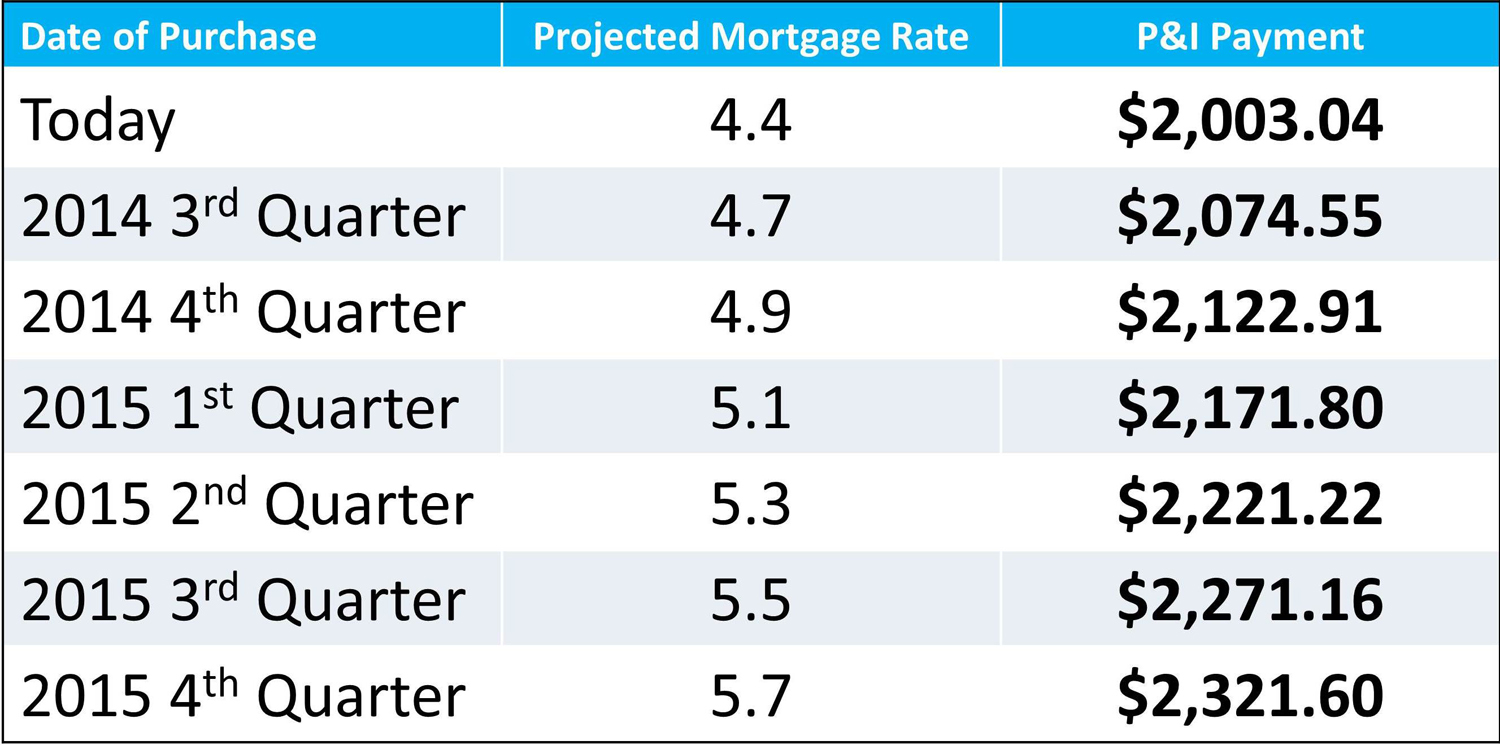

| A Home’s Cost vs. Price Explained Posted: 07 Apr 2014 04:00 AM PDT  We have often talked about the difference between COST and PRICE. As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As either a first time or repeat buyer, you must not be concerned about price but instead about the ‘long term cost’ of the home. Let us explain. We have often talked about the difference between COST and PRICE. As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As either a first time or repeat buyer, you must not be concerned about price but instead about the ‘long term cost’ of the home. Let us explain.Recently, we reported that a nationwide panel of over one hundred economists, real estate experts and investment & market strategists projected that home values would appreciate by approximately 8% from now to the end of 2015. Additionally, Freddie Mac’s most recent Economic Commentary & Projections Table predicts that the 30 year fixed mortgage rate will be 5.7% by the end of next year. What Does This Mean to a Buyer?Here is a simple demonstration of what impact these projected changes would have on the mortgage payment of a home selling for approximately $250,000 today: Agents who desire an even deeper understanding of how interest rates and home prices will dramatically impact this spring buyers’ season, should reserve a seat for our FREE webinar, “Spring Ahead in 2014: KCM’s Action Plan for Dominating this Buyers’ Season,” on Thursday, April 17th at 2PM ET. |

Millennials & Income

April 3, 2014

| Millennials & Income Posted: 03 Apr 2014 04:00 AM PDT Today, Justin DeCesare returns as our guest blogger. Justin is the CEO of Middleton & Associates Real Estate in La Jolla, CA. - The KCM Crew  Millennials have become an important topic of discussion for media outlets and blogs throughout the country. While some argue that my generation is blossoming later than our predecessors, optimists such as myself believe that our rebounding economy will help Millennials finally arrive in the economic arena that allows them the growth potential generations before were afforded. Millennials have become an important topic of discussion for media outlets and blogs throughout the country. While some argue that my generation is blossoming later than our predecessors, optimists such as myself believe that our rebounding economy will help Millennials finally arrive in the economic arena that allows them the growth potential generations before were afforded.While I truly believe Millennials are positioned to become an important force in the new economy, the widening economic policy that minimizes retirement accounts and creates underemployment of Millennials threatens what is now America’s largest demographic. In his post for MSN, Austin Thompson points out that Millennials are now in peak childbearing age. From both a Real Estate and parental standpoint, what goes hand in hand with raising a family is the desire to own a home. Families want to put down roots. They want to know they have a certain level of security while growing some form of equity for retirement. While slashing pensions and lower wages certainly puts a strain on Millennial workers, the ability to purchase Real Estate can still be a saving grace in the Millennial financial planning process. As agents and brokers, we are meant to advise our clients. We can’t change the fact that outside economic factors can have a negative impact on the lives of our clients. What we can do is try and help Millennials understand that they can take their future, and subsequently their retirement, into their own hands. Chances are your average Millennial client, like their parents, will not be starting out with a beach front multi-million dollar estate. Our job is to help explain the advantage that starting in smaller affordable homes now will have down the road; how it will help them grow and how it will help them take control of their livelihood. Do more than sell my generation a house…help them build a future. |

Who Says Millennials are not Buying Houses?

April 2, 2014

| Who Says Millennials are not Buying Houses? Posted: 01 Apr 2014 04:00 AM PDT  We have often gone against the grain to promote the fact that Millennials have a stronger belief in homeownership than previous generations. Some have strongly disagreed. Well, a new study from the National Association of Realtors (NAR) found Millennials now account for the greatest market share of recent home purchases. We have often gone against the grain to promote the fact that Millennials have a stronger belief in homeownership than previous generations. Some have strongly disagreed. Well, a new study from the National Association of Realtors (NAR) found Millennials now account for the greatest market share of recent home purchases.NAR’s Home Buyer and Seller Generational Trends Study for 2014, revealed that Millennials comprised 31 percent of recent purchases, leading all other age groups. Here are the percentages for other generations:

“Given that Millennials are the largest generation in history after the baby boomers, it means there is a potential for strong underlying demand. Moreover, their aspiration and the long-term investment aspect to owning a home remain solid among young people.” Other findings from the report:

Millennials are in the market and recognize the importance of using a real estate professional to guide them to the closing table.  |

© All Rights Reserved

The American desire to own a second home as a vacation home is alive and well!

The American desire to own a second home as a vacation home is alive and well!