Phil's Blog

Millennials: Optimistic & Ready to Buy

March 31, 2014

| Millennials: Optimistic & Ready to Buy Posted: 31 Mar 2014 04:00 AM PDT We believe that 2014 will be the year that Millennials re-enter the housing market in a big way. Because of that, we will be dedicating our blog posts each day this week to a better understanding of this generation. - The KCM Crew  A recent survey by the PulteGroup revealed that the Millennial generation has a more optimistic outlook regarding the American economy than other generations. According to the survey, 54% of Millennials believe the economy is in better shape today than it was last year compared to only 41% of the total population. A recent survey by the PulteGroup revealed that the Millennial generation has a more optimistic outlook regarding the American economy than other generations. According to the survey, 54% of Millennials believe the economy is in better shape today than it was last year compared to only 41% of the total population.It seems this optimism is impacting purchasing decisions as 74% of Millennials view now as an excellent or good time to buy the things they want or need. Jim Zeumer, vice president of corporate communications for the PulteGroup explained: "No other cohort of adults is nearly as confident about their economic future as the millennials are right now. This is definitely a change, as millennials have regularly been viewed as the disenfranchised generation vastly affected by the fallout of the recession. But now, with an increased sense of optimism, this generation is starting to feel as though they have the resources available to lead the lives they want or expect to in the future." WHAT ABOUT HOUSING?Specific to real estate, the survey indicated:

|

3 Reasons the Housing Market Should Thrive in 2014

March 27, 2014

| 3 Reasons the Housing Market Should Thrive in 2014 Posted: 27 Mar 2014 04:00 AM PDT  Recently, HousingWire asked David Berson, chief economist at Nationwide, for his opinion on the near-term future of housing. Below are what Mr. Berson believes to be the three things you need to know about housing in 2014. We have included a quote from the article and a small comment from KCM for all three points. Recently, HousingWire asked David Berson, chief economist at Nationwide, for his opinion on the near-term future of housing. Below are what Mr. Berson believes to be the three things you need to know about housing in 2014. We have included a quote from the article and a small comment from KCM for all three points.

Number 1: 2014 should prove to be the strongest year for housing activity since before the Great Recession“Most economists expect an improved job market in 2014, with employment growth accelerating and the unemployment rate continuing to decline. That jobless rate drop will reflect more of a pickup in employment than further declines in the labor force participation rate. This will be the key factor improving housing demand this year, even if mortgage rates rise and affordability declines. While the housing market tends to do especially well when the job market improves and mortgage rates decline simultaneously, that combination of events occurs only rarely…People buy homes when their job and income prospects improve – even if it’s more expensive to do so – rather than buy when it is inexpensive to do so but they’re worried about keeping their jobs.”KCM Comment:We agree that the job market will continue to improve and that rising interest rates will not be a detriment to the market in 2014. As Doug Duncan, SVP and chief economist at Fannie Mae, recently revealed:“Consumers have taken the interest rate rise in stride. Expectations for continued improvement in housing persist, and sentiment toward the current buying and selling environment is back on track.” Number 2: Demographics should start to favor housing activity“If the economy expands at a faster pace this year, bringing a more rapid rate of job creation, that should translate into more households, raising housing demand. We won’t see all three million missing households return to the housing market at once. (That wouldn’t be a good thing for the housing market anyway, since that would be on top of the 1.2 million households that normally would develop this year; such a surge would swamp the existing housing supply). Beginning in 2014, the pace of household formations should accelerate to an above-trend pace for several years, pushing up housing demand.”KCM Comment:The Urban Land Institute recently released a report, Emerging Trends in Real Estate 2014, projecting that 4.48 million new households will be formed over the next three years. Millennials will make up a large portion of these new households. With the economy improving, we believe they will finally be moving out of their parents’ homes and, after they compare renting versus buying, many will choose homeownership.Number 3: Mortgage availability shouldn’t worsen and may improve“The rise in mortgage rates already has reduced mortgage origination volumes as refinance activity declines. If mortgage rates rise further this year, as expected, then refinance activity will fall still more. In response, mortgage lenders probably will ease lending standards to the extent possible under the QM rules to boost lending activity by increasing purchase originations. As a result, the increase in new households expected to be created this year, spurred by a stronger job market, should find that qualifying for a mortgage loan will be somewhat easier in 2014 than in prior years.”KCM Comment:We also believe that, as the refinancing market begins to dry up, mortgage entities will be more aggressive in the purchase money market (mortgages necessary to purchase a home). There even seems to be recent evidence that lending standards are actually loosening. |

Freddie Mac: Doubtful Rates Will Return to Recent Lows

March 26, 2014

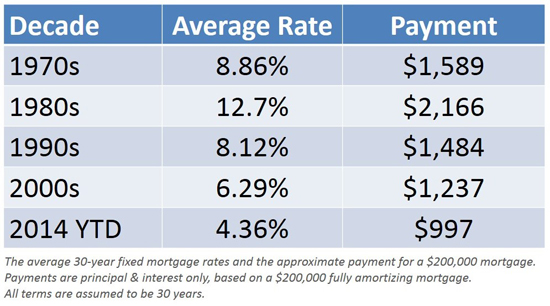

| Freddie Mac: Doubtful Rates Will Return to Recent Lows Posted: 26 Mar 2014 04:00 AM PDT  "One thing seems certain: we aren't likely to see average 30-year fixed mortgage rates return to the historic lows experienced in 2012." "One thing seems certain: we aren't likely to see average 30-year fixed mortgage rates return to the historic lows experienced in 2012."- Freddie Mac, March 24, 2014 There are those that hope that 30-year mortgage interest rates will head back under 4%. Obviously, for any prospective home purchaser that would be great news. However, there is probably a greater chance that interest rates will return to the greater than 6% rate of the last decade before they would return to the less than 3.5% rate of 2012. Freddie Mac, in one of four original posts on their new blog, explained that current rates are still extremely low compared to historic averages: "The all-time record low – since Freddie Mac began tracking mortgage rates in 1971 – was 3.31% in November 2012. Conversely, the all-time record high occurred in October of 1981, hitting 18.63%. That's more than four times higher than today's average 30-year fixed rate of 4.32% as of March 20...rates hovering around 4.5% may be high relative to last year, but something to celebrate compared to almost any year since 1971."  If you are thinking of buying a home, waiting for a dramatic decrease in mortgage rates might not make sense. Agents: Would the chart above help you put today’s interest rate environment in perspective when you’re meeting with buyers? How about a few more showing rate projections and the impact this would have on your buyer’s purchasing power? Start your 14-day trial of KCM to get these and many more visuals to educate your clients. |

The Truth About NAR’s Home Sales Numbers

March 25, 2014

| The Truth About NAR’s Home Sales Numbers Posted: 25 Mar 2014 04:00 AM PDT  The National Association of Realtors (NAR) released their latest Existing Homes Sales Report last Friday. The year-over-year comparison of overall sales did not paint a pretty picture. NAR itself called the sales numbers “subdued”. Other media sources used stronger terminology. The National Association of Realtors (NAR) released their latest Existing Homes Sales Report last Friday. The year-over-year comparison of overall sales did not paint a pretty picture. NAR itself called the sales numbers “subdued”. Other media sources used stronger terminology.There is no doubt that home sales were lower this February (4.60 million) than last February (4.95 million). However, a closer look at the report gives us some evidence as to why that is. Last year, of the 4.95M homes sold, 25% were distressed properties (foreclosures and short sales). This February, only 16% of sales were made up of distressed properties. WHY IS THIS IMPORTANT?Well, if we do the math, we can see that the annualized number of non-distressed properties sold which was revealed in the latest report (3,864,000) was actually greater than the annualized number of non-distressed properties sold that was reported last year (3,712,500). As we sell-off the ‘shadow inventory’ of distressed properties, there will be less homes from which a potential buyer can choose. That will impact sales.As proof of this point, we can look at the months’ supply of housing inventory available for purchase. In a normal market, a six month supply would be optimum. However, we haven’t reached a six month supply once in over 18 months. This shortage of inventory is the main reason sales are down. THE GOOD NEWSAs prices continue to rise, more and more homeowners will be freed from the shackles of negative or limited equity. This combined with an improving economy will allow homeowners to again feel confident that they can sell their homes and move on with their future plans. We are already starting to see increases in listings coming onto the market (unsold inventory is 5.3 percent above a year ago). Once housing inventory reaches normal levels (a 6 months’ supply) we will again see home sales begin to increase. |

Money Magazine: Buy Now not Later

March 24, 2014

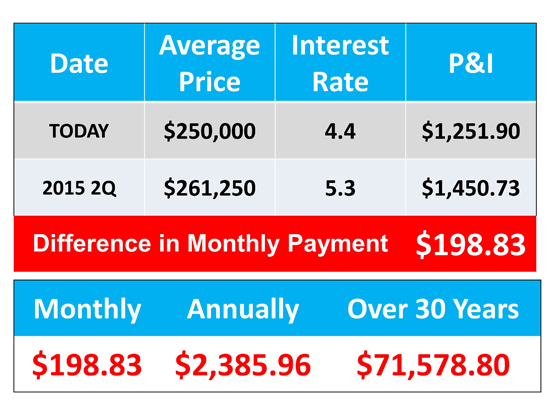

| Money Magazine: Buy Now not Later Posted: 24 Mar 2014 04:00 AM PDT  We have often suggested that potential home buyers consider rising interest rates when thinking about the true cost of a home. Remember, cost is not determined by price alone but by price and mortgage rate. The longer a buyer waits, the higher the mortgage payment will be if rates continue to increase (as is projected by Fannie Mae, Freddie Mac, the National Association of Realtors and the Mortgage Bankers Association). We have often suggested that potential home buyers consider rising interest rates when thinking about the true cost of a home. Remember, cost is not determined by price alone but by price and mortgage rate. The longer a buyer waits, the higher the mortgage payment will be if rates continue to increase (as is projected by Fannie Mae, Freddie Mac, the National Association of Realtors and the Mortgage Bankers Association).Money Magazine, in its latest issue, agreed with our analysis as they also warned their readership of the same ramification if they waited to buy a home. Here is what they said: "BE MINDFUL OF RATES. The average interest rate on a 30-year fixed loan is predicted to climb from the current 4.4% to 5.3% by the 2015 spring buying season, according to Freddie Mac. For a $250,000 loan, that means that a borrower who waits would pay $136 more per month and an additional $49,090 in interest over the life of the loan. Will you need a big loan? Better to act soon before rates tick up." And the monthly increase Money mentioned did not take into consideration that prices are also projected to increase over the next year. Here is what the additional cost would be if prices rise by the 4.5% projected by the latest Home Price Expectation Survey and interest rates go to 5.3%.  |

Why You Need a Real Estate Agent [INFOGRAPHIC]

March 21, 2014

| Why You Need a Real Estate Agent [INFOGRAPHIC] Posted: 21 Mar 2014 04:00 AM PDT  Courtesy of: Jensen and Company - Park City Utah Real Estate Agent |

Do People See You as the Real Estate Expert?

March 20, 2014

| Do People See You as the Real Estate Expert? Posted: 20 Mar 2014 04:00 AM PDT  “Real estate sales have changed more in the last year than the prior 100 years. I needed a real estate agent in 1997. I didn’t have the password to the MLS.” “Real estate sales have changed more in the last year than the prior 100 years. I needed a real estate agent in 1997. I didn’t have the password to the MLS.” - Daniel Pink, bestselling author of the book Drive at a real estate conference February 2014 There was a time when both buyers and sellers were forced to connect with a real estate agent in order to get even the basic information required to make a good decision regarding their housing needs. That time has passed. Buyers can now go on-line to find the homes that are for sale. Sellers can go on-line to find out which homes in their neighborhood sold over the last six months and at what price. Consumers are no longer looking for just information from a real estate agent. They require professional advice based on the information that is available. Guy Kawasaki, Silicon Valley author, speaker, investor and business advisor explained it best: “To provide value, real estate agents must not only provide information but also insights into that information.” We couldn’t agree more! The agents who will dominate their markets in the future are those that embrace the concept that they need to be a counselor not just facilitator; an expert in the market to whom consumers can turn for advice on difficult or complex real estate decisions. And they must brand themselves in that way. Whenever a buyer or seller in your market decides to make a decision on their housing, are you the first person who enters their mind? If not, why not? If you want further information on what it takes to be recognized as the real estate expert in your market, please join us today at 2PM ET for a FREE WEBINAR, "Becoming the INDUSTRY EXPERT in Your Market". Don't Miss Out, Register Now! |

5 REASONS TO SELL NOW

March 18, 2014

| 5 REASONS TO SELL NOW Posted: 18 Mar 2014 04:00 AM PDT  Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? Can buyers qualify for a mortgage? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are five of those reasons. Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? Can buyers qualify for a mortgage? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are five of those reasons.1. The Most Serious Buyers Are Out Now Most people realize that the housing market is hottest from April through June. The most serious buyers are well aware of this and, for that reason, come out in early spring in order to beat the heavy competition. These buyers are ready, willing and able to buy…and are in the market right now! 2. There Is Less Competition Now Housing supply always grows from the spring through the early summer. The choices buyers have will continue to increase over the next few months. Don’t wait until all the other potential sellers in your market put their homes up for sale. 3. The Process Will Be Quicker One of the biggest challenges of the 2014 housing market has been the length of time it takes from contract to closing. Banks are requiring more and more paperwork before approving a mortgage. As the market heats up, banks will be inundated with loan inquiries causing closing timelines to lengthen. Selling now will make the process quicker and simpler. 4. There Will Never Be a Better Time to Move-Up If you are moving up to a larger, more expensive home, consider doing it now. Prices are projected to appreciate by over 19% from now to 2018. If you are moving to a higher priced home, it will wind-up costing you more in raw dollars (both in down payment and mortgage payment) if you wait. You can also lock-in your 30 year housing expense with an interest rate at about 4.5% right now. Rates are projected to be well over 5% by this time next year. 5. It’s Time to Move On with Your Life Look at the reason you decided to sell in the first place and decide whether it is worth waiting. Is money more important than being with family? Is money more important than your health? Is money more important than having the freedom to go on with your life the way you think you should? You already know the answers to the questions we just asked. You have the power to take back control of the situation by pricing your home to guarantee it sells. The time has come for you and your family to move on and start living the life you desire. That is what is truly important.  |

5 REASONS TO BUY A HOME NOW

March 17, 2014

| 5 REASONS TO BUY A HOME NOW Posted: 17 Mar 2014 04:00 AM PDT  Based on prices, mortgage rates and soaring rents, there may have never been a better time in real estate history to purchase a home than right now. Here are five major reasons purchasers should consider buying. Based on prices, mortgage rates and soaring rents, there may have never been a better time in real estate history to purchase a home than right now. Here are five major reasons purchasers should consider buying.1. Competition is about to Increase Every spring a surge of prospective purchasers enter the housing market. Like you, they will want the best home available in the best location at the best price. They will be competing with you for the ‘steals’ in the market. Don’t miss the opportunity to get that ‘once-in-a-lifetime’ buy available today that no longer be available as the market heats up.. 2. Price Increases Are on the Horizon Nationally, home prices are projected to appreciate by 4.5% in 2014 and by over 19% from now until 2018. First home buyers will probably pay more both in price and interest rate if they wait until the spring. Even if you are a move-up buyer, it will wind-up costing you more in net dollars as the home you will buy will appreciate at approximately the same rate as the house you are in now. 3. Owning a Home Helps Create Family Wealth Whether you rent or you own the home you are living in, you are paying a mortgage. Either you are paying your mortgage or your landlord’s. The Federal Reserve, in a recent study, revealed that the net worth of the average homeowner is 30 times greater than that of a renter. 4. Interest Rates Are Projected to Rise The Mortgage Bankers Association, the National Association of Realtors, Freddie Mac and Fannie Mae have all projected that the 30-year mortgage interest rate will be over 5% by the spring of 2015. That is an increase of almost 3/4 of a point over current rates. 5. Buy Low, Sell High Most would all agree that, when investing, we want to buy at the lowest price possible and hope to sell at the highest price. Housing can create family wealth as long as we follow this simple principle. Today, real estate is selling ‘low’ compared to where it will be next year. It’s time to buy.  |

Buying a Home Less Expensive than Renting – by 38%!

March 12, 2014

| Buying a Home Less Expensive than Renting – by 38%! Posted: 12 Mar 2014 04:00 AM PDT  Trulia released their Rent vs. Buy Report last week. The report explained that homeownership remains cheaper than renting in all of the 100 largest metro areas by an average of 38%! Trulia released their Rent vs. Buy Report last week. The report explained that homeownership remains cheaper than renting in all of the 100 largest metro areas by an average of 38%!The other interesting findings in the report include:

|

Home Sales: Are They Increasing or Decreasing?

March 11, 2014

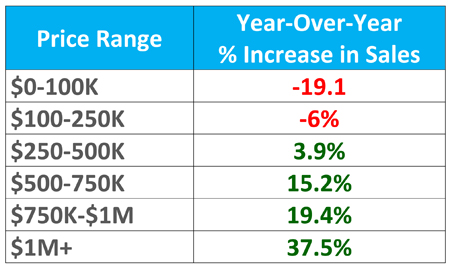

| Home Sales: Are They Increasing or Decreasing? Posted: 11 Mar 2014 04:00 AM PDT  There has been a lot of chatter about the last few Existing Home Sales Reports from the National Association of Realtors (NAR). Year-over-year sales have been down four of the last five months. Experts are asking whether or not the housing recovery is beginning to stall. Let’s take a closer look at the data. There has been a lot of chatter about the last few Existing Home Sales Reports from the National Association of Realtors (NAR). Year-over-year sales have been down four of the last five months. Experts are asking whether or not the housing recovery is beginning to stall. Let’s take a closer look at the data.It is true that last month’s annualized sales rate of 4.62M was less than the 4.87M reported last January. However, after further scrutiny, the report reveals an interesting situation: sales of non-distressed properties are actually up. In January 2013, 23% of the 4.87M sales were distressed properties (foreclosures and short sales) meaning 3.75M non-distressed properties were sold. In January 2014, 15% of the 4.62M sales were distressed properties. That means 3.93M non-distressed properties sold - an increase of 180,000 sales. When we dig deeper into NAR’s research, we also see that homes at the higher price points are selling at greater increases than the lower price points.  This deeper look at the report shows evidence that the housing market is still doing quite well when we removed distressed sales (which are in many cases lower end properties) from the equation.  |

Where Prices are Headed over the Next 5 Years?

March 10, 2014

| Where Prices are Headed over the Next 5 Years? Posted: 10 Mar 2014 04:00 AM PDT  Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number. Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.The results of their latest survey The latest survey was released last week. Here are the results:

|

Real Estate's New Market Reality [INFOGRAPHIC]

March 8, 2014

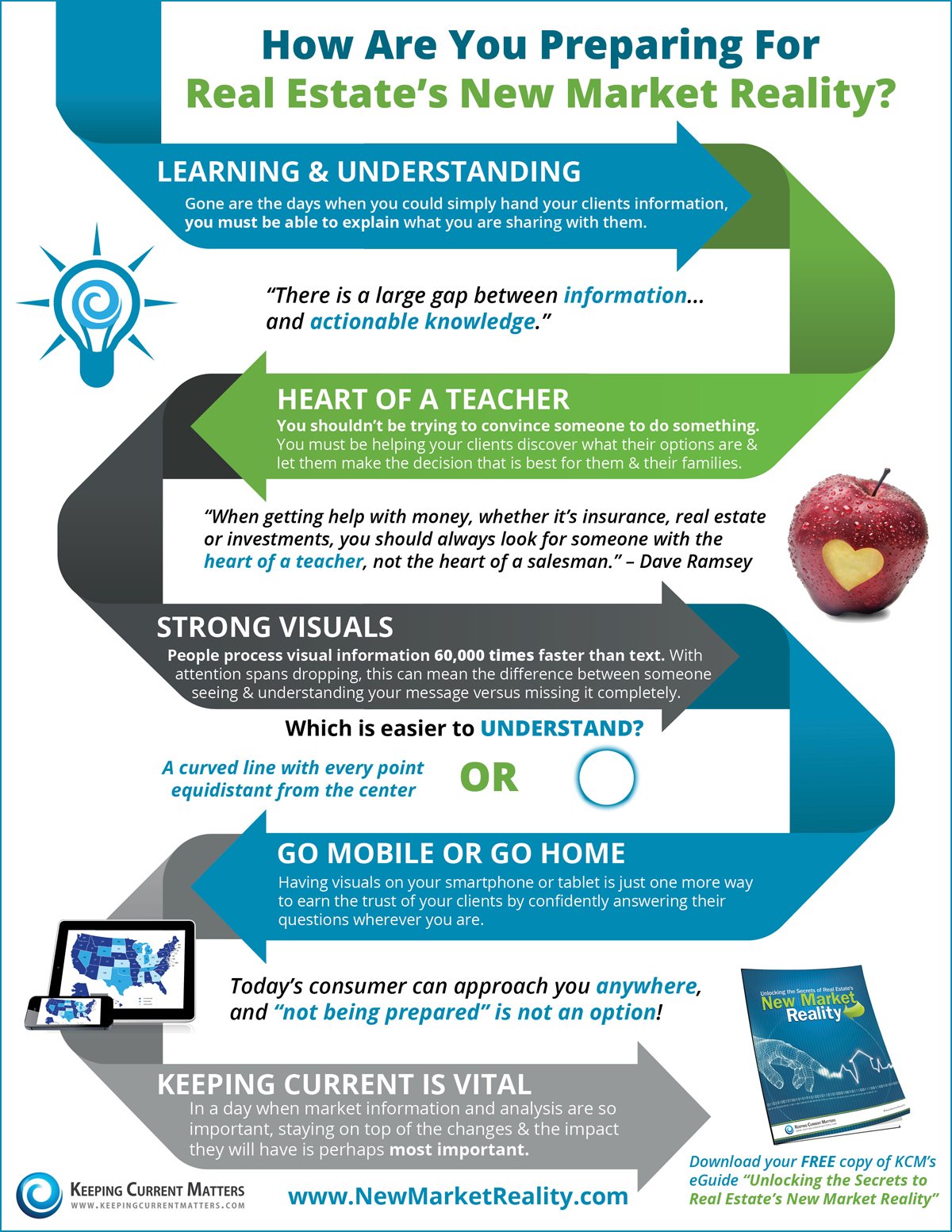

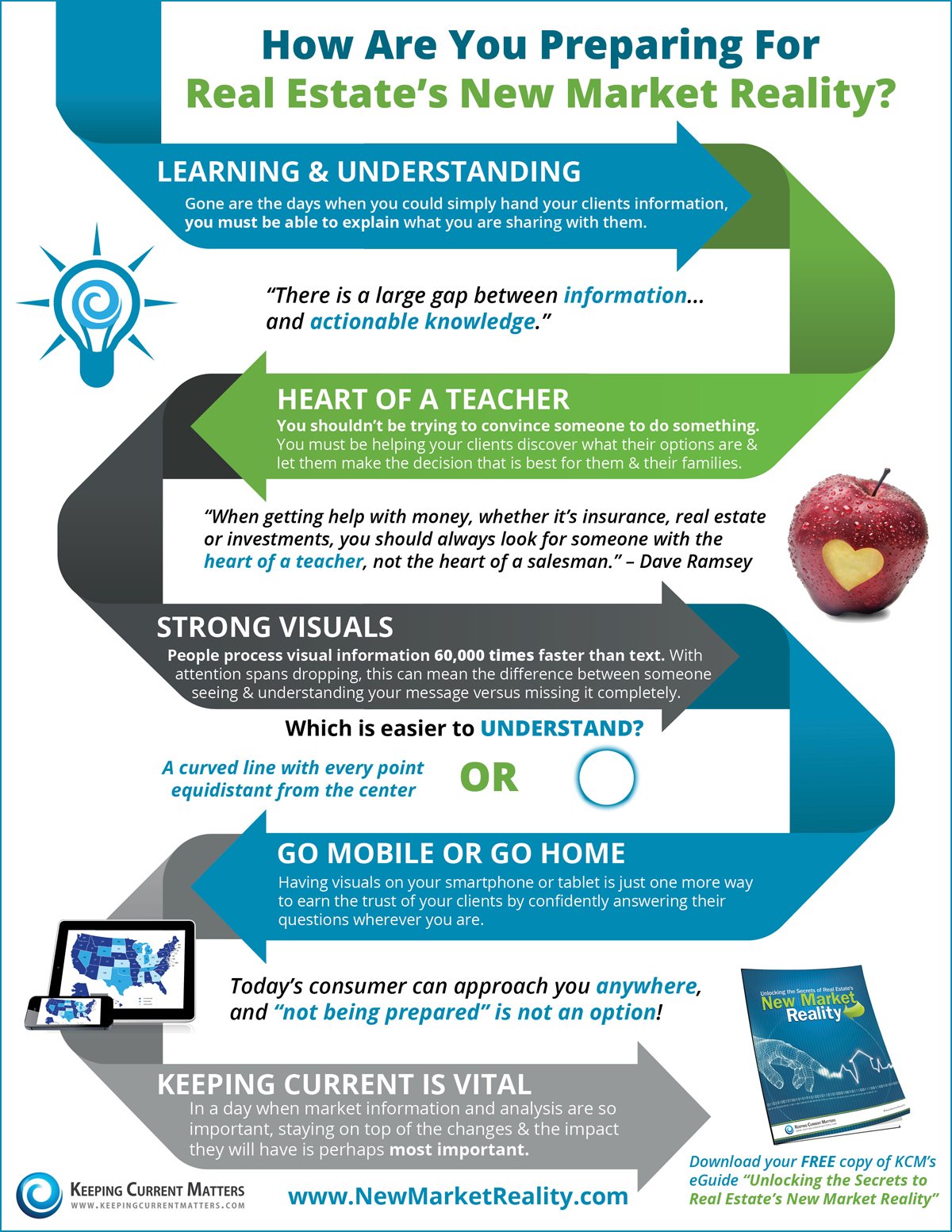

| Real Estate's New Market Reality [INFOGRAPHIC] Posted: 07 Mar 2014 04:00 AM PST  Download your FREE copy of KCM's eGuide, "Unlocking the Secrets to Real Estate's New Market Reality" |

Real Estate's New Market Reality [INFOGRAPHIC]

March 7, 2014

| Real Estate's New Market Reality [INFOGRAPHIC] Posted: 07 Mar 2014 04:00 AM PST  Download your FREE copy of KCM's eGuide, "Unlocking the Secrets to Real Estate's New Market Reality" |

5 Reasons to Hire a Real Estate Professional

March 5, 2014

| 5 Reasons to Hire a Real Estate Professional Posted: 03 Mar 2014 04:00 AM PST  Whether you are buying or selling a home, you need an experienced Real Estate Professional to lead you toward your ultimate goal. In this world of instant gratification and Internet searches, many sellers think that they can For Sale by Owner or FSBO. Whether you are buying or selling a home, you need an experienced Real Estate Professional to lead you toward your ultimate goal. In this world of instant gratification and Internet searches, many sellers think that they can For Sale by Owner or FSBO.The 5 Reasons You NEED a Real Estate Professional in your corner haven’t changed, but rather have been strengthened in recent months with the Federal Government continuing to taper bond purchases and the impact that decision has had on mortgage rates. 1. What do you do with all this paperwork?Each state has different regulations regarding the contracts required for a successful sale, and these regulations are constantly changing. A true Real Estate Professional is an expert in their market and can guide you through the stacks of paperwork necessary to make your dream a reality.2. Ok, so you found your dream house, now what?According to the Orlando Regional REALTOR Association, there are over 230 possible actions that need to take place during every successful real estate transaction. Don’t you want someone who has been there before, who knows what these actions are to make sure that you acquire your dream?3. Are you a good negotiator?So maybe you’re not convinced that you need an agent to sell your home. However, after looking at the list of parties that you need to be prepared to negotiate with, you’ll realize the value in selecting a Real Estate Professional. From the buyer (who wants the best deal possible), to the home inspection companies, to the appraiser, there are at least 11 different people that you will have to be knowledgeable with and answer to, during the process.4. What is the home you’re buying/selling really worth?Not only is it important for your home to be priced correctly from the start, to attract the right buyers and shorten the time that it’s on the market, but you also need someone who is not emotionally connected to your home, to give you the truth as to your home’s value.According to the National Association of REALTORS, “the typical FSBO home sold for $184,000 compared to $230,000 among agent-assisted home sales.” Get the most out of your transaction by hiring a professional. 5. Do you know what’s really going on in the market?There is so much information out there on the news and the Internet about home sales, prices, mortgage rates; how do you know what’s going on specifically in your area? Who do you turn to, to tell you how to competitively price your home correctly at the beginning of the selling process? How do you know what to offer on your dream home without paying too much, or offending the seller with a low-ball offer?“When getting help with money, whether it’s insurance, real estate or investments, you should always look for someone with the heart of a teacher, not the heart of a salesman.” – Dave Ramsey Hiring an agent who has their finger on the pulse of the market will make your buying/selling experience an educated one. You need someone who is going to tell you the truth, not just what they think you want to hear. Bottom Line:You wouldn’t hike up Kilimanjaro without a Sherpa, or replace the engine in your car without a trusted mechanic, why would you make one of your most important financial decisions of your life without hiring a Real Estate Professional?Agents: How do you earn the trust of your clients? Our upcoming FREE webinar “Becoming the Industry Expert in Your Market” is on Thursday, March 20th. Register now to learn the significance of being seen as the industry expert, the power of branding yourself this way and the essentials required to accomplish these two feats. |

Buying a Home? How the Serenity Prayer May Help

March 5, 2014

| Buying a Home? How the Serenity Prayer May Help Posted: 05 Mar 2014 04:00 AM PST  You may be frustrated while attempting to buy a home in today’s market. You may feel powerless to the process. How could YOU possibly know whether the current good news about housing will continue? There is no doubt that today’s real estate market is extremely difficult to navigate. However, we want you to know that thousands of homes sold yesterday, thousands will sell today and thousands will sell each and every day from now until the end of the year. You may be frustrated while attempting to buy a home in today’s market. You may feel powerless to the process. How could YOU possibly know whether the current good news about housing will continue? There is no doubt that today’s real estate market is extremely difficult to navigate. However, we want you to know that thousands of homes sold yesterday, thousands will sell today and thousands will sell each and every day from now until the end of the year.It is totally within your power to decide whether it is the right time for you and your family to move. Even in the current market. “How?” Let’s look at the simplicity of the famous Serenity Prayer and apply it to buying a home in today’s real estate market. “God, grant me the serenity to accept the things I cannot change; courage to change the things I can; and wisdom to know the difference.” Accept the things you cannot changeThe two main concerns many talk about when discussing the housing market are:

Have the courage to change the things you canWhether you are a first-time buyer or a move-up buyer and you believe now is the right time for your family to purchase a home – DO IT! Prices will only be higher later this year and though interest rates are rising they are still at historic lows. That means that your monthly housing expense will still be lower than almost any time in the last 50 years – and probably lower than your current rent payment.The wisdom to know the differenceWith the winter ending, the outlook on inventory is positive. Sellers will look to come out of hibernation and list their homes. The question is whether or not it makes sense to delay moving on with your life until everything gets ‘better’. Should you not buy a house and enable your kids to attend the school you have already decided is best for them? Should you spend another winter up north even though your doctor recommends you move to a climate better suited to your current medical situation?This is where your wisdom must kick in. You already know the answers to the questions we just asked. You have the power to take back control of the situation by moving forward. The time has come for you and your family to move on and start living the life you desire. That is what truly matters. |

© All Rights Reserved