Phil's Blog

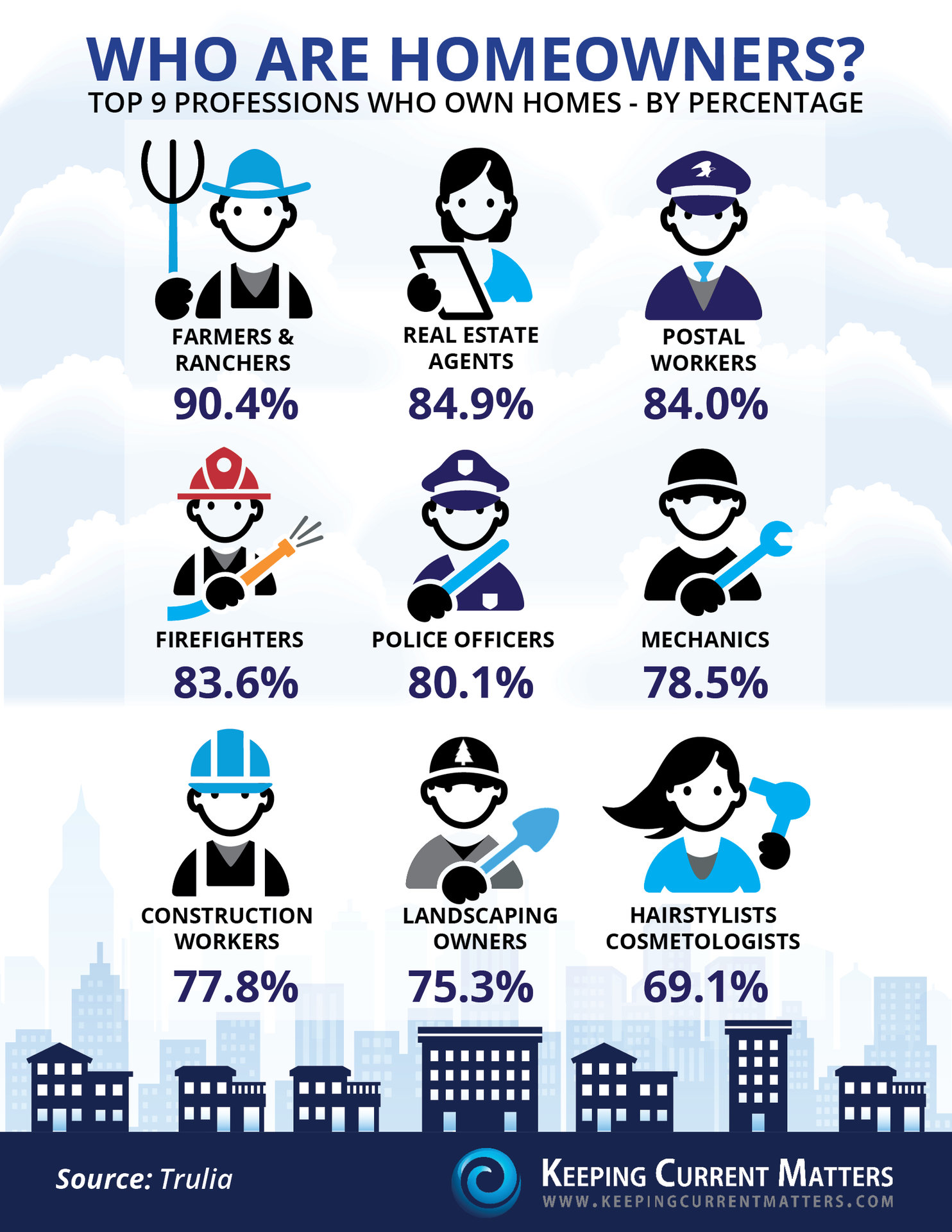

Who Are Homeowners? [INFOGRAPHIC]

February 28, 2014

| Who Are Homeowners? [INFOGRAPHIC] Posted: 28 Feb 2014 04:00 AM PST  |

February 27, 2014

| Millennials & Social Media Posted: 27 Feb 2014 04:00 AM PST We are excited to have Justin DeCesare as our guest blogger today! Justin is the CEO of Middleton & Associates Real Estate in La Jolla, CA. - The KCM Crew  If you are a REALTOR® hoping to capitalize on the emerging Millennial buying demographic, it is crucial to understand the wants, needs, and desires of your potential client. If you are a REALTOR® hoping to capitalize on the emerging Millennial buying demographic, it is crucial to understand the wants, needs, and desires of your potential client.Our generation was the catalyst for every social media outlet that is now used by every age group in America, and no matter what traits pundits would like to label on the Millennials, their own information is transported with a wider reach and on an exponentially faster scale than ever before. The key to understanding social media is this: It is a medium… Not a product. Much like any other marketing strategy that has been used by agents since the beginning of our industry – such as bus bench signs, direct mail, or cold calling – your brand on Social Media will not create rapport with everyone, and you cannot expect it to do so. Treat social media as you would any other marketing campaign: Create a brand, find a target audience, and then execute. The key to maximizing its potential is to understand what the Millennial wants out of a Business on Social Media. Keep in mind that Social Media is entirely intended to facilitate a conversation between individuals – not to be utilized as an advertising mechanism; however, our business is local, and if you proceed with genuine interest in communicating, your efforts can be successful. In a recent post on Social Media Today, Nathan Mendenhall writes that in a recent poll of Millennials, the reason they follow brands on social media are:

Whatever you choose, make it about yourself. Disingenuous marketing is a fail safe way to not create new relationships with Millennials. It is about communication that goes both ways, so remember, it’s not just about your ability to sell; it’s about your ability to listen. |

Just Believe Your Own Eyes

February 26, 2014

| Just Believe Your Own Eyes Posted: 26 Feb 2014 04:00 AM PST Our founder, Steve Harney, occasionally asks to do a personal post on what he sees as important to our industry. Today is one of those days. Enjoy! – The KCM Crew  Many believe the housing market is in a full out recovery. Others are questioning that assumption. To find out, maybe the only thing we need to do is just open our eyes. Many believe the housing market is in a full out recovery. Others are questioning that assumption. To find out, maybe the only thing we need to do is just open our eyes.When my wife and I visited Miami ten years ago, we were amazed at the number of building cranes that lined the streets along the beachfront. There was a wave of buyers descending on the city with pockets full of money. Everywhere you looked, there was a new condo complex going up and each building being constructed required a crane on the property. Back then, the city of Miami looked like the set of a Transformer movie with what seemed like hundreds of these huge mechanical machines marching through the city. Then the housing crisis hit. Miami property values dropped by over 50%. The buying frenzy cooled. The cranes disappeared. Today, Miami's house prices are beginning to rebound quite nicely. We purchased a condo in South Beach two years ago and have been happy to experience a nice bump in value already. However, this week we realized the Miami market is definitely back. Why do we know this? The cranes are back. From the balcony of our waterfront home we can look at the city skyline. This week we saw a familiar sight. Building cranes dotted that skyline. New buildings are being built. There is a new buzz in Miami. Things are the way we remember them being ten years ago. It seems the market is back! |

Moving-Up? Do it NOW not Later

February 25, 2014

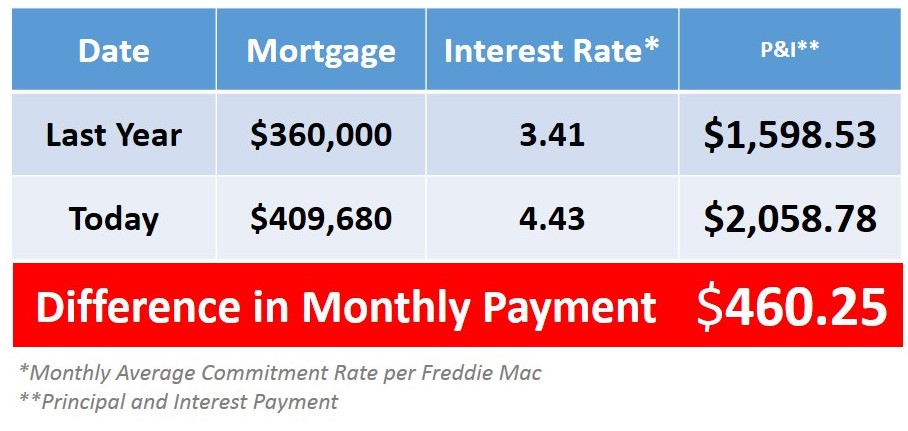

| Moving-Up? Do it NOW not Later Posted: 25 Feb 2014 04:00 AM PST  A recent study revealed that the number of existing home owners planning to buy a home this year is about to increase dramatically. Some are moving up, some are downsizing and others are making a lateral move. Another study shows that over 75% of these buyers will, in fact, be in that first category: a move-up buyer. We want to address this group of buyers in today’s blog post. A recent study revealed that the number of existing home owners planning to buy a home this year is about to increase dramatically. Some are moving up, some are downsizing and others are making a lateral move. Another study shows that over 75% of these buyers will, in fact, be in that first category: a move-up buyer. We want to address this group of buyers in today’s blog post.There is no way for us to predict the future but we can look at what happened over the last year. Let’s look at buyers that considered moving up last year but decided to wait instead. Assume they had a home worth $300,000 and were looking at a home for $400,000 (putting 10% down they would get a mortgage of $360,000). By waiting, their house appreciated by 13.8% over the last year (national average based on the Case Shiller Pricing Index). Their home would now be worth $341,400. But, the $400,000 home would now be worth $455,200 (requiring a mortgage of $409,680). Here is a table showing what additional monthly cost would be incurred by waiting:  Prices are projected to appreciate by over 4% and interest rates are also expected to rise by as much as another full percentage point. If your family plans to move-up to a nicer or bigger home this year, it may make sense to move now rather than later. ____________________________________________________________________ In the two most recent editions of KCM, we have broken down the Cost of Waiting for Move-Up Buyers. Members can login now to download this information today. If you're not a KCM Member yet, start your free trial to add materials like this to your business. |

Should You Buy or Rent a Home?

February 24, 2014

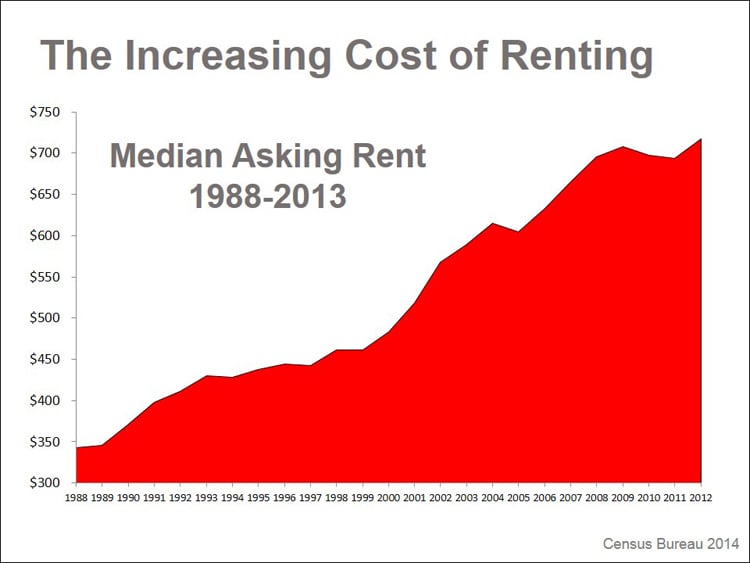

| Should You Buy or Rent a Home? Posted: 24 Feb 2014 04:00 AM PST Here is one simple chart that explains why we think buying a home makes more sense than renting one.  KCM Members: You can now login to download this and all bonus slides moving forward by visiting the Infographics page under the Content drop down menu inside the Member Area. Not a KCM Member yet? Click Here to discover out how you can receive visuals like this one with a KCM Membership! |

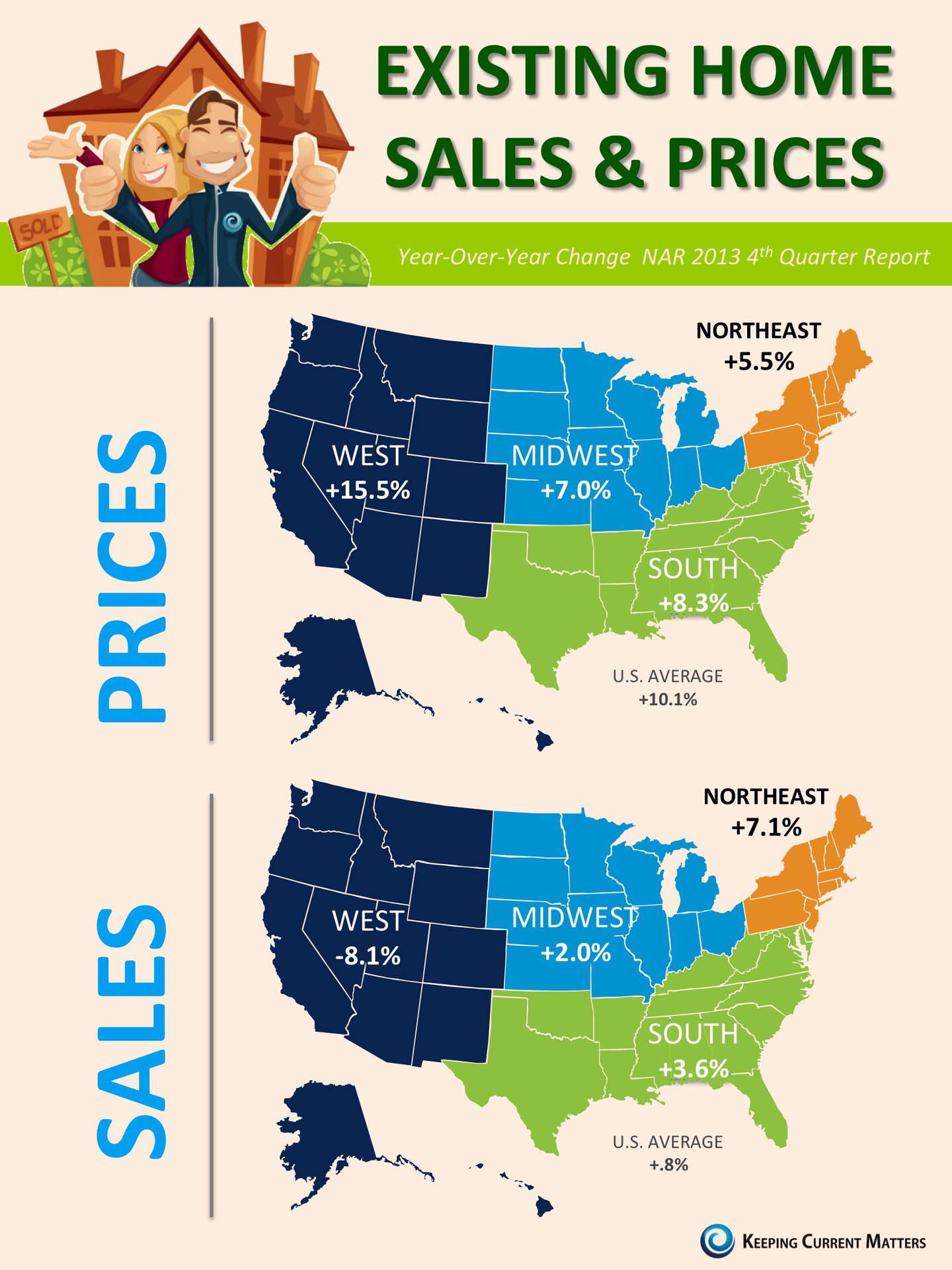

Existing Home Sales & Prices [INFOGRAPHIC]

February 21, 2014

| Existing Home Sales & Prices [INFOGRAPHIC] Posted: 21 Feb 2014 04:00 AM PST  |

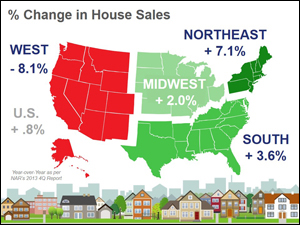

Home Sales Up in 3 of 4 Regions

February 19, 2014

| Home Sales Up in 3 of 4 Regions Posted: 19 Feb 2014 04:00 AM PST  Some industry gurus are questioning whether the housing momentum we saw early in 2013 began to dissipate later in the year. The more dramatic have claimed the housing sector is still on shaky ground. Others have blamed the slowdown in sales on a lack of consumer confidence or rising interest rates. Some industry gurus are questioning whether the housing momentum we saw early in 2013 began to dissipate later in the year. The more dramatic have claimed the housing sector is still on shaky ground. Others have blamed the slowdown in sales on a lack of consumer confidence or rising interest rates.The National Association of Realtors (NAR) just released their 2013 4th Quarter Housing Report. The report revealed that home sales numbers barely outperformed (an .08% increase) those in the 4th quarter of 2012. We believe the leveling in home sales is directly attributable to a lack of salable listing inventory; specifically in the West. Three of the four regions in the NAR report had an increase in sales: Northeast (+7.1%), Midwest (+2%) and South Regions (+3.6%). A big fall-off in sales occurred in the Western Region. The dramatic fall-off in the West (-8.1%) can be directly linked to a shortage of inventory in their hottest markets. If the decrease in sales was caused by an eroding of consumer confidence and/or rising interest rates, we believe each region would have seen similar decreases.  |

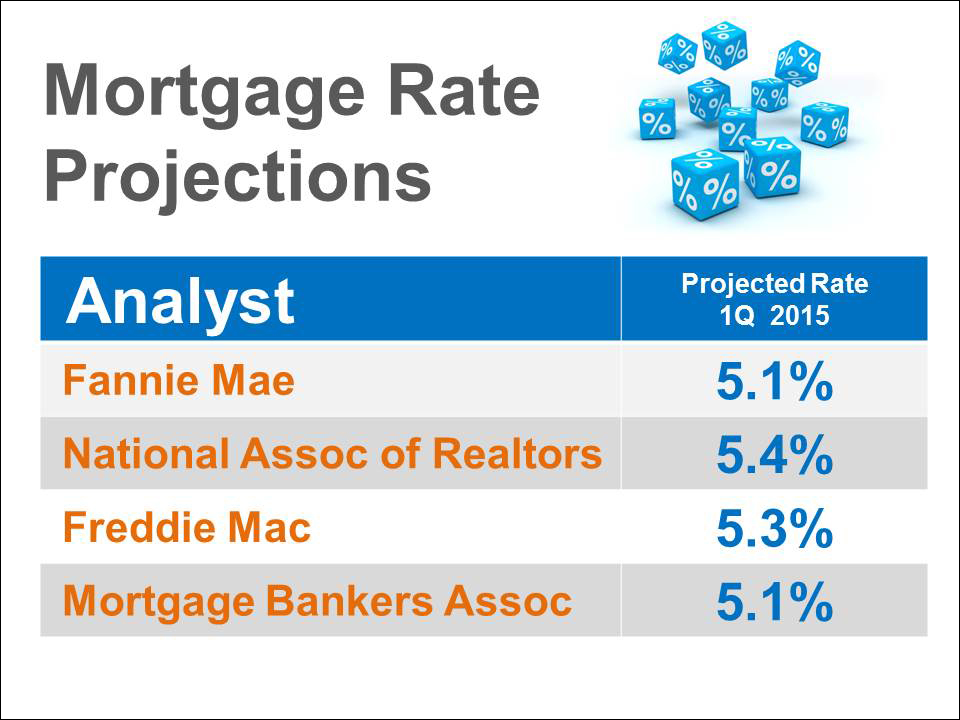

Mortgage Rates Projected to Rise as Tapering Continues

February 18, 2014

| Mortgage Rates Projected to Rise as Tapering Continues Posted: 18 Feb 2014 04:00 AM PST  It is projected that if the Fed continues to cut back on bond purchases that long term mortgage rates would start to climb. Many experts felt that Janet Yellen, who replaced Ben Bernanke as Fed Chair, was going to be less inclined to continue tapering bond purchases at the level established. It is projected that if the Fed continues to cut back on bond purchases that long term mortgage rates would start to climb. Many experts felt that Janet Yellen, who replaced Ben Bernanke as Fed Chair, was going to be less inclined to continue tapering bond purchases at the level established.However, in her testimony in front of the Financial Services Committee last week, Yellen made it quite clear that she will in fact continue the current pace of tapering: “In December, the Committee judged that the cumulative progress toward maximum employment and the improvement in the outlook for labor market conditions warranted a modest reduction in the pace of purchases, from $45 billion to $40 billion per month of longer-term Treasury securities and from $40 billion to $35 billion per month of agency mortgage-backed securities. At its January meeting, the Committee decided to make additional reductions of the same magnitude. If incoming information broadly supports the Committee's expectation of ongoing improvement in labor market conditions and inflation moving back toward its longer-run objective, the Committee will likely reduce the pace of asset purchases in further measured steps at future meetings.” What does that mean to a prospective purchaser? Currently, Freddie Mac’s 30 year rate is at 4.28%. Here are the projected interest rates for this time next year:   |

More Americans Confident about Buying

February 17, 2014

| More Americans Confident about Buying Posted: 17 Feb 2014 04:00 AM PST  Last week, Fannie Mae released their January 2014 National Housing Survey results. Two categories reported all-time survey highs. Last week, Fannie Mae released their January 2014 National Housing Survey results. Two categories reported all-time survey highs.

“A majority of consumers now believe that it is getting easier to get a mortgage. For the first time in the National Housing Survey’s three-and-a-half-year history, the share of respondents who said it is easy to get a mortgage surpassed the 50-percent mark. The gradual upward trend in this indicator during the last few months bodes well for the housing recovery and may be contributing to this month’s increase in consumers’ intention to buy rather than rent their next home. The dip in overall home price expectations, though notable, is consistent with our view of moderating home price gains this year from a robust pace last year, while positive trends in perceptions about the economy and personal finances over the next year support our view of stronger growth in the broader economy.” With home prices projected to increase in 2014 (albeit at a slower pace than they did in 2013) and with mortgage interest rates projected to increase, it is good news that consumers are becoming more confident in their ability to buy a home if they so desire.  |

A Flood of Listings Coming to the Market?

February 12, 2014

| A Flood of Listings Coming to the Market? Posted: 12 Feb 2014 04:00 AM PST  We have previously talked about the diminishing supply of housing inventory and how it is impacting the real estate market. The situation might be about to change dramatically according to a recent survey by Lending Tree. The survey revealed three interesting findings. Of those surveyed:

71% of homeowners are considering selling their home in the next 12 months! While we realize that 70% of the housing inventory in this country could never be turned over in a year, it is interesting that people are again thinking about moving. There has been a pent-up selling demand over the last few years because families lost both equity in their homes and confidence in the economy. Rising prices have returned equity to many and an improving economy is again rebuilding consumer confidence. Bottom LineOnly time will tell. However, even if a small portion of that 71% actually decide to sell, this year’s real estate market could be very interesting as we move forward. |

Buying a Home: Should You Do it Now or Later?

February 11, 2014

| Buying a Home: Should You Do it Now or Later? Posted: 11 Feb 2014 04:00 AM PST  Last month, the Federal Reserve, in a unanimous vote, decided to further decrease its bond purchasing. The bond purchases were the government’s stimulus package created to keep long term mortgage interest rates artificially low in order to help drive the housing market. Most experts believe that tapering will cause interest rates to increase as we move through the year. Last month, the Federal Reserve, in a unanimous vote, decided to further decrease its bond purchasing. The bond purchases were the government’s stimulus package created to keep long term mortgage interest rates artificially low in order to help drive the housing market. Most experts believe that tapering will cause interest rates to increase as we move through the year.Interest rates have remained relatively stable since the onset of the tapering in December. This is probably because the first round of increases had already been ‘priced into’ the equation last summer when rates skyrocketed by over a full percentage point just on the speculation that tapering would take place later in 2013. However, as we move forward, most analysts believe rates will start to rise culminating in a rate close to a full percentage point higher than current rates by this time next year. For example, Freddie Mac, Fannie Mae, The Mortgage Bankers’ Association and the National Association of Realtors have all recently projected rates to be between 5-5.4% at this time next year. Bottom LineIf you are a first time buyer or a move-up buyer, the cost of the mortgage on your new home will probably increase as we move through the year. If the timing makes sense, buying sooner rather than later may save you a substantial amount of money over the long term in lower mortgage payments. |

Be Quiet Chicken Little. The Sky is NOT Falling

February 10, 2014

| Be Quiet Chicken Little. The Sky is NOT Falling Posted: 10 Feb 2014 04:00 AM PST  There has been much speculation about what is causing the falling sales numbers in the most recent Existing Home Sales Reports (EHS) from the National Association of Realtors (NAR). Some have claimed that rising interest rates have scared buyers out of the market. Others have claimed that consumers are just losing confidence in the housing recovery fearing a new bubble may be forming. We want to look at the validity of these two assumptions. There has been much speculation about what is causing the falling sales numbers in the most recent Existing Home Sales Reports (EHS) from the National Association of Realtors (NAR). Some have claimed that rising interest rates have scared buyers out of the market. Others have claimed that consumers are just losing confidence in the housing recovery fearing a new bubble may be forming. We want to look at the validity of these two assumptions.

MORTGAGE INTEREST RATESASSUMPTION: Rising interest rates have forced buyers back onto the fence. Evidence offered up by those in this camp comes directly from the EHS Report from NAR. Three of the last four reports revealed that sales were below sales from the same month the previous year.THE REALITY: Though it is true year-over-year sales have fallen nationally, a closer look at the report reveals major regional differences. Sales in the West Region are down 10.7% versus the same month last year. Sales in the Midwest Region are also down but by less than 1%. The Northeast Region is up 3.2% and the Southern Region is up 4.6%. If the issue is interest rates, why is one region virtually unchanged and two of the remaining three regions up in sales? We don’t believe rates are the challenge. CONSUMER CONFIDENCE in REAL ESTATE is ERODINGASSUMPTION: The pace of the recent price increases has caused many to fear the emergence of a new housing bubble. Similar to the first assumption, evidence offered up by those in this camp comes directly from the less than enthusiastic EHS Reports from NAR.THE REALITY: As we mentioned before, sales in the Midwest Region are down but by less than 1%. The Northeast and the Southern Region have both shown increased sales as compared to the year before. Are only the consumers in the Western Region afraid of a possible bubble forming? The fear of a new housing bubble is vastly overstated. Forty states have not yet returned to home values they experienced seven to nine years ago. Nineteen of those forty states still have home prices 15% or more below peak prices. We believe home values will continue to increase but just at a slower rate of appreciation. It is not just us that believe this is the case. The over 100 housing experts recently surveyed by Pulsenomics revealed that they believe prices will continue to appreciate at historical annual numbers (3-4%) for at least the next five years. THEN WHAT IS THE CHALLENGE?If the lack of sales is not the result of increasing interest rates or decreasing consumer confidence, what actually is happening? We believe it can be broken down to three words: LACK of INVENTORY.Inventories of foreclosure and short sale properties are falling like a rock in the vast majority of regions across the nation. These two categories of homes have driven the market for the last few years. As foreclosures and short sales sell, they are not being replaced because the economy has gotten better and more families have regained control of their finances. All fifty states have seen a decrease in the number of homeowners who are seriously delinquent on their mortgage payments with thirty nine states seeing the number shrink by over 20%. This inventory has not yet begun to be replaced by the non-distressed properties in the country. Just this month, NAR revealed that the months’ inventory of homes for sale has dropped to only a 4 month supply. A normal market has between 5-6 months’ supply. This is the main reason home sales are declining in certain regions – there are just not enough houses for sale. BOTTOM LINEWith the economy improving and with homeowners gaining back some equity they lost when prices fell, we believe there will be many homes coming unto the market this spring. A recent survey revealed that 71% of homeowners are at least considering selling their home in 2014.If you are thinking of selling, beating this increased competition to the market before spring might make sense – and might enable you to get the best price possible for your home.  |

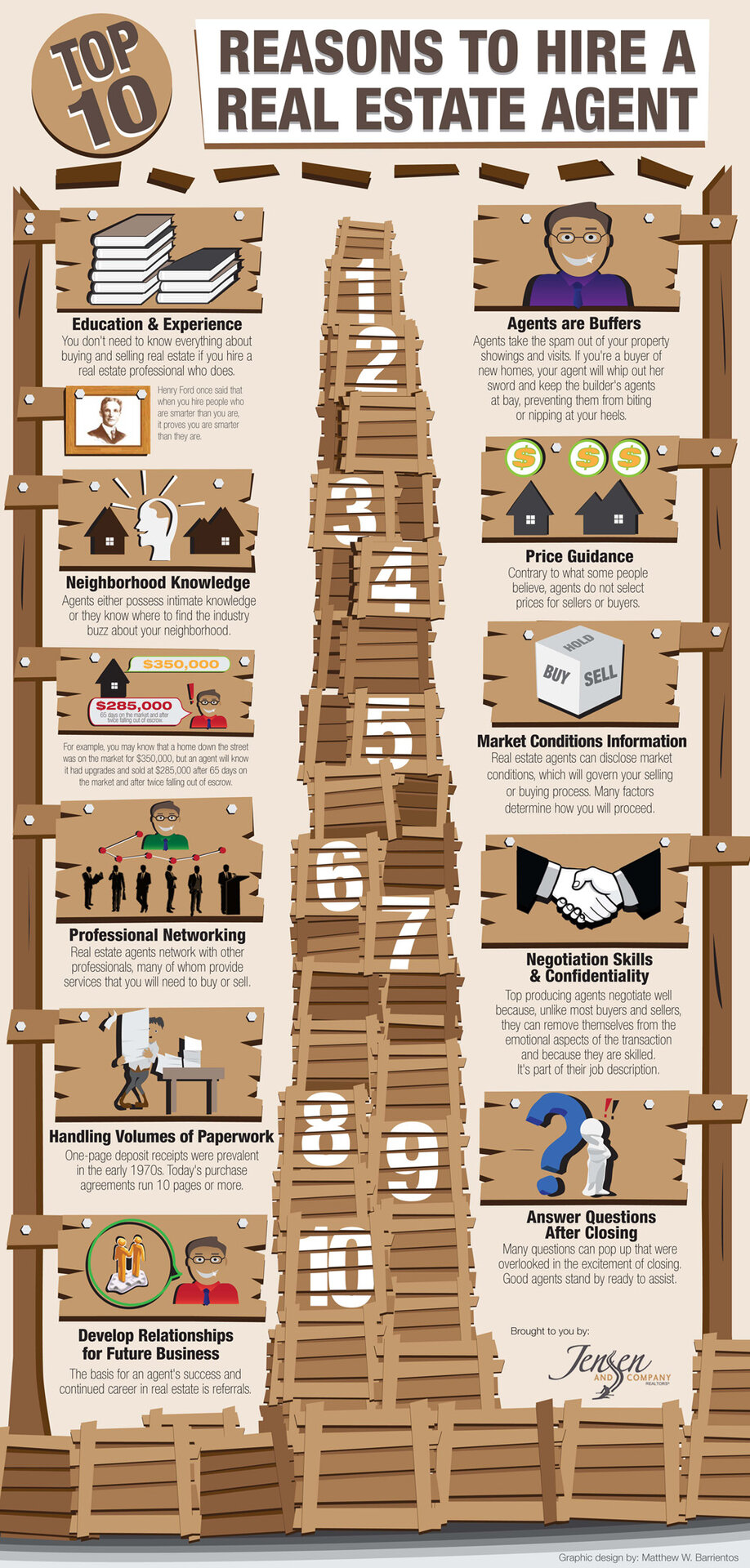

Top 10 Reasons To Hire A Real Estate Agent [INFOGRAPHIC]

February 7, 2014

| Top 10 Reasons To Hire A Real Estate Agent [INFOGRAPHIC] Posted: 07 Feb 2014 04:00 AM PST  Courtesy of: Park City Real Estate - JensenandCompany.com |

5 Reasons You Shouldn’t For Sale by Owner

February 5, 2014

| 5 Reasons You Shouldn’t For Sale by Owner Posted: 05 Feb 2014 04:00 AM PST  Some homeowners consider trying to sell their home on their own, known in the industry as a For Sale by Owner (FSBO). We think there are several reasons this might not be a good idea for the vast majority of sellers. Some homeowners consider trying to sell their home on their own, known in the industry as a For Sale by Owner (FSBO). We think there are several reasons this might not be a good idea for the vast majority of sellers.

Here are five of our reasons:1. There Are Too Many People to Negotiate WithHere is a list of some of the people with whom you must be prepared to negotiate if you decide to FSBO.

2. Exposure to Perspective PurchasersRecent studies have shown that 92% of buyers search online for a home. That is in comparison to only 28% looking at print newspaper ads. Most real estate agents have an internet strategy to promote the sale of your home. Do you?3. Results Come from the InternetWhere do buyers find the home they actually purchased?

4. FSBOing has Become More and More DifficultThe paperwork involved in selling and buying a home has increased dramatically as industry disclosures and regulations have become mandatory. This is one of the reasons that the percentage of people FSBOing has dropped from 19% to 9% over the last 20+ years.5. You Net More Money when Using an AgentMany homeowners believe that they will save the real estate commission by selling on their own. Realize that the main reason buyers look at FSBOs is because they also believe they can save the real commission. The seller and buyer can’t both save the commission.Studies have shown that the typical house sold by the homeowner sells for $184,000 while the typical house sold by an agent sells for $230,000. This doesn’t mean that an agent can get $46,000 more for your home as studies have shown that people are more likely to FSBO in markets with lower price points. However, it does show that selling on your own might not make sense. Bottom LineBefore you decide to take on the challenges of selling your house on your own, sit with a real estate professional in your marketplace and see what they have to offer. |

5 Reasons to Buy a Home Now Instead of Spring

February 4, 2014

| 5 Reasons to Buy a Home Now Instead of Spring Posted: 04 Feb 2014 04:00 AM PST  Based on prices, mortgage rates and soaring rents, there may have never been a better time in real estate history to purchase a home than right now. Here are five reasons purchasers should consider buying before the spring market arrives: Based on prices, mortgage rates and soaring rents, there may have never been a better time in real estate history to purchase a home than right now. Here are five reasons purchasers should consider buying before the spring market arrives:

Supply Is ShrinkingWith inventory declining in many regions, finding a home of your dreams may become more difficult going forward. There are buyers in more and more markets surprised that there is no longer a large assortment of houses to choose from. The best homes in the best locations sell first. Don’t miss the opportunity to get that ‘once-in-a-lifetime’ buy.Price Increases Are on the HorizonPrices are projected to appreciate by over 25% from now to 2018. First home buyers will probably pay more both in price and interest rate if they wait until the spring. Even if you are a move-up buyer, it will wind-up costing you more in net dollars as the home you will buy will appreciate at approximately the same rate as the house you are in now.Owning a Home Helps Create Family WealthWhether you are rent or you own the home you are living in, you are paying a mortgage. Either you are paying your mortgage or your landlord’s. The Fed, in a recent study, revealed that the net worth of the average homeowner is 30 times greater than that of a renter.Interest Rates Are Projected to RiseThe Mortgage Bankers Association, the National Association of Realtors, Freddie Mac and Fannie Mae have all projected that the 30-year mortgage interest rate will be over 5% by the this time next year. That is an increase of almost one full point over current rates.Buy Low, Sell HighWe would all agree that, when investing, we want to buy at the lowest price possible and hope to sell at the highest price. Housing can create family wealth as long as we follow this simple principle. Today, real estate is selling ‘low’ compared to where it will be next year. It’s time to buy. |

5 Reasons to Hire a Real Estate Professional

February 3, 2014

| 5 Reasons to Hire a Real Estate Professional Posted: 03 Feb 2014 04:00 AM PST  We are often asked if it makes sense to hire a real estate professional when buying or selling a home. We always emphatically answer – YES! We are often asked if it makes sense to hire a real estate professional when buying or selling a home. We always emphatically answer – YES!Here are five reasons why: PAPERWORKAn agent will help with all disclosures and paperwork necessary in today’s heavily regulated environment. This helps remove much of the liability a buyer or seller could face.EXPERIENCENavigating today’s real estate and mortgage processes can be like walking through a minefield of challenges. Real estate professionals are well educated in and experienced with the entire sales process.NEGOTIATIONSNegotiating such a large financial transaction can get tricky. Agents act as a ‘buffer’ in negotiations with all parties throughout the entire transaction.PRICINGReal estate professionals help buyers and sellers understand the true real estate value of a property in today’s market. This is crucial when setting the price on a listing or on an offer to purchase.UNDERSTANDING OF CURRENT MARKET CONDITIONSThere is a plethora of housing information available today. The challenge is that some information appears to be in direct conflict with other pieces of information. A true real estate professional can simply and effectively explain today’s real estate headlines and decipher what they mean to you.________________________________________________________________________________ At KCM, we offer a monthly information service for agents that helps them keep up with current market conditions. When looking for a real estate professional, ask them if they’re a KCM Member and if they’re prepared to educate you on what’s truly happening in real estate today. |

© All Rights Reserved