Phil's Blog

Latinos & New Year’s Resolutions

December 26, 2013

~~ ~~

~~

~~Latinos & New Year’s Resolutions

Posted: 26 Dec 2013 04:00 AM PST

With their preparation for the holidays the Latino culture also prepares for some rituals, customs and traditions that are going to help to augur a New Year. Depending on the country or origin these traditions may vary, but one of the most commons in general is the 12 grapes and the 12 wishes. At 12 o’clock (or midnight), with the 12 chimes of the clock they will eat 12 grapes while asking for their 12 wishes. But what does this have to do with real estate?

One of those 12 wishes, you will have the opportunity to help to fulfill. The wish to buy a new home!

During the year we gave you a series of blogs talking about the Latino Community; the different segments within the community and some ideas of how to help them. It is our resolution for the next year to continue giving you information to make sure that the Latino Community will be able to fulfil one of those 12 wishes. The opportunity to be homeowners!

We are happy to announce the creation of our latest e-guide, “An Agent’s Guide to Working with the Latino Community”. Click here to download the guide and learn how to capitalize on the opportunities that exist within the Latino Market.

~~

~~~~Latinos & New Year’s Resolutions

Posted: 26 Dec 2013 04:00 AM PST

With their preparation for the holidays the Latino culture also prepares for some rituals, customs and traditions that are going to help to augur a New Year. Depending on the country or origin these traditions may vary, but one of the most commons in general is the 12 grapes and the 12 wishes. At 12 o’clock (or midnight), with the 12 chimes of the clock they will eat 12 grapes while asking for their 12 wishes. But what does this have to do with real estate?

One of those 12 wishes, you will have the opportunity to help to fulfill. The wish to buy a new home!

During the year we gave you a series of blogs talking about the Latino Community; the different segments within the community and some ideas of how to help them. It is our resolution for the next year to continue giving you information to make sure that the Latino Community will be able to fulfil one of those 12 wishes. The opportunity to be homeowners!

We are happy to announce the creation of our latest e-guide, “An Agent’s Guide to Working with the Latino Community”. Click here to download the guide and learn how to capitalize on the opportunities that exist within the Latino Market.

Tapering Begins!

December 23, 2013

~~

~~ ~~

~~ ~~~~Tapering Begins!

~~~~Tapering Begins!Posted: 23 Dec 2013 04:00 AM PST

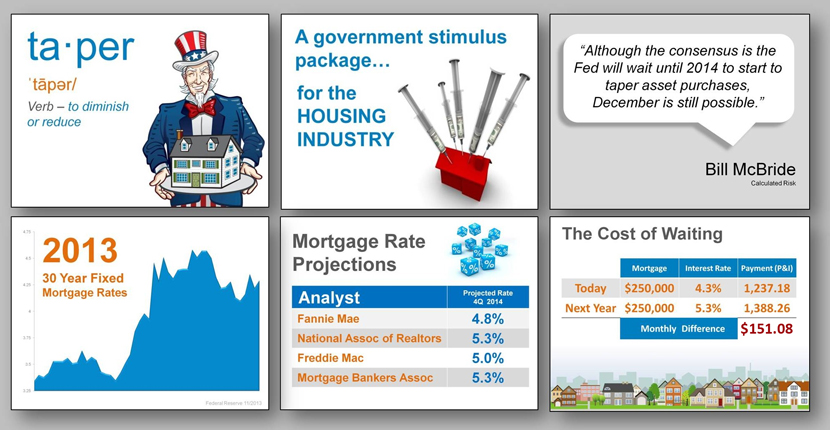

The Fed announced they would be pulling back some of their stimulus package which has helped the housing market by keeping long term mortgage rates at historic lows for the last few years. This should come as no surprise as the KCM Blog has been warning of this likelihood over the last several months.

We even went against the belief of the vast majority of economists who thought the Fed would wait until next year. In this month’s edition of KCM, we quoted Bill McBride of Calculated Risk:

“Although the consensus is the Fed will wait until 2014 to start to taper asset purchases, December is still possible.”

We also gave our members the following grouping of slides to help them explain the ramifications of the Fed’s decision during meetings with buyers and sellers.

What it Means to the Consumer

In an article in MarketWatch today, Lawrence Yun, the Chief Economist at NAR, explained that sellers looking to move-up (to a better school district or larger home) “need to realize that it could be more challenging a year from now.” Yun stated the average 30-year mortgage rate currently hovers at 4.3%, but that could rise to 5% or 5.5% next year.

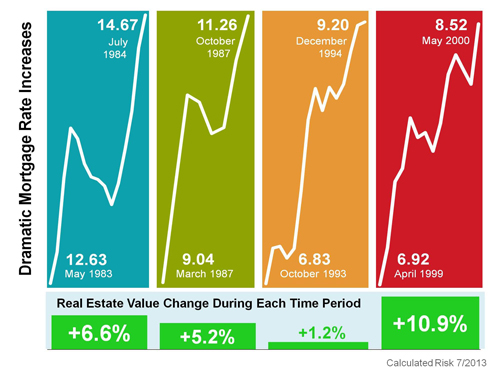

What it Does NOT Mean to the Housing Market

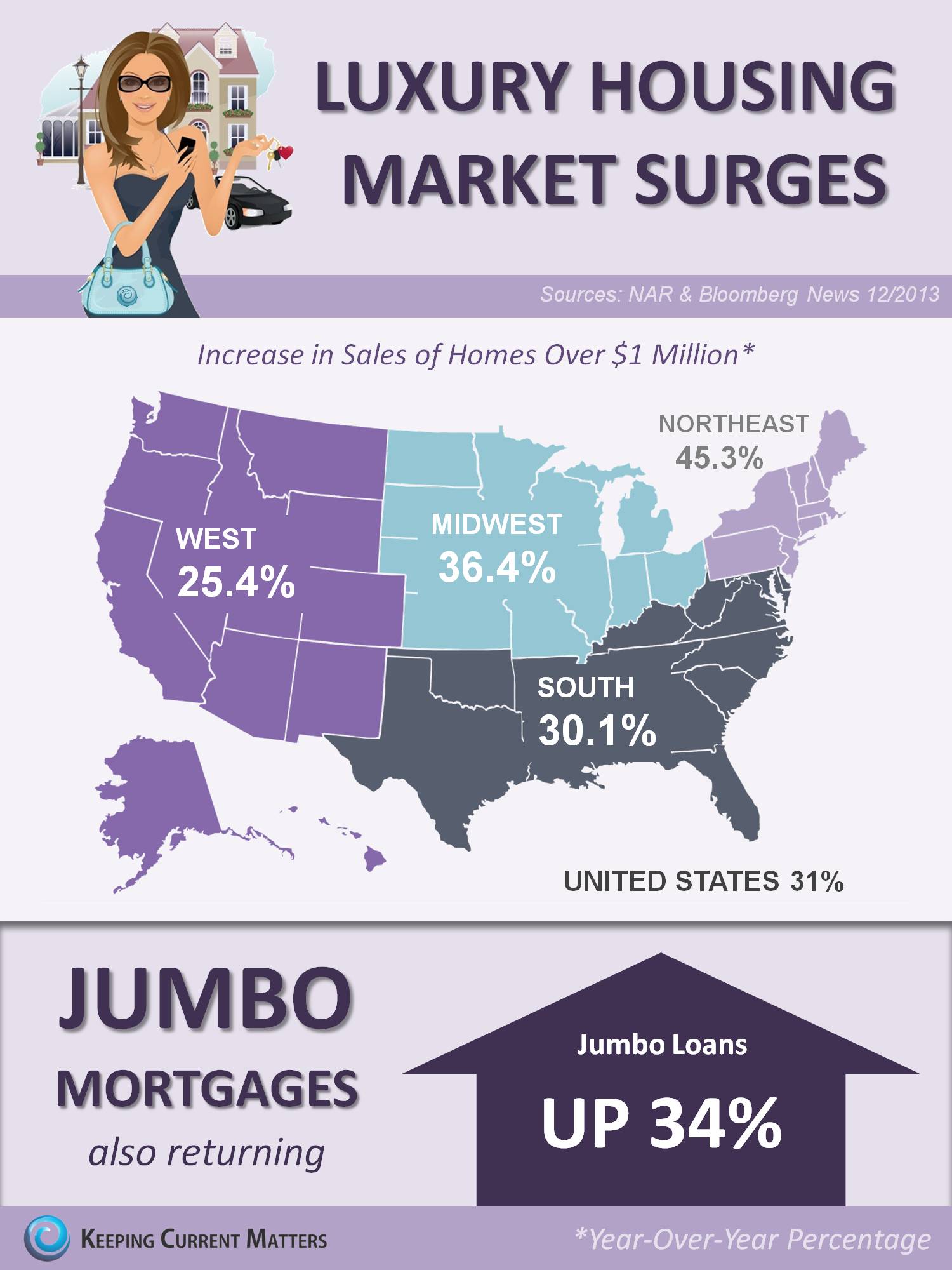

Some reports will now claim that housing prices will have to drop as interest rates begin to rise. There is no historical evidence of this. Below is a chart showing the last four instances of mortgage rates rising dramatically and what happened to home values at the time.

Bottom Line

If a client is either a first time buyer or a move-up buyer, they should make the move earlier in 2014 instead of later as mortgage rates will probably increase as the year goes on.

Experts Predict 2014 Housing Market

December 19, 2013

~~Experts Predict 2014 Housing Market

2013 Real Estate Review, Buy, Sell | Dec 6, 2013 | By: Michele Lerner |

454

The U.S. real estate market made a robust comeback in 2013, surpassing expectations of many economists, as the combination of low inventories and historically low interest rates caused home prices to rise and even helped fuel bidding wars in some markets, surpassing the expectations of many economists. While positive trends, such as increasing home values, are expected to continue into 2014, mortgage rates are also expected to rise in the coming year and could put a damper on home buyers’ abilities to afford new homes.

Looking back at some 2013 data can give us a hint of the year ahead:

Predictions - Inventory

1. Inventory Should Gradually Stabilize and Return to Traditional Seasonal Levels

The beginning of 2013 could be characterized as the “year of low inventory” as buyer demand ramped up and homeowners waited for further price increases and evidence of a solid economic recovery before putting their homes on the market. The year began with a significant shortage of inventory (reported by realtor.com®), and then as early as February the level of shortages started to decline slowly. As 2013 comes to a close, inventory is approximately the same as a year ago. However, homes are selling faster than in 2012, with the median age of the inventory down by 11 percent.

2. More Homeowners Are Likely to Return to Positive Equity

Rising prices helped 2.5 million homeowners who were previously underwater regain positive equity status during the second quarter of 2013. However, approximately 7.1 million homes were still in negative equity at that time and an estimated 10 million homeowners, or about 21.1 percent of all homeowners with a mortgage, remained “under-equitied,” with less than 20 percent in home equity. The good news is that prices are expected to continue rising in 2014, which will lift more homeowners into positive territory. According to realtor.com®, median list prices for homes in October rose 7.57 percent above the same month of 2012.

3. Mortgage Rates Are Expected to Rise

Mortgage rates increased approximately 100 basis points in 2013 and are likely to rise in 2014. The new chairman-designate of the Federal Reserve, Janet Yellen, is expected to continue the policies of Chairman Ben Bernanke, including keeping mortgage rates low by buying blocks of mortgage-backed securities. However, the Fed has considered tapering its bond-buying activity as the economy improves, which could lead to a slight increase in interest rates.

Predictions - Foreclosure

4. Foreclosure Activity Is Expected to Slow

Foreclosure sales are likely to play a minimal role in the housing market in 2014. September 2013 was the 36th consecutive month with a year-over-year decrease in foreclosure activity. Foreclosure inventory has dropped to multi-year lows, down nearly 33 percent since the end of 2012. Foreclosure starts were down 39 percent in the third quarter of 2013 to the lowest level since the second quarter of 2006.

5. Further Declines in Home Affordability Are Expected

The National Association of REALTORS®’ Home Affordability Index, which compares home prices with income, dropped to a five-year low in 2013 as price increases outpaced income growth. If the U.S. economy begins to grow at a faster pace and incomes begin to rise, though, the affordability index will slide further from rising mortgage rates.

While no one can predict with certainty what the housing market holds in store for 2014, a constant in real estate is always that local markets vary widely in their performance. National numbers can tell a story about the economy in general, but home prices, inventory and foreclosure activity depend on local market conditions. Contact a Realtor® in your community for the most up-to-date information about your market.

Good News for the Economy = Bad News for Rates

December 16, 2013

~~Good News for the Economy = Bad News for Rates

Posted: 16 Dec 2013 04:00 AM PST

The economy is improving. As an example, the latest employment report showed that the unemployment rate hit a five-year low. We must realize that, as the economic news gets better, the government will consider whether or not to continue the programs they put in place to stimulate the economy. One such program is the Fed’s purchasing of assets which has led to historically low long-term mortgage rates.

Analysts at Capital Economics noted in a recent HousingWire article:

"The 203,000 increase in November's non-farm payrolls, along with the drop in the unemployment rate to a five-year low of 7.0%, gives the Fed all the evidence it needs to begin tapering its asset purchases at the next FOMC meeting later this month."

Whether such ‘tapering’ occurs this month or early next year is questionable. The fact that mortgage rates will spike when it does occur is more a guarantee.

Here are the thoughts of a few Fed presidents regarding whether it is in fact time to cut back on this stimulus program:

James Bullard, President of the Federal Reserve Bank of St. Louis

“To the extent that key labor market indicators continue to show cumulative improvement, the likelihood of tapering asset purchases will continue to rise. The Committee’s 2012 criterion of substantial improvement in labor markets gets easier and easier to satisfy on a cumulative basis as labor markets continue to heal…Based on labor market data alone, the probability of a reduction in the pace of asset purchases has increased.”

Richard Fisher, President of the Federal Reserve Bank of Dallas

“In my view, we at the Fed should begin tapering back our bond purchases at the earliest opportunity…I consider this strategy desirable on its own merit: I would feel more comfortable were we to remove ourselves as soon as possible from interfering with the normal price-setting functioning of financial markets.”

Jeffrey Lacker, President of the Federal Reserve Bank of Richmond

“I expect discussion about the possibility of reducing the pace of asset purchases. The key issue, in my view, is the extent to which the benefits of further monetary stimulus are likely to outweigh the costs.”

If you are thinking about purchasing a home, buying before the tapering will probably mean a lower mortgage interest rate than if you waited.

Harvard: 5 Financial Reasons to Buy a Home

December 10, 2013

~~Harvard: 5 Financial Reasons to Buy a Home

Posted: 10 Dec 2013 04:00 AM PST

Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also currently serves on the editorial board of the Journal of Housing Research and Housing Policy Debate. This year he released a new paper on homeownership - The Dream Lives On: the Future of Homeownership in America. In his paper, Belsky reveals five financial reasons people should consider buying a home.

Here are the five reasons, each followed by an excerpt from the study:

1.) Housing is typically the one leveraged investment available.

“Few households are interested in borrowing money to buy stocks and bonds and few lenders are willing to lend them the money. As a result, homeownership allows households to amplify any appreciation on the value of their homes by a leverage factor. Even a hefty 20 percent down payment results in a leverage factor of five so that every percentage point rise in the value of the home is a 5 percent return on their equity. With many buyers putting 10 percent or less down, their leverage factor is 10 or more.”

2.) You're paying for housing whether you own or rent.

“Homeowners pay debt service to pay down their own principal while households that rent pay down the principal of a landlord.”

3.) Owning is usually a form of “forced savings”.

“Since many people have trouble saving and have to make a housing payment one way or the other, owning a home can overcome people’s tendency to defer savings to another day.”

4.) There are substantial tax benefits to owning.

“Homeowners are able to deduct mortgage interest and property taxes from income...On top of all this, capital gains up to $250,000 are excluded from income for single filers and up to $500,000 for married couples if they sell their homes for a gain.”

5.) Owning is a hedge against inflation.

“Housing costs and rents have tended over most time periods to go up at or higher than the rate of inflation, making owning an attractive proposition.”

Bottom Line

We realize that homeownership makes sense for many Americans for many social and family reasons. It also makes sense financially.

-----------------

Agents interested in gaining a better understanding of the financial and social advantages to homeownership should consider becoming a member of Keeping Current Matters. You can sign-up for a free 14 day trial here.

Knowing Your Options for the "Fixer Upper"

December 5, 2013

~~Knowing Your Options for the "Fixer Upper"

Posted: 05 Dec 2013 04:00 AM PST

We are happy to introduce Preston Sandlin as our guest blogger today. Preston is the owner and founder of Home Inspection Carolina and has over 15 years experience in the inspection industry. - The KCM Crew

The fixer-upper properties on the market will give you more purchasing power when shopping for a new home. Bargains can be found in homes that have been foreclosed, seized by the government or just fallen out of repair due to homeowner neglect. While it is true that you will save thousands of dollars on these homes that will need lots of work, there are hidden costs that buyers fail to consider. Ask yourself if it’s worth it and know your options.

Know exactly what you are getting into

Don’t underestimate the cost of renovations and repairs. A home inspection will let you know the fundamental repairs and maintenance that must be done to the home. Without a home inspector, you may end up over paying for the fixer-upper anyway.

The inspector will evaluate any problems with the interior and appliances, roofing, heating and cooling system, plumbing, electrical wiring, insulation and ventilation, and the structural foundation, exterior faults and more. Fixer-uppers may have a lot of problems with these parts of the home, and a realtor can downplay the extent of the issues because of their stake in the outcome of the sale. A home inspector is worth hiring to get an unbiased perspective and uncover problems you can’t see yourself.

You ultimately have to decide how much money you are actually saving by buying the fixer-upper once you add in the costs. Once you spend all the money on repairs to make it habitable, will you still be satisfied with your choice? Will you hire someone to do the repairs or do you have the patience and skill to do it yourself?

Consider a FHA insured HUD 203(K)

It is worth checking to see if you qualify for a program known as HUD 203(k). It allows the buyer to purchase a fixer-upper with a FHA guaranteed loan, and the best part is that it protects you from extra costs if the “fixing” part costs more than estimated. You must submit a comprehensive list of repairs with corresponding cost estimates with your application, so you will need to get a home inspector, have the cost of labor and repair determined, and prepare your detailed plan for accomplishing it all for the FHA and your creditor.

DIY

The ideal fixer-upper would consist of superficial revamps rather than major appliance, ventilation, or structural repairs. Minor renovations would be painting inside and out, installing ceiling fans and light fixtures, and replacing carpets, windows, or doors.

Be patient

Fixing up the house might take longer than you originally planned, but it can be well worth it. Remodeling and minor repairs will most likely take longer than you expect, especially if you are haven’t dealt with this before. You chose to save money with a fixer-upper. It takes time to give a house the proper care that will result in a comfortable house to call your home. Do your homework and make an informed decision.

Are Home Sales Tanking?

December 3, 2013

| Are Home Sales Tanking? Posted: 03 Dec 2013 04:00 AM PST  If you read some of the headlines about home sales over the last few weeks, you may believe that sales of houses in the U.S. are beginning to slow dramatically. There have been some that have used the recent Existing Home Sales Reports (EHSR) from the National Association of Realtors’ as proof of this supposition. We should be careful not to put too much credence in these reports of impeding doom. If you read some of the headlines about home sales over the last few weeks, you may believe that sales of houses in the U.S. are beginning to slow dramatically. There have been some that have used the recent Existing Home Sales Reports (EHSR) from the National Association of Realtors’ as proof of this supposition. We should be careful not to put too much credence in these reports of impeding doom.It is true that the last EHSR revealed that sales were down 3.2% from the previous month. However, there are two crucial points that are not being addressed:

Sales of non-distressed properties are increasing nicely. However, as the inventory of distressed properties continues to shrink, the number of overall properties sold may diminish over the next few months. This is a sign that we are entering a much healthier housing market.  |

14,027 Houses Sell Every Day in the U.S.!!

December 2, 2013

| 14,027 Houses Sell Every Day in the U.S.!! Posted: 02 Dec 2013 04:00 AM PST  There are some homeowners that might consider waiting for the spring to sell their house thinking that no one buys a home during the winter months. What we should understand is that homes sell EVERY DAY. As a matter of fact, according to the latest Existing Homes Sales Report from the National Association of Realtors, on average 14,027 homes sell daily in this country. There are some homeowners that might consider waiting for the spring to sell their house thinking that no one buys a home during the winter months. What we should understand is that homes sell EVERY DAY. As a matter of fact, according to the latest Existing Homes Sales Report from the National Association of Realtors, on average 14,027 homes sell daily in this country.It is true that more houses sell in the spring than the winter in most markets. However, it is also true that there will be more competition as many sellers wait to the spring to put their house on the market. Thousands of homes sell each and every day in this country. Don’t be afraid to put your house on the market this winter. |

© All Rights Reserved