Phil's Blog

When Will Mortgage Rates Hit 5%?

November 26, 2013

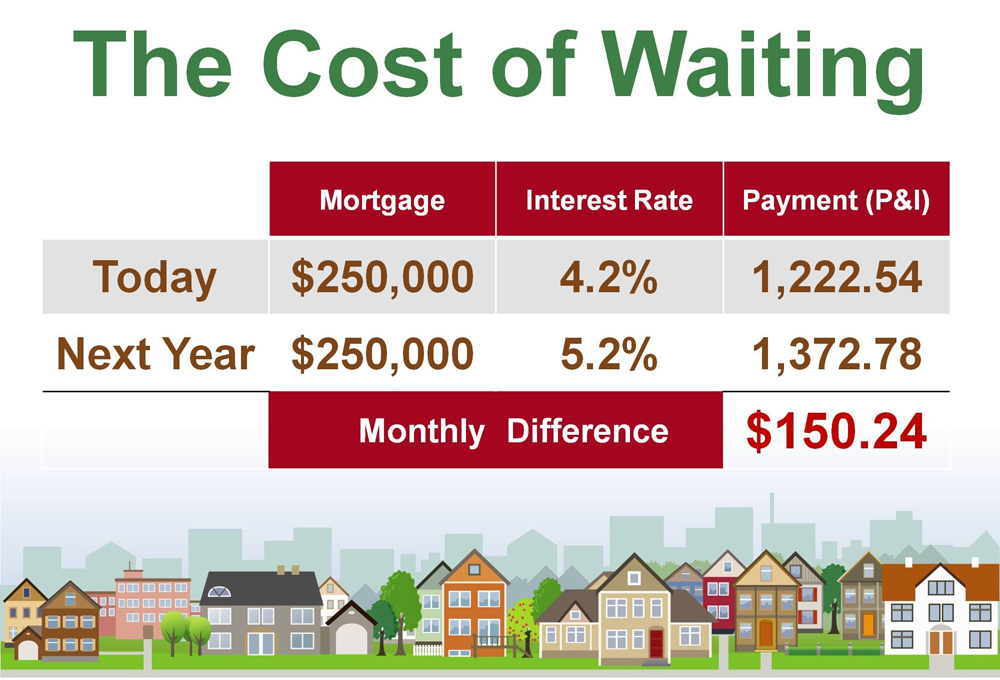

| When Will Mortgage Rates Hit 5%? Posted: 26 Nov 2013 04:00 AM PST  The big question for homebuyers is when interest rates will begin to rise to the 5% mark. The effect of a rise in mortgage rates could be a dramatic increase in the monthly mortgage payment when purchasing a home. In an article last week, HousingWire quoted two different sources regarding this issue. The big question for homebuyers is when interest rates will begin to rise to the 5% mark. The effect of a rise in mortgage rates could be a dramatic increase in the monthly mortgage payment when purchasing a home. In an article last week, HousingWire quoted two different sources regarding this issue.Most experts are projecting that rates will rise when the Fed decides to taper the purchase of bonds which has acted as a stimulus to the housing market by keeping long term mortgage rates at historic lows. In the article, Sterne Agee’s managing director and chief economist Lindsey Piegza pointed out: "Federal Reserve officials said they might reduce their monthly bond buying program from $85 billion 'in coming months' as the economy continues to improve." The article also quotes Frank Nothaft, chief economist with Freddie Mac: “By the end of 2014, rates will probably approach and perhaps touch 5%. A reason we see the uptick in rates is that I do think some point the Federal Reserve will start to taper and scale back its very active purchase on long-term Treasuries and mortgage-backed securities.” Rates will hit 5% sometime in 2014. It might be better to buy sooner rather than later.  |

Home Buying for Unmarried Couples

November 21, 2013

| Home Buying for Unmarried Couples Posted: 21 Nov 2013 04:00 AM PST Today we are excited to have Mark Scheets return as our guest blogger. Mark is a writer for Total Mortgage Services, and often writes about home buying and refinancing.  Throughout the home buying process there can be various hurdles to jump over to make sure everything goes smoothly. In today’s culture, we are finding more often unmarried couples are purchasing their first homes together. Although this sounds like a great plan, there are precautions that need to be taken in order to make sure the process is done right. Doing your research beforehand can alleviate any headaches. From a financial sense it is more difficult to break the co-ownership of a house, than it is to get a divorce, if things turn sour. Throughout the home buying process there can be various hurdles to jump over to make sure everything goes smoothly. In today’s culture, we are finding more often unmarried couples are purchasing their first homes together. Although this sounds like a great plan, there are precautions that need to be taken in order to make sure the process is done right. Doing your research beforehand can alleviate any headaches. From a financial sense it is more difficult to break the co-ownership of a house, than it is to get a divorce, if things turn sour.When making the decision to purchase a home with your significant other, you and partner must know that just like with marriage, a property agreement is a legal contract. One of the more important aspects of purchasing a home together is knowing how the investment will be split. In many cases, one partner may initially invest more money into the home than the other. This may cause issues in the future if things don’t work out due to the fact that legally one person may end up owning more of the house than the other. Plan NowIf the relationship were to end, a dividing of the assets needs to take place. Although everyone in a relationship hopes for the best, preparing for the worst-case scenario will alleviate any hassle in the future. The best way to protect yourself is to come to an agreement as soon as possible while you both are still happy. If there were to be any future issues, it could get real ugly resolving things if steps were not taken care of from the start.Credit ScoresAs an unmarried couple looking to purchase a home together, there are a few concerns you need to be aware of. When the time comes to apply for a mortgage, the lender needs to run both of your credit scores. This can backfire if one of you has a great credit score and one has a terrible score. If this is the case, then you may not get the loan.LegalityYou will also want to check your individual state’s laws regarding an unmarried couple purchasing a home together, as some states don’t allow it. You as the homebuyer need to know this because if you are planning on going through with the purchase and can’t legally, you will be extremely disappointed.Protect YourselfHaving the right paperwork filed is another important step to take, because without it you could find yourself in trouble in the future. One thing to do early in the home buying process is to file for a Joint Tenancy With Rights Of Survivorship (JTWROS). A JTWROS allows for the home and assets to be passed to the surviving partner if the other were to pass away. This lets the partner avoid inheritance taxes, as the home won’t go through an estate. Married couples are automatically granted JTWROS whereas unmarried couples are not. By doing this you can save yourself a great deal of potential stress in the future.If you had filed for JTWROS with your partner and something went wrong with the relationship, you would need to fix your agreement. If you don’t adjust past agreements, then your soon to be ex is still entitled to the house and potentially your assets if you were to die. On paper if you had left everything all to your partner but intended to change that and never did, they are still legally getting everything. This also goes for if one partner were to pass away and if you didn’t file for JTWROS, the family of the deceased partner may try to sell the house. If the partner had made a will to leave everything to their family, it would not matter if the surviving partner wished to remain in the home. What to Adjust After Getting MarriedIf down the line you and your partner decide to get married, there will be more papers that would need to be altered. The biggest adjustment would need to be the title to the house. After the title is adjusted, creditors cannot single out one of you for bad credit. This is good due to the fact that they cannot add extra interest to that partners share. If you and your soon to be married partner both have good credit, this can work out great if you were looking to refinance once everything is fixed.As stated, there are precautions that need to be taken when purchasing a home as an unmarried couple. As we all know, getting married is one of the biggest decisions we will make. Planning to buy a home together is a great decision as long as you are cautious about how you go about it. |

From White Picket to Upcycled Pallet Fences: Millennials and Housing

November 20, 2013

| From White Picket to Upcycled Pallet Fences: Millennials and Housing Posted: 20 Nov 2013 04:00 AM PST We are happy to have Jim Haney as our guest blogger today! Jim is a finance writer, working to ensure greater public understanding of the ins and outs of the housing industry. – The KCM Crew  Critiques and defenses about Millennials abound. However, I think an overlooked aspect of the kerfuffle over Generation Y is the question “Why?” Although it is great to spur the generation on to great heights, it is crucial we understand some of the hurdles they are facing, economically and socially in order to anticipate how the market will have to change and adjust to accommodate a new generation’s capabilities and values. Critiques and defenses about Millennials abound. However, I think an overlooked aspect of the kerfuffle over Generation Y is the question “Why?” Although it is great to spur the generation on to great heights, it is crucial we understand some of the hurdles they are facing, economically and socially in order to anticipate how the market will have to change and adjust to accommodate a new generation’s capabilities and values.

Educational Debt & CreditNo big newsflash here: millennials are facing unprecedented levels of debt, between the various recessions, housing bubbles, and explosion of educational debt. New legislation in the works is attempting to help set up a more stable higher education financing system as well as relieve the staggering debt loads. Although debt forgiveness is the big buzzword these days, most students will still face shouldering a majority of their debt. Fortunately for the economic outlook, the legislation focuses on creating more income-based repayment plans that won’t put millennials on the street. However, the big question that remains is how will this affect their credit?Public vs. Private SectorWith the specter of the 2008 housing bubble burst looming over everyone’s head, the situation is no longer about whether or not millennials are willing to take on more debt or have the income to cover minimum payments, it is about if lenders are willing to take on the risk. President Obama has rolled out plans that Fannie Mae and Freddie Mac will be gradually diminished, leaving the private sector to provide the backbone of risk management. With first-time buyers being edged out of the market due to new credit requirements, we could see a short-term slowdown in home-buying.UncertaintySurprisingly, the instability recently exhibited by the U.S. government shutdown and continued clamor over the debt ceiling may actually work in the market’s advantage. Millennials, wary of being overly reliant on vacillating government promises, might become increasingly inclined to use their savvy to explore home equity loans and carefully consider newly-revised reverse mortgages as part of their retirement plans. Having front-row seating for the recent economic meltdowns, the newest generation will be more inclined to do their research and not bite off more than they can chew, meaning they might, actually, leave a positive legacy for the housing industry.American DreamAs the Keeping Current Matters crew mentioned, homeownership is still an important idea to many Americans. If the government and the private sector work together to slowly adjust the system and increase stability, which is already the direction we are driving in, we can expect to see homeownership continue to increase with this generation. However, we should expect to hold the memory of Desi and Lucy fondly in our hearts, and leave them there as the face of home buyers will be forever changed.It is a pervasive misconception that millennials are thoroughly disenchanted with the concept of settling down. The revitalized home-making movement—as evidenced on social media platforms like Pinterest--within more progressive millennial circles would indicate that although it might take a bit longer for the birds to return from their explorations, they will inevitably nest. Furthermore, the creativity and frugality of Generation Y will provide them fresh incentives to invest in housing as home ownership opens up new avenues hosting friends and international travelers. As this new group of home-buyers realizes that a mortgage doesn’t necessarily clip their wings, we should be able to anticipate a new, stronger, and invigorated market of responsible borrowers. These iPod-wearing, tweeting, bicycle-riding youngsters just might be the market we’ve been looking for. |

5 Reasons to Sell Before Spring

November 19, 2013

| 5 Reasons to Sell Before Spring Posted: 19 Nov 2013 04:00 AM PST  Many sellers feel that the spring is the best time to place their home on the market as buyer demand increases at that time of year. However, the fall and winter have their own advantages. Here are five reasons to sell now. Many sellers feel that the spring is the best time to place their home on the market as buyer demand increases at that time of year. However, the fall and winter have their own advantages. Here are five reasons to sell now.

Only Serious Buyers Are OutAt this time of year, only those purchasers who are serious about buying a home will be in the marketplace. You and your family will not be bothered and inconvenienced by mere 'lookers'. The lookers are at the mall or online doing their holiday shopping.There Is Far Less CompetitionHousing supply always shrinks dramatically at this time of year. The choices for buyers will be limited. Don't wait until the spring when all the other potential sellers in your market will put their homes up for sale.The Process Will Be QuickerOne of the biggest challenges of the 2013 housing market has been the length of time it takes from contract to closing. Banks have been inundated with both purchase and refinancing loan requests. Both of these will slow in the winter cutting timelines and the frustration these delays cause both buyers and sellers.There Will Never Be a Better Time to Move-UpIf you are moving up to a larger, more expensive home, consider doing it now. Prices are projected to appreciate by over 25% from now to 2018. If you are moving to a higher priced home, it will wind-up costing you more in raw dollars (both in down payment and mortgage payment) if you wait. You can also lock-in your 30 year housing expense with historically low interest rates right now. There is no guarantee rates will remain at these levels in years to come.It's Time to Move On with Your LifeLook at the reason you decided to sell in the first place and decide whether it is worth waiting. Is money more important than being with family? Is money more important than your health? Is money more important than having the freedom to go on with your life the way you think you should?You already know the answers to the questions we just asked. You have the power to take back control of the situation by pricing your home to guarantee it sells. The time has come for you and your family to move on and start living the life you desire. That is what is truly important.  |

Buying a Home? Consider COST not just Price

November 18, 2013

| Buying a Home? Consider COST not just Price Posted: 18 Nov 2013 04:00 AM PST  We have often talked about the difference between COST and PRICE. As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As a buyer, you must be concerned not about price but instead about the ‘long term cost’ of the home. Let us explain. We have often talked about the difference between COST and PRICE. As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As a buyer, you must be concerned not about price but instead about the ‘long term cost’ of the home. Let us explain.Last month, the Mortgage Bankers Association (MBA), the National Association of Realtors, Fannie Mae and Freddie Mac all projected that mortgage interest rates will increase by about one full percentage over the next twelve months. We also know that many experts are calling for home prices to also increase over the next year. What Does This Mean to a Buyer? Here is a simple demonstration of what impact an interest rate increase would have on the mortgage payment of a home selling for approximately $250,000 even if home prices don’t increase:   |

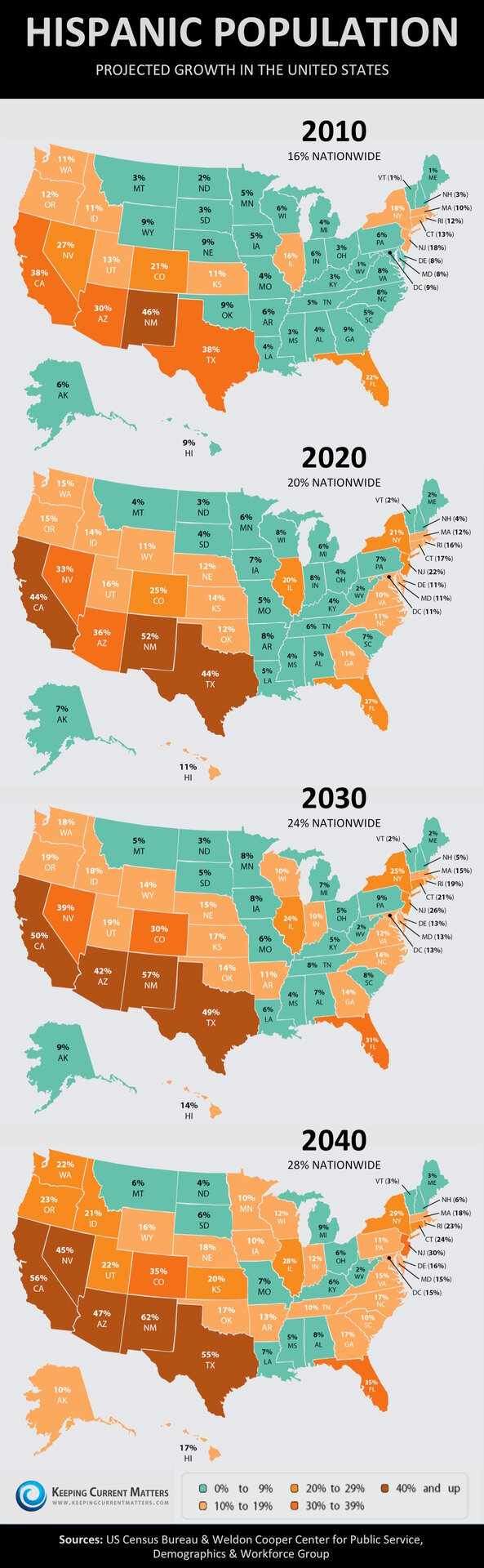

Hispanic Population Growth Projections [INFOGRAPHIC]

November 15, 2013

| Hispanic Population Growth Projections [INFOGRAPHIC] Posted: 15 Nov 2013 04:00 AM PST  |

Ignoring Insurance Risks Can Be Costly

November 14, 2013

| Ignoring Insurance Risks Can Be Costly Posted: 14 Nov 2013 04:00 AM PST We are pleased to have Carrie Van Brunt-Wiley, editor of the www.insurancesolutionsplus.com Blog, return as our guest blogger today. The www.insurancesolutionsplus.com blog serves as a resource center for insurance consumers and homebuyers across the country. – The KCM Crew  One of the first stages during the hunt for a new home is crunching the numbers to figure out your budget. And no matter how high or low that budget may be, prospective homebuyers should take into consideration the cost of insuring the home. One of the first stages during the hunt for a new home is crunching the numbers to figure out your budget. And no matter how high or low that budget may be, prospective homebuyers should take into consideration the cost of insuring the home.It's easy to overlook insurance, especially since you may be more worried about the number of bedrooms, the school district, or the size of the backyard. But before you can close on the purchase, your lender will require you to line up homeowners insurance. You may be hit with some sticker shock if the home you are about to buy ends up being a high risk- and therefore high cost- home to insure. Once you’ve got a few homes in your sight, you should get some preliminary home insurance quotes on each property. Just as you will compare asking price and property taxes- figure your insurance costs into the equation as well. Even homes of similar size and style can vary greatly in terms of cost to insure. Here are a few lesser known home features that affect insurance costs:Location- The location of a home will have a huge impact on the insurance premiums due to the proximity to a fire station, the fire station ratings and the flood zone it’s located in.

Swimming Pool- You might be looking specifically for a house with a pool but you should know swimming pools can drive up your insurance premiums. Accidents frequently happen in and around pools so insurance companies see them as a high-risk home feature. Remember, you can be held liable even if a trespasser has an accident at your pool. For this reason, homes with swimming pools located on the property should meet all local safety codes and carry high limits of liability coverage. Age- The age of the home can also affect your premium. Typically older homes have outdated electrical wiring and plumbing systems, which can lead to fires or water damage. If you are considering an older home, ask your realtor the age of the plumbing, HVAC and electrical systems. If they have been updated in recent years, this is important to note with your insurance agent. If not, make sure you know what this may cost you in additional premiums and to upgrade in the future. Security equipment- Security equipment is a plus for obvious reasons- items such as burglar alarms, deadbolt locks, and smoke alarms can make your home a safer environment. In addition, insurance providers offer discounts for homes featuring these items. In fact, you could save 10% or more on your premium. Take note of the types of safety devices in the homes you are comparing so you can get accurate discounts figured into your insurance rates. You likely won't make a decision on a house because of insurance factors alone. But it's best to have an idea of where you stand as you consider your options. Start by checking out average home insurance rates in your state. Then work with an agent you can trust to compare quotes on various properties. An educated search can help you find the home of your dreams and home insurance premiums that won't break the bank. |

The Importance of the Latino Market in RE

November 13, 2013

| The Importance of the Latino Market in RE Posted: 13 Nov 2013 04:00 AM PST  Fannie Mae's National Housing Survey examined the attitudes among the Hispanic population toward homeownership, getting a mortgage and the expectations for future homeownership, in order to have a better understanding of the potential impact of this fast-growing population on future homeownership demand. Fannie Mae's National Housing Survey examined the attitudes among the Hispanic population toward homeownership, getting a mortgage and the expectations for future homeownership, in order to have a better understanding of the potential impact of this fast-growing population on future homeownership demand.In their report “Hispanics: A Key Driver of Future Homeownership Demand” they show that “Hispanic expectations for buying in the next three years are an encouraging sign for the ongoing housing market recovery.” Over the last two years, Hispanics have become more likely than the general population to say that lifestyle benefits are the best reason to buy a house. Hispanics are more likely to prefer owning, particularly for lifestyle reasons:

“Despite greater concern about their ability to get a mortgage, Hispanics are more likely to expect to buy a home in the next three years.” Include the Hispanic market in your business plan, they are ready to buy! |

Millennials: Our Time Is Now

November 7, 2013

| Millennials: Our Time Is Now Posted: 07 Nov 2013 04:00 AM PST Our guest blogger today is Justin DeCesare. Justin is the CEO of Middleton & Associates Real Estate and has some great advice for the Millennial generation in today's post. - The KCM Crew  There will likely be no other time in the lifespan of the Millennial generation that is filled with more opportunity than right now. There will likely be no other time in the lifespan of the Millennial generation that is filled with more opportunity than right now.I understand that the preceding sentence may seem overly optimistic, but when we look at modern history, all generations flourished more in the decade following an economic downturn than any other. This, coupled with exponential growth in technology, is currently paving the way for a wave of young entrepreneurs and successful business people unparalleled in our Millennial Timeline. Generally, I write these blogs to help instill the importance of our generation to Real Estate Agents and Brokers, but today, my message is directly to you, the young Millennial Yourself. If you have not already grasped the importance that the next five years are going to have on your life, do so today. Get Pumped Up.This isn’t high school anymore, and our teenage-angst should have been thrown by the wayside along with every other burdensome baggage we have carried along the way.Prices are at their lowest, NOWEconomists around the country agree that housing prices have fallen to their true lows, corrected, and should now be back on track for the steady growth necessary to maintain a healthy market.New housing inventory is minimal, and EVENTUALLY the government will be forced to curtail bond buying programs, and as monetary policy is contracted the price of borrowing will increase. By far the greatest reason you have to buy a home NOW and not 2 years from now is that money is cheap… cheaper than it has ever been and cheaper than it will ever be. Stop Renting!Plus, when you are renting, you are throwing your money away in taxes, especially those single professionals who have no other write-offs.I am a Millennial. I am 30. I bought my first home when I was 21 while I was enlisted in the Navy. My mindset has changed over the last 10 years, but I can say this: Youthful optimism may be the best asset we have. At 21, fear of failing and needing to start over with kids’ college funds to worry about do not weigh as heavily as they will 10 years from now. Your jobs are starting to come back. With every tepid job report comes the chance for new jobs to be found that pay in line with what you are worth. Take advantage of this time and don’t look back in 25 years saying, “It really was the best opportunity of my life.” This is your opportunity for freedom, your opportunity to own something that gives back, and doesn’t merely suck the value out of your debit card. |

Working Together as RE Professionals

November 6, 2013

| Working Together as RE Professionals Posted: 06 Nov 2013 04:00 AM PST Today we are happy to welcome back Tim Richmond as our guest blogger. Tim writes about the housing market and Native American home loans.  The economy is complicated because everyone is trying to stake out their target market and lay claim to a certain clientele. This is natural in a society that often leans toward capitalistic tendencies. Real estate is no different in the sense that there is competition, but there is more room for progress in this profession than many others. A healthy rivalry amongst real estate professionals is the way to go. The economy is complicated because everyone is trying to stake out their target market and lay claim to a certain clientele. This is natural in a society that often leans toward capitalistic tendencies. Real estate is no different in the sense that there is competition, but there is more room for progress in this profession than many others. A healthy rivalry amongst real estate professionals is the way to go.This is a hard concept to understand for many business people, but it can work in real estate with genuine effort and common understanding. Below are some ideas that help explain how real estate professionals can re-think the way they approach their job, with the end goal being consistent and sustaining business. It’s a unique market niche because when a real estate professional helps another one succeed, it oftentimes comes back around. Sharing business is efficient in real estateReal estate agents are usually paid primarily after a deal is done. This makes client selection much more crucial. If you are an agent and feel that the area or sector of the market that you work within doesn’t directly match a client’s needs, pass them on. If you provide a perfect client to a competitor in the real estate market, both that customer and the competitor will respect you and your name will be seen in a positive light.Bottom line: Real estate agents don’t sell any home in any location; it’s much more complicated than that. Due to the price tag on the product, it’s important to be efficient. If it won’t work for you, pass it on to someone that you have built a mutual respect for, and the same will happen to you when a client knocks their door. Work Smarter, Not HarderThis type of thinking also saves you time. If you’re not going to watch a signing happen on closing day, your efforts aren’t prioritized as much as they could be. Providing work to other professionals in the industry is a form of teamwork that creates respect amongst your peers. This leads to more lucrative sales that fit directly within your sales focus.Assisting a homebuyer in finding their dream home should be the priorityA real estate agent should approach every client with the mindset that they are helping them find the home of their dreams. The practice of pushing a property on a client simply because you were the first contact is a bubble practice. You can ride that wave, but to have a business long term, you need word of mouth working in your favor. You want to make deposits into the Karma bank, while doing the right thing for your client. Your client will respect you more if you find them a professional that can better assist them in their home buying process than you can. A situation where clients and other real estate professionals view you as a resource and promote you as a genuine person to future customers will only grow your business.Bottom line: Real estate is an industry that relies so heavily on word of mouth and reputation that it’s in your best interest to put the buyer first. These transactions are so large scale that it is important to get them right. Providing another professional, or your own client with a dreamy situation, can push your career to the next level. Finding the right match for your client with a professional that can help them, frees you up to better serve your own clients and referrals. It’s unfortunate that this “teamwork attitude” isn’t more prevalent throughout all facets of the economy. It’s simply not possible with hyper-competitiveness and capitalistic tendencies. However, in real estate, the stars line up in a way that makes generosity amongst business operations advantageous. It’s up to you as a professional to take advantage of the situation. |

FSBOs Must Be Ready to Negotiate

November 5, 2013

| FSBOs Must Be Ready to Negotiate Posted: 05 Nov 2013 04:00 AM PST  In a recovering market, some sellers might be tempted to try and sell their home on their own (FSBO) without using the services of a real estate professional. The real estate agent is a trained and experienced negotiator. In most cases, the seller is not. The seller must realize the ability to negotiate will determine whether they get the best deal for themselves and their family. In a recovering market, some sellers might be tempted to try and sell their home on their own (FSBO) without using the services of a real estate professional. The real estate agent is a trained and experienced negotiator. In most cases, the seller is not. The seller must realize the ability to negotiate will determine whether they get the best deal for themselves and their family.Here is a list of some of the people with whom the seller must be prepared to negotiate if they decide to FSBO:

|

Chicken Little is Wrong: Homeownership Still the American Dream

November 4, 2013

| Chicken Little is Wrong: Homeownership Still the American Dream Posted: 04 Nov 2013 04:00 AM PST  After the harrowing challenges experienced by so many homeowners over the last few years, many housing experts had predicted that the belief in homeownership as a major element of the American Dream would soon die. There is now conclusive evidence that these experts were wrong. As we reported back in September, The Joint Center of Housing Studies at Harvard University completed a study which concluded: After the harrowing challenges experienced by so many homeowners over the last few years, many housing experts had predicted that the belief in homeownership as a major element of the American Dream would soon die. There is now conclusive evidence that these experts were wrong. As we reported back in September, The Joint Center of Housing Studies at Harvard University completed a study which concluded:“The long term cultural preference for owning seems to have weathered the recent housing crisis.” Now, a second source recently announced similar results. Fannie Mae just released their National Housing Survey of Delinquent Mortgage Borrowers. The survey asked questions about the value of homeownership to the most sensitive of all groups – those delinquent on their mortgages. Here is what they found: Of those delinquent borrowers:

Homeownership has always been and will always be a crucial piece of the American Dream.  |

Importance of Curb Appeal [INFOGRAPHIC]

November 1, 2013

| Importance of Curb Appeal [INFOGRAPHIC] Posted: 01 Nov 2013 04:00 AM PDT Today we are featuring an infographic originally created for Door Emporium by Optimal Targeting. - The KCM Crew  |

© All Rights Reserved