Phil's Blog

Buying or Selling: Now May Be the Time

October 31, 2013

| Buying or Selling: Now May Be the Time Posted: 31 Oct 2013 04:00 AM PDT  As we enter the winter months, many expect the real estate market to begin to slow down. However, this winter there are many reasons that both buyers and sellers should consider moving forward with their real estate goals instead of waiting until the spring. As we enter the winter months, many expect the real estate market to begin to slow down. However, this winter there are many reasons that both buyers and sellers should consider moving forward with their real estate goals instead of waiting until the spring.BUYERS Waiting until the spring will probably mean increases in the two elements that determine the cost of purchasing a home: home prices and mortgage rates. SELLERS A seller will get the best price when demand is high and inventory is low. Demand will remain strong throughout this winter (see above) while inventory historically shrinks this time of year. To dive deeper into the reasons both buyers and sellers should act now instead of waiting, join us later today for a free webinar where we'll give you everything you need to dominate the next 60 days and set yourself up for a great 2014. Secure your seat for this free webinar! |

Taking the Spooky Feeling Out of Foreclosures

October 30, 2013

| Taking the Spooky Feeling Out of Foreclosures Posted: 30 Oct 2013 04:00 AM PDT Today we are excited to have Joan Erni, as our guest blogger. Joan is the Director of Business Development at Michael Saunders & Company, and wrote today's post in response to last Wednesday's blog post re: foreclosures. - The KCM Crew Buying a Foreclosure isn’t as Risky as You May Think, with the Proper Know-How  Last week, when Amanda Kostina laid out her 10 Hidden Hazards When Buying Foreclosure, it hit close to home. My husband and I relocated to Florida in the midst of the credit crunch, and what awaited me in my new home state was a depressed real estate market. Even though foreclosures had always been part of my repertoire, nothing could prepare me for the crash course I was about to get in the owned-asset market. Last week, when Amanda Kostina laid out her 10 Hidden Hazards When Buying Foreclosure, it hit close to home. My husband and I relocated to Florida in the midst of the credit crunch, and what awaited me in my new home state was a depressed real estate market. Even though foreclosures had always been part of my repertoire, nothing could prepare me for the crash course I was about to get in the owned-asset market.At my five years at Michael Saunders and Company, we have managed and sold an extremely high volume of properties for financial institutions and government sponsored entities (GSEs). And I have found that despite the inherent stigma that comes with purchasing a foreclosure, REO properties are a great opportunity for buyers, especially first time buyers. That’s because there are built-in incentives to revitalize the area. All GSEs, and most banks, offer programs called First Look Initiatives. These programs allow for owner occupants to have first crack at their listings over buyers who are looking to purchase a listing as an investment. The hope is to pass the property to stable, caring owners. In fact, Freddie Mac has a policy to repair at least 65% of their inventory, seeking to rejuvenate the neighborhoods where their properties are listed. With those improvements comes some assurances of a relatively-smooth transaction. My foreclosure sellers provide disclosures of anything they are aware of, or have been made aware of, with the property, as well as ensure all liens are satisfied and code issues are rectified, and pass clear title. Now, while the hazards Amanda listed are present, I don’t know if they’re necessarily hidden. After all, if there are holes in the walls or the electric is off, you’ll know. But there are some precautions you can take to navigate some of the unseen, volatile waters of owned-assets. Find an Agent Familiar with Foreclosures: An agent who doesn't know the process and/or the seller's contracts and policies could slow or derail an otherwise sound transaction. A trusted, experienced Realtor® can steer foreclosure buyers clear of unspoken pitfalls, and ensure an expedited process. Get a Home Inspection: Many buyers feel that, because they are buying "as is" property, a home inspection is a waste of time and money. Not so. Having the home inspected will uncover problems within the inspection period. That’s important, because should you want to cancel the contract and it’s outside the timeline, some REO sellers will keep the earnest money deposit. Consult with an Attorney on Your Contract: Many buyers don't have an attorney review their contract because they've been told that REO sellers won't allow any changes to it. That is definitely true: changes aren’t allowed, but, if you sign without fully understanding the contract, you (and your selling agent) might be surprised by what you've bound yourself to. For example, 99% of the sellers of properties we list have a policy to turn on the water and electric if possible. It is not guaranteed that it will be. Not even for inspections. So, if the plumbing is cut out, don't expect the house to be re-plumbed because you have to have utilities on for inspections. No, you don't, and the contract addendum you signed probably says so. In any real estate transaction the buyer should beware, and that rings particularly true when purchasing an REO. But working with a Realtor® who is well versed in the REO market can allow buyers to see the benefits of purchasing a property that has been foreclosed on, and many times, those benefits can outweigh any potential “hazards”. |

Walk a Mile

October 29, 2013

| Walk a Mile Posted: 29 Oct 2013 04:00 AM PDT This is my story. There are many like it, but this one was mine. Answer a few calls.From yard signs (people who almost always say “that’s a lot of money”), from Zillow inquires and from escrow officers. From agents asking for feedback from a showing, from idx inquiries on other agents listings and from buyers who have to see a few houses “right now”. From loan officers telling you the appraisal didn’t come in at the right amount, from a buyer saying “thank you” or from another agent telling you that their seller went with “the other offer” instead. Answer in the middle of dinner with your family, at 11pm, on vacation. Answer a few calls.From yard signs (people who almost always say “that’s a lot of money”), from Zillow inquires and from escrow officers. From agents asking for feedback from a showing, from idx inquiries on other agents listings and from buyers who have to see a few houses “right now”. From loan officers telling you the appraisal didn’t come in at the right amount, from a buyer saying “thank you” or from another agent telling you that their seller went with “the other offer” instead. Answer in the middle of dinner with your family, at 11pm, on vacation.

Walk through some houses.Look at 10 houses in 3 different price ranges and neighborhoods. Study comparable reports before you go. Touch the hand rails, imagine being in the shower or barbecuing in the backyard. Look at the staging, the cleanliness and the paint colors. Check out the neighbors (do they have dogs? kids? nice cars?). How old does the roof look? Has the plumbing been updated? Is there new insulation in the attic? Wood floors underneath the carpet? Is the foundation crooked? Cracked? Look at the buyers body language as they explore. Take notes when they make comments. Take pictures of anything suspicious or wonderful. Walk slowly through a few homes you’ll never be able to afford yourself.Negotiate a contract.Explain dozens of legal documents in layman’s terms. Remember to make sure the buyer asks for that stainless refrigerator, in writing. Is Friday really a good closing date, ever? Convince the buyer they need to pay over asking price. Convince a seller they need to accept less than asking price. Tell the other agent “this is my client’s final offer”, and mean it. Load the forms into your software of choice. Take note of all the sources needed to fill them out completely. Triple check your work. Are you going to write a cover letter? Should you meet the other agent in person or will an email do the trick? Work with a sub-par agent. Work with a great one. Tell your seller that the buyers financing fell through, 5 days before the closing.Get belly to belly.Talk to a first-time-homebuyer.[Notice how they always think they can “just knock that wall down”. Notice how excited they are. Notice how they have no savings. Or notice how big their trust fund is. Notice how they want more space] Talk to a 6th-time-homebuyer. [Notice how they know everything. Notice how they really don’t. Notice how staunch they are about the details. Notice how they want less space] Talk to a 4 months late on the mortgage homeowner. [Notice how scared they are. Notice how scared you are] Reflection.A friend recently asked me “aren’t you glad you don’t have to tell people you’re a real estate agent anymore?” Funny, but this never occurred to me.My brother read science fiction novels when our family went on road trips and I chose to look out the window and observe the world. I was a paperboy for a while. I knew all of my neighbors. I knew the details of every home on my route. I knew the details of every person on my route. I won the geography bee a few times. I love every house I’ve every seen and I’m not sure if it’s a gift or a curse. Being a real estate agent is one of the greatest privileges in the world. It requires a diverse skill-set of sales, compassion, empathy, marketing, organization, hustle, wit and patience. It’s connected me with people in ways unlike anything I’ve ever experienced before and is incomparable to any job I’ve ever had (and I’ve had a lot). It takes no guts to start but it takes all of them to continue. The narrative of the agent is often lost in a sea of “look-at-me” marketing, in the churn of disruption aimed at the profession and in the daily grind in which we (they) willingly participate. It’s a narrative I hope we get right one day. It’s a narrative that I’m proud, was mine. |

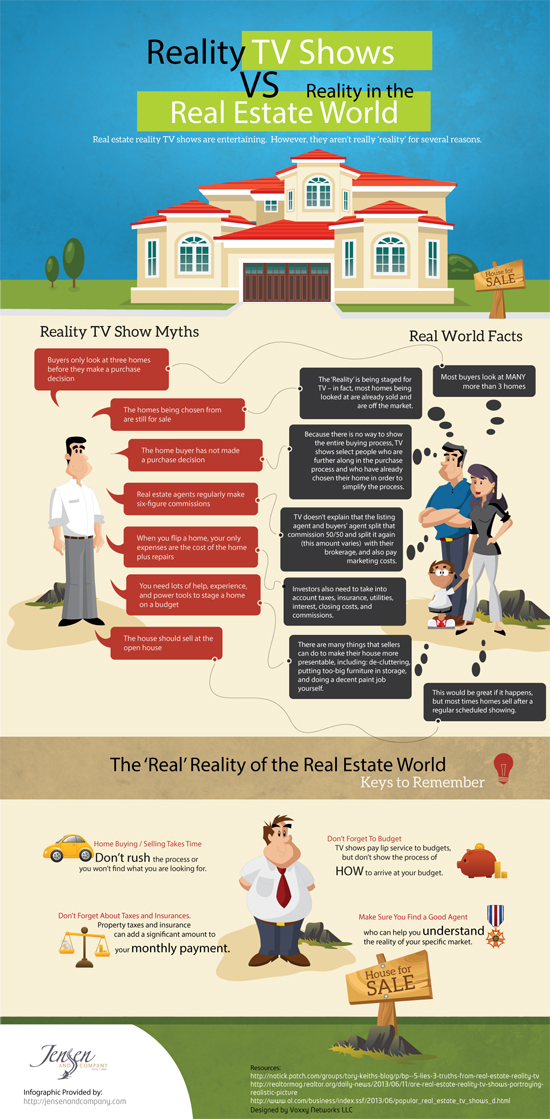

Real Estate: TV vs. Reality [INFOGRAPHIC]

October 25, 2013

| Real Estate: TV vs. Reality [INFOGRAPHIC] Posted: 25 Oct 2013 04:00 AM PDT  Courtesy of: Park City Real Estate - JensenandCompany.com |

Great Advice for Senior Sellers During Showings

October 24, 2013

Today we are honored to have Nikki Buckelew, the Founder and CEO of the Seniors Real Estate Institute, return as our guest blogger. Nikki is considered a leading authority on seniors real estate and housing. - The KCM Crew  If there is one that frustrates real estate agents the most, it is when homeowners decide to stay home for showings! So, how do you get a senior homeowner to leave when their home is being shown? First, let’s consider why they are choosing to stay there in the first place. Even though it may feel like they are just trying to make our lives difficult, there may be in their minds very good reasons for staying put. Ask yourself these questions... Is it possible they:

This requires a conversation -- a very intentional conversation. While most of the time and with most clients, we can merely say, “Be sure to leave the house during showings,” and they do, you may need to have a more thorough discussion with senior home sellers and provide your procedure and rationale in writing. Revisiting this conversation is not a bad idea either, putting them at ease regarding concerns, fears, or questions. Provide alternatives. If you are serving an older adult, especially a frail older adult, who doesn’t have family support nearby, you may need to go above and beyond what you normally do relative to showings. This little bit of extra effort is not only beneficial to the home sale process, but it can also be an amazing gift and value add setting you apart from the average agent. |

10 Hidden Hazards When Buying Foreclosures

October 23, 2013

| 10 Hidden Hazards When Buying Foreclosures Posted: 23 Oct 2013 04:00 AM PDT We are pleased to present, Amanda Kostina, as our guest blogger today. Amanda is a writer for Whitefence.com. - The KCM Crew  Buying a foreclosed home can seem like a dream. What could be better than getting a home for a fraction of the market value? Some may even say that the deals sound like they could be too good to be true. In some cases, those doubters aren't too far off the mark. There are some hidden dangers in buying foreclosure properties that, if you're not aware of them, could be disheartening and disappointing. If you are pursuing this route in buying your new home, be sure to look out for these hazards and hidden costs. Buying a foreclosed home can seem like a dream. What could be better than getting a home for a fraction of the market value? Some may even say that the deals sound like they could be too good to be true. In some cases, those doubters aren't too far off the mark. There are some hidden dangers in buying foreclosure properties that, if you're not aware of them, could be disheartening and disappointing. If you are pursuing this route in buying your new home, be sure to look out for these hazards and hidden costs.

Resources: http://www.investopedia.com/articles/mortgages-real-estate/08/foreclosur... http://www.zillowblog.com/2012-08-17/buying-a-foreclosure-watch-out-for-... |

Forbes: Buy Now or Pay More Later?

October 22, 2013

| Forbes: Buy Now or Pay More Later? Posted: 22 Oct 2013 04:00 AM PDT  Even though no one at KCM actively lists or sells real estate, some of our readers believe that there is an inherent basis toward the real estate community in our writing. For that reason, we want to quote a third party source today. Forbes, in their online edition last week, spoke to the importance of buying a home now rather than waiting. Even though no one at KCM actively lists or sells real estate, some of our readers believe that there is an inherent basis toward the real estate community in our writing. For that reason, we want to quote a third party source today. Forbes, in their online edition last week, spoke to the importance of buying a home now rather than waiting.The article, Should You Buy a Home Now or Pay More Later?, explains: “With mortgage rates creeping up toward 5% as 2013 draws to a close, potential home buyers have some decisions to make — and soon. The danger for potential homebuyers isn’t that mortgage rates are nearing 5.00%; the real threat is that rates could go higher, to 5.50% or even 6.00% in 2014.” The article spells out the financials consequences a buyer would face by waiting. ($67,746 on a $300,000 mortgage). They gone on to identify four things a buyer should take into consideration before delaying a decision to purchase.

The financial advice Forbes gave to their readers was rather simple. Buy now or pay more later!!  |

The Curious Case of the Jumbo Mortgage

October 16, 2013

| The Curious Case of the Jumbo Mortgage Posted: 16 Oct 2013 04:00 AM PDT Today we are pleased to have Miranda Marquit, a financial writer for RateZip.com, as our guest blogger. - The KCM Crew  Though it may feel like yesterday, it's been about half a decade since the housing bubble burst and the subprime mortgage crisis hit. In September 2008, the United States government took over Fannie Mae and Freddie Mac. Since then, the mortgage industry has undergone fundamental changes, experiencing both increased regulation and a large shift toward nationalization. To give you an idea of the size of these changes, in 2006 around 30% of mortgage loans in the US were backed by a government guarantee. This number rose to around 90% in 2012. Though it may feel like yesterday, it's been about half a decade since the housing bubble burst and the subprime mortgage crisis hit. In September 2008, the United States government took over Fannie Mae and Freddie Mac. Since then, the mortgage industry has undergone fundamental changes, experiencing both increased regulation and a large shift toward nationalization. To give you an idea of the size of these changes, in 2006 around 30% of mortgage loans in the US were backed by a government guarantee. This number rose to around 90% in 2012.

Private vs. Government FundingAs we move further from the financial crisis, it makes sense to start asking if and when the mortgage industry will return to a world where private money plays a greater role and government institutions such as Fannie, Freddie, and the Federal Housing Administration (FHA) play a smaller one. Recently, our representatives in Washington have begun to discuss plans to dissolve Fannie and Freddie and bring private money back into the game, and that's a good start. In the past few months, we've also seen a few encouraging trends in the jumbo mortgage market that could point toward a mortgage industry less reliant on government guarantees.Jumbo MortgagesIf you're not familiar with a jumbo mortgage, the entire concept revolves around the type of loans that Fannie and Freddie are willing to guarantee. Fannie and Freddie will guarantee loans only up to $417,000 in value (sometimes more, but not important for this discussion), and these are referred to as conventional mortgages. A jumbo mortgage refers to one with a higher loan amount, typically $417,000 to $750,000, and these are not backed by a government guarantee. Prior to the financial crisis, jumbo loans were priced around .25% higher than conforming. After the financial crisis, the gap has widened to as much as 1.8%, just one more indicator of the flight of private capital.Latest TrendIn September, something changed – by some measures, the rates on jumbo mortgages actually fell below the rates on equivalent conventional loans. This phenomena was covered in many media outlets, and you can read more detail here and here. As of this writing, the rates on a few popular websites are almost too close to tell the difference, with 30 year fixed rate conventional mortgages at 4.28% and jumbo 30 year fixed rate mortgages at 4.32%. Though it's only been one month, the fact that jumbo mortgage rates did not immediately diverge from conventional rates is a sign that we may be witnessing a trend.There are countless ways to interpret the closing spread between jumbo and conventional mortgage rates. For example, banks with excess capital to lend may feel pressure to put this money to work, which one could argue is leading to higher demand for jumbo loans and thus lower rates. Another interesting interpretation, however, ties back to Fannie and Freddie. In recent years, both institutions have raised guarantee fees, the fees that are meant to compensate them for providing a guarantee on a mortgage. This makes conventional loans more expensive, which would help close the gap with jumbo loans in the other direction. If you're in favor of more private market involvement within the mortgage industry, you may be wondering if falling jumbo mortgage rates are the first step in a path toward private options for conventional loan amounts. After all, at some point working with Fannie and Freddie may become prohibitively expensive, and the WSJ article linked earlier mentioned a mortgage lender encouraging borrowers to borrow more money to jump over conventional limits. It's far too early to tell, but this trend certainly deserves attention over the coming months. |

Why You Should Sell Your House Now

October 15, 2013

| Why You Should Sell Your House Now Posted: 15 Oct 2013 04:00 AM PDT  Many now realize that it is a great time to buy a home. It might also be an opportune time to sell your house. Here are the five reasons we believe now may be a perfect time to put your house on the market. Many now realize that it is a great time to buy a home. It might also be an opportune time to sell your house. Here are the five reasons we believe now may be a perfect time to put your house on the market.

1. Demand Is HighThe most recent Existing Home Sales Reports by the National Association of Realtors (NAR) show a double digit percent increase in sales year-over year; sales have remained above last year’s levels for over 25 months. There are buyers out there right now and they are serious about purchasing.2. Supply Is Beginning to IncreaseTotal housing inventory is again approaching historic norms of a 5 month supply compared with 4.3 months in January. Many expect inventory to continue to rise as 3.2 million homeowners escaped the shackles of negative equity in the last 12 months and an additional 1.9 million are expected to enter positive equity in the next 12 months. Selling now while demand is high and before supply increases may garner you your best price.3. New Construction Is Coming BackOver the last several years, most homeowners selling their home did not have to compete with a new construction project around the block. As the market is recovering, more and more builders are jumping back in. These ‘shiny’ new homes will again become competition as they are an attractive alternative for many purchasers.4. Interest Rates Will Again RiseAlthough Freddie Mac’s Primary Mortgage Market Survey shows that interest rates for a 30-year mortgage have softened recently, most experts predict that they will begin to rise later this year. The Mortgage Bankers Association, Fannie Mae, Freddie Mac and the National Association of Realtors are in unison projecting that rates will be up almost a full percentage point by this time next year.Whether you are moving up or moving down, your housing expense will be more a year from now if a mortgage is necessary to purchase your next home. 5. It’s Time to Move On with Your LifeLook at the reason you are thinking about selling and decide whether it is worth waiting. Is the possibility of a few extra dollars more important than being with family; more important than your health; more important than having the freedom to go on with your life the way you think you should?You already know the answers to the questions we just asked. You have the power to take back control of your situation by putting the house on the market today. The time may have come for you and your family to move on and start living the life you desire. That is what is truly important.  |

Homeownership’s Impact on Net Worth

October 14, 2013

| Homeownership’s Impact on Net Worth Posted: 14 Oct 2013 04:00 AM PDT  Over the last five years, homeownership has lost some of its allure as a financial investment. As homeowners suffered through the housing bust, more and more began to question whether owning a home was truly a good way to build wealth. A recent study by the Federal Reserve formally answered this question. Some of the findings revealed in their report:

The Fed study found that homeownership is still a great way for a family to build wealth in America. If you are a real estate agent and want a full explanation of how homeownership builds wealth along with powerful visuals you can use to better inform your buyers on this issue, we cover the topic at length in the October edition of KCM. Members can login to the member area. Not yet a member, try a FREE 14 Day Trial Membership. |

Latinos Paint a Portrait of Future Buyers in US

October 10, 2013

| Latinos Paint a Portrait of Future Buyers in US Posted: 10 Oct 2013 04:00 AM PDT A recent Pew Research Center report gives us a better idea of who our future buyers will be, if we look at the numbers based on school enrollment. College  18- to 24-year-old Hispanics enrolled in college increased by 324,000 students between 2011 and 2012, marking the third straight year of increases. The number of Hispanic 18- to 24-year-olds enrolled in college has reached a new high—2.4 million—and has been growing since 2009. In 2012, 14.5% of Latinos ages 25 and older had earned one degree. Kindergarten to High School According to the Census Bureau, one out of every four public school students nationwide in October 2012 was Hispanic and the share varies across different school levels:

|

Home Loans: Shopping for a Low Interest Rate

October 9, 2013

| Home Loans: Shopping for a Low Interest Rate Posted: 09 Oct 2013 04:00 AM PDT Today we are excited to have Morgan Sims as our guest blogger. Morgan is an accomplished writer who has been featured on many blogs with topics ranging from Real Estate to Social Media. – The KCM Crew  Buying a home is likely the biggest purchase you will make, and even more likely a purchase that will require a loan. When dealing with a financial commitment such as this, understanding how to get the lowest possible interest rate could mean a difference of thousands of dollars. Home loans are a complicated business, so here are a few tips to help you shop for the lowest interest rate. Qualifying for the Lowest RatesComputer models fix a large percentage of the costs of a home loan with strict prequalification. Loan officers are not able to give every client that walks in the door the same deal. It is a good idea to be aware of your own credit score and equity, while also comparing rates in your local market, so you know what to expect.For the best interest rates you'll likely need a credit score of at least 740 and have 20 percent equity. These figures are a general guide and are always changing. However, if your score is considerably lower than this and you have low equity, be prepared for heavily increased rates compared to the best that are offered. Be PreparedThe best thing you can do for yourself to make the loan process easier is to plan ahead and be prepared. Be sure to gather all the necessary documents before you begin; to ensure timeliness and organization. You should also prepare for the down payment by saving up monthly. Depending on the lender and type of loan, you may be required to put anywhere from 2.25% to 20% of the purchase price down. In addition, keep in mind the estimated closing costs, as many tend to forget to budget for these fees. It’s never too late to start saving.Another factor to consider is home insurance costs. If insurance costs for your area are particularly low, it may free up some additional cash for loan repayments. Tools like the home insurance calculator allow you to plug in all of your information to get an estimated cost for your home insurance. Understand your NeedsBefore going to speak to anyone about getting a home loan, be sure you are clear about what it is that you're looking for and what parameters you have set. If for any reason they can't be met, be cautious of alternative offers that are suggested to you, as you may be persuaded down a different path.Looking Will Lead to the Right RateThere’s no easy way around it if you want to find the lowest interest rates on a home loan. You have to spend a long time looking, and you need a strategy. It may not be something you're particularly interested in but if it saves you a large sum of money, it’s worth it.You must compare similar policies; otherwise you're wasting your time, as a sensible comparison is almost impossible. Consider the closing costs, interest rate, and lock period to ensure that they are comparable offers. Move QuicklyAs they say, time is money. Be sure to respond promptly to your lender if they require any additional information from you so you can keep the process moving.If you've managed to find a great deal on your home loan, waiting around for ages while you try to better it or find the equity required to close the deal, is likely to end up costing you. Shopping around is certainly in your best interest. However with today’s market on the rise, rates are not likely to stay stagnant. So if you find a great rate that fits your needs don’t wait long to close it. Also look into getting prequalified for a loan. This process is rather simple and can put you in a much better place to buy, as well as give you a great idea as to what you can expect to borrow. Taking out a home loan is one of the biggest financial commitments you are likely ever going to make. Make sure you put in the time to do your research and look around for the best possible deal. |

You Need a Professional to Sell or Buy a Home

October 8, 2013

| You Need a Professional to Sell or Buy a Home Posted: 08 Oct 2013 04:00 AM PDT  Many people ask us whether they should hire an agent to sell their home or whether they should first try as a For Sale by Owner (FSBO). In today’s market, we believe this is an easy decision: you need an experienced professional! Many people ask us whether they should hire an agent to sell their home or whether they should first try as a For Sale by Owner (FSBO). In today’s market, we believe this is an easy decision: you need an experienced professional!You need an expert guide if you are traveling a dangerous path The field of real estate is loaded with land mines. You need a true expert to guide you through the dangerous pitfalls that currently exist. Finding a buyer ready, willing and able to pay fair market value for your home at a time when lending standards are so stringent is not an easy task. Finding reasonable financing can also be tricky when interest rates are volatile like they have been over the last several months. You need a skilled negotiator In today’s market, hiring a talented negotiator could save you thousands, perhaps tens of thousands of dollars. Each step of the way – from the original offer, to the possible re-negotiation of that offer after a home inspection, to the possible cancellation of the deal based on a troubled appraisal – you need someone who can keep the deal together until it closes. Realize that when an agent is negotiating their commission with you, they are negotiating their own salary; the salary that keeps a roof over their family’s head; the salary that puts food on their family’s table. If they are quick to take less when negotiating for themselves and their families, what makes you think they will not act the same way when negotiating for you and your family? If they were Clark Kent when negotiating with you, they will not turn into Superman when negotiating with the buyer or seller in your deal. Bottom Line We believe that famous sayings become famous because they are true. You get what you pay for. Just like a good accountant or a good attorney, a good agent will save you money…not cost you money.  |

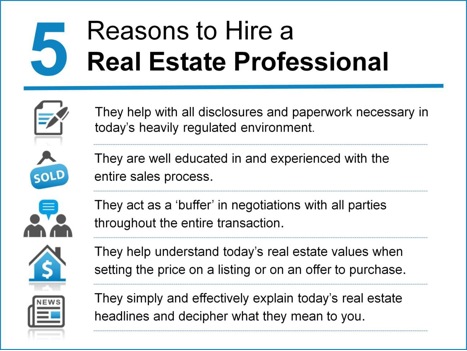

5 Reasons to Hire a Real Estate Professional

October 2, 2013

| 5 Reasons to Hire a Real Estate Professional Posted: 02 Oct 2013 04:00 AM PDT Today we are excited to have Ashley Garner, a Director of the North Carolina Association of Realtors (NCAR), as our guest blogger. Ashley was so inspired from our most recent edition of KCM that he chose to expand on one of his (and our) favorite slides from the presentation. - The KCM Crew  The real estate market is a place where most people will make their largest investment ever. It is a place where fortunes can be, and often are, made. It is not a place, however, for you to “wing it”. While the myriad TV shows about real estate make the process look so simple – it’s not really that simple… they make it seem like all you need to do is slap a for sale by owner sign in the yard, have one open house with fresh flowers and fresh baked cookies and bam! SOLD! in one day. Well I can tell you that in New Hanover County, North Carolina it takes an average of 121 days to sell a home. An average means that some houses take much longer to sell and some much less than 121 days to sell. You need a professional, full time, well educated, ethical and trustworthy REALTOR to represent you whether buying or selling real estate. 1 - PaperworkCurrently in North Carolina there are over 24 pages of contracts involved with buying or selling most homes. The state law requires much of this paperwork regardless or whether or not you hire a REALTOR. REALTORS are trained and educated on the contracts, which are constantly changing, so they can advise you during the process. They can also refer you to a real estate attorney to represent you on all legal matters involved in the process.2 - ProcessThere are about 180 typical actions, research steps, procedures, processes and review stages in a successful residential real estate transaction that are normally provided by full service real estate brokerages in return for their sales commission. (Based on a report prepared by the Orlando Regional REALTORS Association). So this means that if you choose to go it on your own, you are going to have to do all 180 things yourself… or they don’t get done… which probably means your transaction doesn’t end in a successful purchase/sale.3 - NegotiationWhile there will always be that one guy (or gal) who thinks he (she) is the all-time greatest negotiator, the vast majority of folks do not like confrontational interactions. A negotiation for the purchase/sale of an asset as large as a piece of real estate can be a very confrontational interaction. The role of the REALTOR is to act as a buffer between the two parties who are in the midst of a very emotional and high-level financial transaction, both wanting to get the best they can get often at the detriment of the other party. A real estate professional is experienced in all aspects of the negotiation and is bound legally to do only what is in the best interest of his/her client.4 - ValuesPerhaps the single most important aspect of the transaction is the value of the piece of property.If you are a seller you want to know how much you can expect to get for the sales price and how much of that you will walk away with in your pocket. You want to advertise the property for sale at the right price so you sell for as much as possible but you don’t want to price it so high that no buyers make you an offer (and YES if you price it too high MOST buyers will not want to offend you by making a low offer…thus you don’t get any offers). If you are the buyer, you want to know how much to offer. Now multiple offer situations are happening more frequently and if a buyer offers too low, they can either be rejected completely by the seller or they can cause the negotiation to take too long thus allowing time for a competing bid to come in… allowing the seller to be in the driver’s seat. 5 - TeacherAny good professional, whether a real estate professional, doctor, lawyer, CPA, etc., will have the heart of a teacher. Real estate brokerage is a service business. The professional REALTOR is there to educate you about the conditions impacting today’s real estate market. It is as easy as picking up the newspaper or searching the Internet for real estate news to see conflicting headline after conflicting headline. “Prices are up 20%”, “Among worst markets in nation”, “Best year since the crash”…well which is it? All real estate is local and your real estate professional will know the local market conditions and will lead you through the process, like any good teacher would, making sure you understand all that is going on around you.A real estate professional is a crucial member of your team when buying or selling real estate. You could be buying your first home or your tenth home, an investment property or a vacation home, commercial or residential…whichever it is you are best served in the care of a full time, well educated, ethical, trustworthy real estate professional.  |

© All Rights Reserved