Phil's Blog

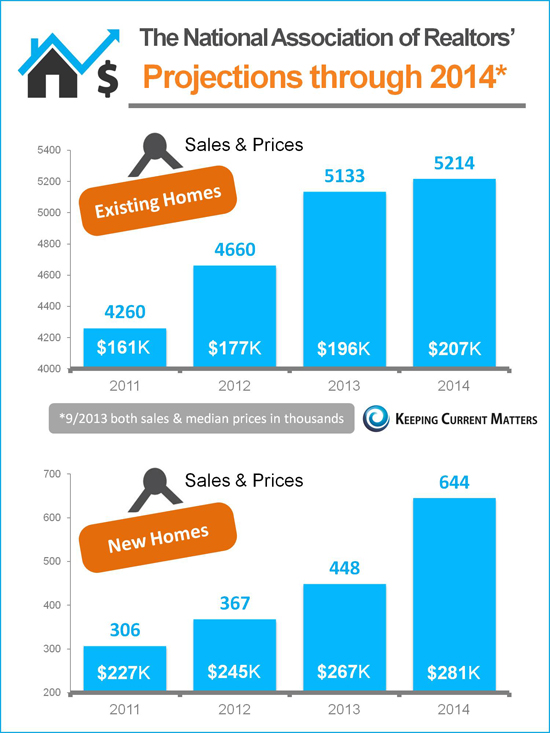

NAR's Projections through 2014 [INFOGRAPHIC]

September 27, 2013

| NAR's Projections through 2014 [INFOGRAPHIC] Posted: 27 Sep 2013 04:00 AM PDT  |

Does Your Credit Score Effect Your Homeowners Insurance Cost?

September 26, 2013

| Does Your Credit Score Effect Your Homeowners Insurance Cost? Posted: 26 Sep 2013 04:00 AM PDT Our guest blogger for today is Carrie Van Brunt-Wiley, Editor of the www.insurancesolutionsplus.com blog. The www.insurancesolutionsplus.com blog provides tips for consumers on a wide variety of topics ranging from home maintenance to insurance shopping. - The KCM Crew  Your credit score and your insurance payments- what’s the connection? Your credit score and your insurance payments- what’s the connection?You’re likely not surprised when your loan officer asks for your social security number- a thorough credit check is standard when applying for a loan. However, many consumers are caught off-guard when a homeowners insurance agent asks for their social security number. It’s widely debated, but quite commonly practiced- for an insurance carrier to use a customer’s credit score to determine their insurance premiums. What does your credit score really mean to your potential insurance carrier? While many businesses will use a consumer’s credit score to determine eligibility for a line of credit or to discern whether a deposit should be held for an advance of services, insurance companies actually perform a different type of credit inquiry that they use for a very different reason. A “Soft” Credit Check First and foremost, it’s important to know that when an insurance company runs your credit they are actually performing what is called a “soft” credit check which accesses only your credit score and is not reflected as an inquiry on your credit report. As you probably can surmise, this is different from a “hard” credit check that a lender, for example, may run which does show up on your credit report as an inquiry. Since credit inquiries from “hard” credit checks can hurt your overall score it’s good to limit these types of credit checks when shopping for a mortgage, for example. However, since insurance carriers only perform a “soft” credit check you can feel free to shop for multiple insurance quotes without worrying about hurting your credit rating. What they use it for Here’s where a lot of confusion, and sometimes even frustration, can set in from a consumer’s perspective. Once an insurance company has your credit score, they use it (along with many other factors about you and your home, car, etc.) to assign you an “insurance score”. This insurance score reflects your potential risk to the insurer. The insurance carrier then takes your risk potential and calculates your premiums. The more risk you pose, the higher your premiums will most likely be. This is where the real question comes in: What does poor credit history have to do with my potential to file a claim? If you’re asking this question, you’re not alone. There is much debate over the use of credit scoring as a way to determine risk, and therefore assign rates to insurance consumers. However, insurance companies defend the practice saying that studies have shown a direct correlation between a person’s credit score and their likelihood to file a claim. Therefore, consumers with a lower credit score often pay higher rates for insurance. Whether you agree with the practice or not, qualifying for better insurance premiums is just one other way that you can save money by keeping a good credit rating. |

Mortgage Rates after the Bernanke Announcement

September 23, 2013

| Mortgage Rates after the Bernanke Announcement Posted: 23 Sep 2013 04:00 AM PDT  Last week, Bernard Bernanke startled many by announcing that the Fed will not wind down their bond buying program right now. The program is part of an overall stimulus package geared at bringing back the national economy. The Fed’s purchase of these bonds over the last few years has driven mortgage rates to historic lows. The assumption that there would be a reduction in bond purchases has caused 30 year mortgage rates to spike upward over the last few months. Last week, Bernard Bernanke startled many by announcing that the Fed will not wind down their bond buying program right now. The program is part of an overall stimulus package geared at bringing back the national economy. The Fed’s purchase of these bonds over the last few years has driven mortgage rates to historic lows. The assumption that there would be a reduction in bond purchases has caused 30 year mortgage rates to spike upward over the last few months.Surprisingly, Bernanke revealed the Fed will continue bond purchasers at the current pace. What happened and what does it mean to mortgage interest rates? What would have happened if they reduced bond purchases?According to Bankrate.com:“The Fed could have caused rates to shoot up this week if it had announced the tapering of its bond-purchasing program.” Why did the Fed decide not to start winding down bond purchases?Moody’s Analytics reported that there were three reasons:

What does this mean to a buyer applying for a mortgage?Those at Bankrate.com explain:“For now, borrowers have dodged another spike in rates. The Fed’s announcement might even cause rates to drop in coming days, says Paul Edelstein, director of financial economics at IHS Global Insight. ‘Mortgage rates should fall back — not massively, but to some extent,’ he says. That doesn’t mean homebuyers and homeowners should wait for lower rates, mortgage professionals say. Eventually, once the Fed lets the mortgage market and the economy start walking on their own, rates will probably head back to the 5 percent or 6 percent range, says Scott Schang, manager for Broadview Mortgage Katella in Orange, Calif.” When will the Fed begin winding down bond purchases?According to an article in the Wall Street Journal:“Federal Reserve policy makers decided this week that the economy isn’t in the right place for them to start winding down their bond-buying program. By the time they meet in December, it might be. The decision to not start winding down the bond-buying program now was close… The economy only needs to get a little bit better over the next few months for the central bank to get its nerve back. That should be an easy bar for the economy to clear.” Bernanke himself has not ruled out that the Fed could still scale back the stimulus this year. He stated: “If the data confirms our basic outlook, then we could move later this year.” Bottom LineEd Conarchy, a mortgage planner at Cherry Creek Mortgage in Gurnee, IL had a great quote in the Bankrate article:“Remember that rates go up like a rocket and fall like a feather.” Still, Bankrate.com itself probably put it best: Grab the gift before it’s gone!  |

Coffee & Bagel or Financial Freedom? [INFOGRAPHIC]

September 20, 2013

| Coffee & Bagel or Financial Freedom? [INFOGRAPHIC] Posted: 20 Sep 2013 04:00 AM PDT ![CoffeeInfographic-e1379346654723[1]](http://www.kcmblog.com/wp-content/uploads/2013/09/StarbucksInfographic-e13793466547231.jpg) Today’s InfoGraphic courtesy of our great friend Dave Savage from Mortgage Coach. Here is an EDGE VIDEO Dave created to help you see how to take this concept and tailor it for specific homebuyers. |

Wealthy Pick Real Estate Over the Stock Market

September 18, 2013

| Wealthy Pick Real Estate Over the Stock Market Posted: 18 Sep 2013 04:00 AM PDT  We are taught from birth that the quickest way to achieve a goal is to seek out those who have already accomplished the goal and do what they do. Interested in creating wealth? It seems the wealthy trust real estate as an investment before even the stock market. We are taught from birth that the quickest way to achieve a goal is to seek out those who have already accomplished the goal and do what they do. Interested in creating wealth? It seems the wealthy trust real estate as an investment before even the stock market.A recent survey revealed that 75 percent of luxury homebuyers believe homeownership is a more sound investment than the stock market. The study also reported 57 percent of employed luxury homeowners believe homeownership is a bigger indicator of success than their job or title. Want to join the wealthy? Invest in real estate. |

Experts Comment on the Housing Market

September 17, 2013

| Experts Comment on the Housing Market Posted: 17 Sep 2013 04:00 AM PDT

Responding to the report that over 80% of housing markets are improving: |

Housing Inventory Making a Comeback

September 16, 2013

| Housing Inventory Making a Comeback Posted: 16 Sep 2013 04:00 AM PDT  The shortage of homes for sale earlier in the year created an imbalance of supply to demand which resulted in double digit year-over-year price increases nationally. According to a recent Wall Street Journal article, the inventory of homes for sale is now beginning to reach more normal levels. The article reported: The shortage of homes for sale earlier in the year created an imbalance of supply to demand which resulted in double digit year-over-year price increases nationally. According to a recent Wall Street Journal article, the inventory of homes for sale is now beginning to reach more normal levels. The article reported:“Housing inventories increased in August and stood just 2.5% below their levels of a year ago, offering the latest sign that more sellers are testing the market after swift home-price gains over the past year. Nationally, there were 1.98 million homes listed for sale in August, according to a report released Thursday by Realtor.com. That was up by more than 24% from the low point in February and up 1% from July. Inventories have increased for six straight months.” What about Home Prices?This doesn’t mean prices will collapse. The inventory levels are still depressed, just improving. As the article mentions:“While the overall level of homes for sale remains relatively depressed, the report suggests that inventory may have hit a bottom earlier this year after an extended two-year decline.” However, as we mentioned last week, properly pricing your home in this market can be tricky. You should depend on the advice of your real estate agent.  |

Pricing Your House to Sell Can Be Tricky

September 11, 2013

| Pricing Your House to Sell Can Be Tricky Posted: 11 Sep 2013 04:00 AM PDT  The housing market is finally recovering. Sales are up and so are prices. That means good news for anyone thinking about selling. However, we must be careful not to fall into the trap of over exuberance. Pricing a house incorrectly when it is first listed for sale can be a huge mistake. The housing market is finally recovering. Sales are up and so are prices. That means good news for anyone thinking about selling. However, we must be careful not to fall into the trap of over exuberance. Pricing a house incorrectly when it is first listed for sale can be a huge mistake.Ken H. Johnson, Ph.D. at Florida International University and Editor of the Journal of Housing Research, referring to previous research by John Knight, revealed: “Sellers as well as Brokers/Agents should therefore be aware of the critical necessity of getting the price correct from the start. Sellers wanting to over list will ultimately take longer to sell and will sell their property for less, on average, according to Knight. Brokers/Agents’ desire to take a listing and get the price right later will ultimately lead to their working harder according to Knight, and they are not doing their sellers any favors.” Why Are We Bringing This Issue Up Now?Recent price increases seen in housing have been the result of a lack of salable housing inventory across the country. This inventory challenge is beginning to correct itself and many believe that price increases will begin to taper off.Bill McBride, the author of the renowned economic blog Calculated Risk, explains: “I think that inventory bottomed earlier this year, and that the NAR will report a year-over-year increase in inventory very soon (probably for September). As more inventory comes on the market, buyer urgency will wane and price increases will slow and even decline seasonally in many areas this winter.” If you are putting your house on the market, make sure you consult with a real estate professional before establishing your price. That is the only way you can guarantee getting top dollar in this market.  |

Thinking of Selling Your House? 5 Reasons to Do it Now

September 10, 2013

| Thinking of Selling Your House? 5 Reasons to Do it Now Posted: 10 Sep 2013 04:00 AM PDT  Many now realize that it is a great time to buy a home. Today, we want to look at why it might also be an opportune time to sell your house. Here are the Top 5 Reasons we believe now may be a perfect time to put your house on the market. Many now realize that it is a great time to buy a home. Today, we want to look at why it might also be an opportune time to sell your house. Here are the Top 5 Reasons we believe now may be a perfect time to put your house on the market.

1.) Demand Is HighThe most recent Existing Home Sales Report by the National Association of Realtors (NAR) showed a 17.2 percent increase in sales over July 2012; sales have remained above year-ago levels for 25 months. There are buyers out there right now and they are serious about purchasing.2.) Supply Is Beginning to IncreaseTotal housing inventory last month rose 5.6% to 2.28 million homes for sale. This represents a 5.1-month supply at the current sales pace, compared with 4.3 months in January. Many expect inventory to continue to rise as 3.2 million homeowners escaped the shackles of negative equity in the last 12 months and an additional 1.9 million are expected to enter positive equity in the next 12 months. Selling now while demand is high and before supply increases may garner you your best price.3.) New Construction Is Coming BackOver the last several years, most homeowners selling their home did not have to compete with a new construction project around the block. As the market is recovering, more and more builders are jumping back in. These ‘shiny’ new homes will again become competition as they are an attractive alternative for many purchasers.4.) Interest Rates Are RisingAccording to Freddie Mac’s Primary Mortgage Market Survey, interest rates for a 30-year mortgage have shot up to 4.57% which represents a jump of more than a full point since the beginning of the year. The Mortgage Bankers Association, Fannie Mae, Freddie Mac and the National Association of Realtors are in unison projecting that rates will continue to climb.Whether you are moving up or moving down, your housing expense will be more a year from now if a mortgage is necessary to purchase your next home. 5.) It’s Time to Move On with Your LifeLook at the reason you are thinking about selling and decide whether it is worth waiting. Is the possibility of a few extra dollars more important than being with family; more important than your health; more important than having the freedom to go on with your life the way you think you should?You already know the answers to the questions we just asked. You have the power to take back control of your situation by putting the house on the market today. The time may have come for you and your family to move on and start living the life you desire. That is what is truly important.  |

Why Do American Families Buy a Home?

September 9, 2013

| Why Do American Families Buy a Home? Posted: 09 Sep 2013 04:00 AM PDT  There is a plethora of opinions voiced by real estate gurus as to why the dream of home ownership is so important to most Americans. However, study after study reveals the same five reasons families decide to buy a home. They… There is a plethora of opinions voiced by real estate gurus as to why the dream of home ownership is so important to most Americans. However, study after study reveals the same five reasons families decide to buy a home. They…

If you are considering purchasing a home, look at the five reasons mentioned above. If any of them apply to you and your family, perhaps it is time for you to take the plunge. With both prices and interest rates rising, waiting will only increase your monthly cost as we move forward.  |

Housing Data: Past & Future [INFOGRAPHIC]

September 6, 2013

| Housing Data: Past & Future [INFOGRAPHIC] Posted: 06 Sep 2013 04:00 AM PDT  |

Powerful Presentations a Must in Today’s Environment

September 5, 2013

| Powerful Presentations a Must in Today’s Environment Posted: 05 Sep 2013 04:00 AM PDT  When it comes to choosing their real estate professional, consumers have higher expectations today than ever before. They want someone who: When it comes to choosing their real estate professional, consumers have higher expectations today than ever before. They want someone who:

1. Keep Abreast of What is Happening in the MarketIn a recent infographic we ran on this blog, Top 10 Reasons to Hire a Real Estate Agent, it was revealed that a real estate agent must be prepared to:“Disclose market conditions which will govern your buying or selling process. Many factors will determine how you succeed.” Obviously, in order to ‘disclose’ these market variables the agent must have familiarized themselves with the issues that are impacting real estate. 2. Prepare Presentations that Help Educate Buyers and SellersKnowing current market trends is meaningless unless you can easily explain the effects they will have on the plans of your buyer or seller. We must take the time to prepare powerful, conversation provoking presentations so the consumer can make good, informed decisions for themselves and their families.In a recent article in RisMedia, Patty McNease is the Director of Marketing for Homes.com explained: “On your slides, keep text to a minimum and let the graphics tell the story but pause to verbally expand on your message and allow time for questions.” Following these two basic rules will help you become the sought after real estate expert in your marketplace.  |

Harvard: Homeownership Still the American Dream

September 4, 2013

| Harvard: Homeownership Still the American Dream Posted: 04 Sep 2013 04:00 AM PDT  A big question facing the real estate industry over the last few years is how the housing crisis would impact the public’s belief in homeownership as a major component of the American Dream. Many felt the tragedy experienced by so many families would force them to reconsider their desire to ever be a homeowner again. A big question facing the real estate industry over the last few years is how the housing crisis would impact the public’s belief in homeownership as a major component of the American Dream. Many felt the tragedy experienced by so many families would force them to reconsider their desire to ever be a homeowner again.A recent study by the Joint Center for Housing Studies at Harvard University addressed this question. Their paper, Reexamining the Social Benefits of Homeownership after the Housing Crisis, revealed some interesting findings: Homeownership Still Preferred Over Renting“Even after the dramatic loss of equity and the high foreclosure rates, the early evidence suggests that people seem to believe that, over the long run, owning is still preferable to renting…The long term cultural preference for owning seems to have weathered the recent housing crisis.”Americans Still Expect to be Homeowners“The research on home-buying expectations supports the conclusion that very large percentages of Americans still expect to buy a home at some time in the future.”Younger Americans More Desirous of Homeownership“Moreover, the finding that younger renters and owners are more likely than their older counterparts to expect to own bodes well for the future of the housing market.”Even after one of the most difficult decades in this country’s real estate history, the belief that homeownership is a part of the American Dream still lives on. |

Should I Wait for Interest Rates to Come Back Down?

September 3, 2013

| Should I Wait for Interest Rates to Come Back Down? Posted: 03 Sep 2013 04:00 AM PDT  Above is a graph of the movement of the 30 year fixed mortgage rate since the beginning of 2012. Above is a graph of the movement of the 30 year fixed mortgage rate since the beginning of 2012.Some buyers are waiting to see if interest rates will come back down before making a decision about buying a home. Though no one can guarantee where rates will be in a few months, we don’t believe waiting is a good strategy. Most experts believe rates may actually move higher. The Mortgage Bankers Association, Fannie Mae, Freddie Mac and the National Association of Realtors are in unison projecting that rates will continue to climb. With home prices increasing and interest rates projected to also increase, the cost of buying a house could quickly increase rather dramatically.  |

© All Rights Reserved