Phil's Blog

The Growth of Latino-Owned Farms in the U.S.A

July 31, 2014

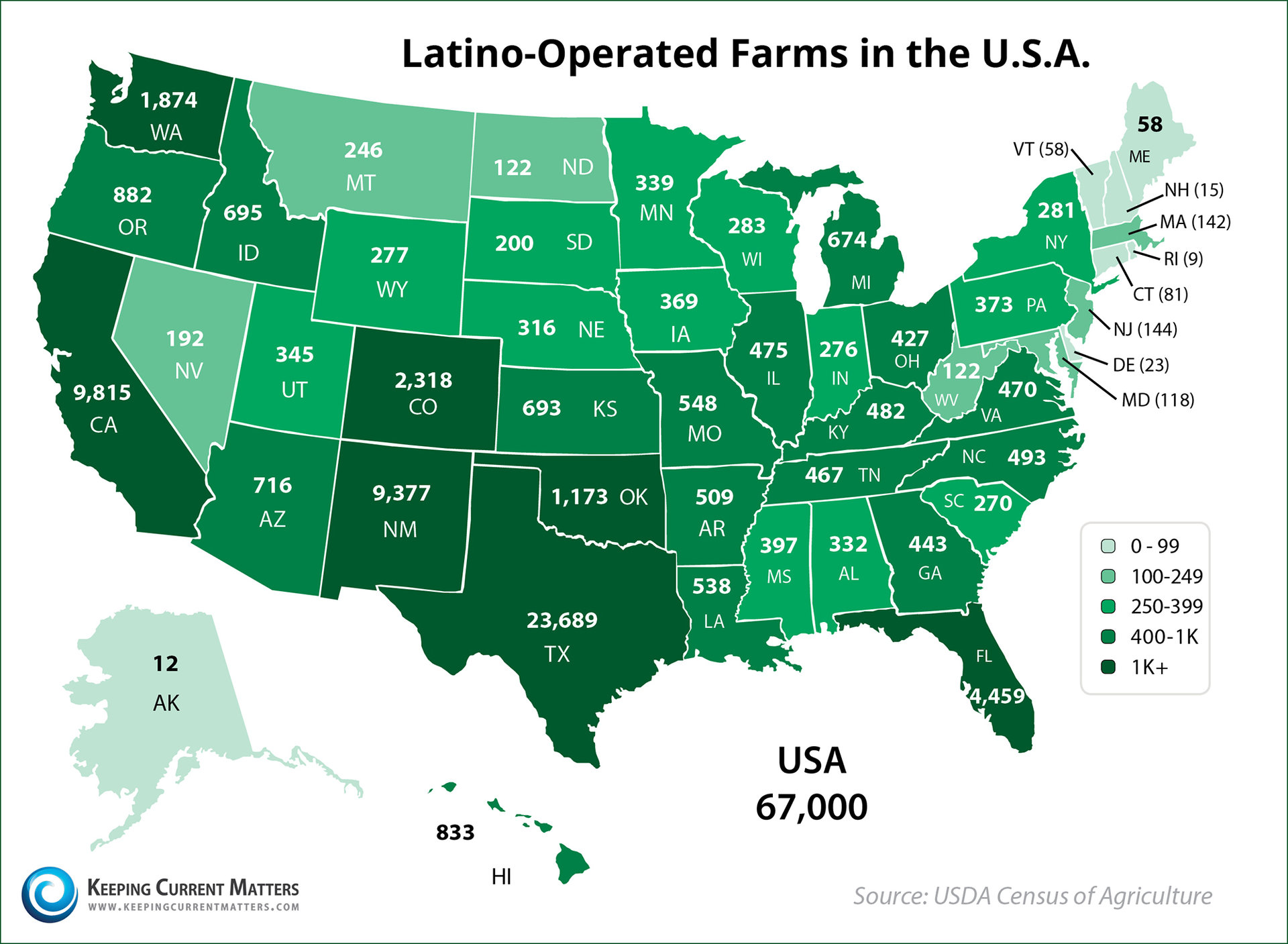

| The Growth of Latino-Owned Farms in the U.S.A Posted: 31 Jul 2014 04:00 AM PDT  Today we are pleased to have the VP of Spanish KCM, Jeymy Gonzalez, as our guest blogger. Jeymy has personal experience with the challenges Hispanics may face during the real estate process and works to assist this community with guidance and education. Enjoy! - The KCM Crew A recent Fox News Latino article talks about the healthy growth of Latino-Owned farms. According with the Census of Agriculture “there has been a 21 percent increase in ownership in the last 5 years.” Most of those farms are small or mid-sized with greatest concentrations living in Texas, New Mexico and California. "The Latino-owned farms have become key providers of certain produce." The article mentioned for example; Latinos own two-thirds of the strawberry farms in California. This increase is the result of the work of Organizations like Rural Coalition that represents small farmers and producers in the U.S. and Mexico, the recruitment efforts to bring in minority and women farmers by the USDA, and large economic forces, as NAFTA, who led new farm owners to work their way up from being laborers. There is a great opportunity for real estate professionals who focus their business on farms and ranches. The USDA Census of agriculture published a table with the Farms with Hispanic/Latino Principal operator and The KCM Crew put it together on this map for you!

You can help these Latino operators become farm owners & fulfill the American Dream! |

Buying a Home? You Don’t Need to Do It Alone

July 30, 2014

| Buying a Home? You Don’t Need to Do It Alone Posted: 30 Jul 2014 04:00 AM PDT  Last week, Discover Home Loans released an interesting survey which revealed how prepared home buyers are for the actual mortgage process. The survey reported that 94 percent of prospective buyers believe they are making a good investment decision if they buy a home. The survey also explained that 66 percent of buyers reach out to real estate agents to help determine whether buying a certain home would be a good investment. However, there is less certainty regarding the mortgage process. Most buyers overwhelmedThe majority of potential buyers are actually overwhelmed with the plethora of information available about the home financing process. Here are some interesting highlights from the report:

There is help available…use it!Cameron Findlay, chief economist at Discover Home Loans, gives great advice:“The industry is becoming more transparent in an effort to help homebuyers become informed about changes that may affect their process. The sheer amount of information can lead to confusion and stress. Those looking to purchase should work closely with their lender and realtor to make sure they are comfortable with mortgage terms and understand the impact a loan will have on their finances.” Bottom LineThe purchasing of a home can put great pressure on a family. Reach out to the best mortgage and real estate professionals in your market for assistance throughout the process.________________________________________________________________  Agents: Start your 14-day free trial to see how KCM enables you to simply & effectively explain a complex housing market to families who are ready to buy. Agents: Start your 14-day free trial to see how KCM enables you to simply & effectively explain a complex housing market to families who are ready to buy. |

Buying a House? 4 Reasons to DO IT NOW

July 28, 2014

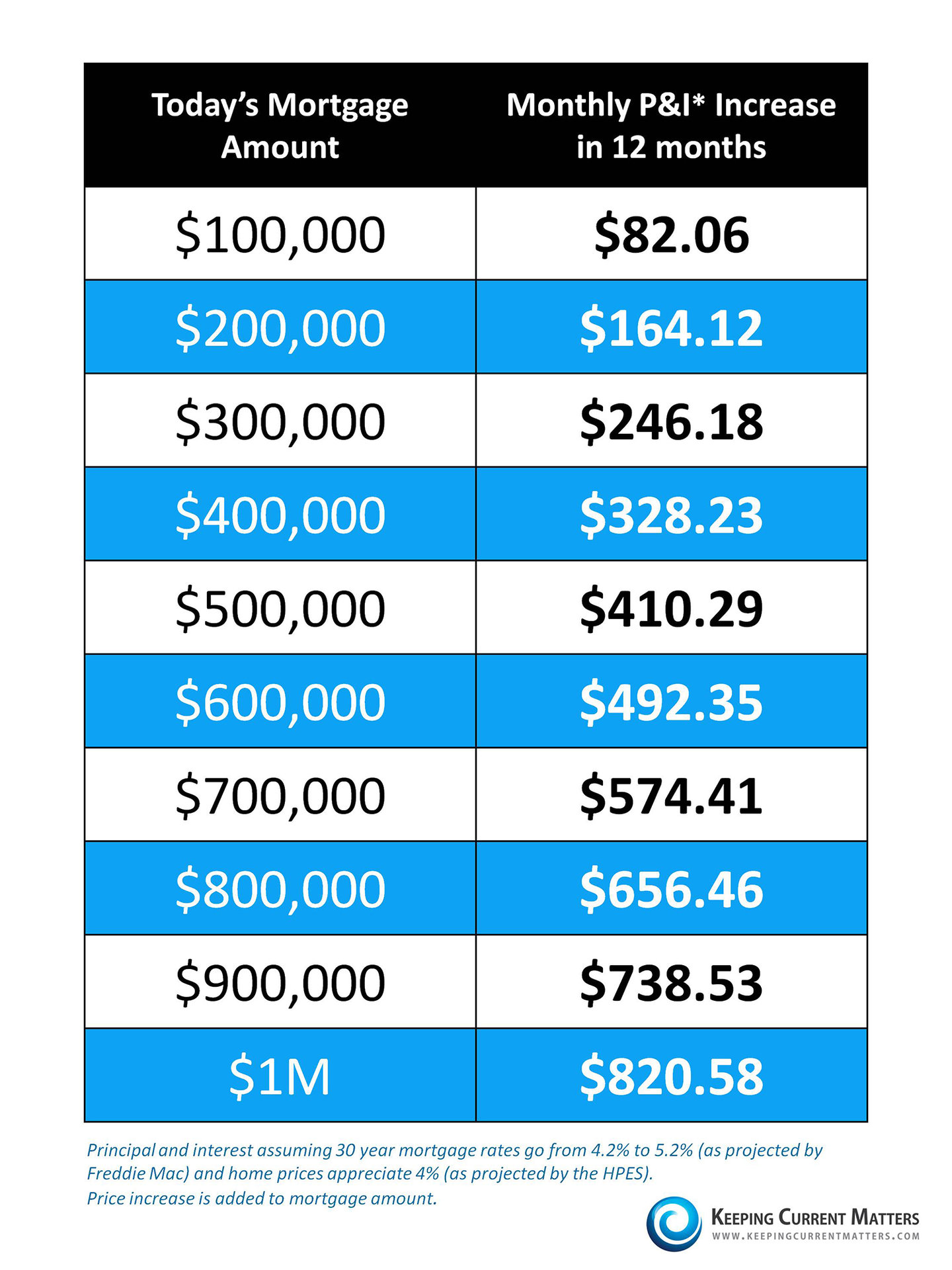

| Buying a House? 4 Reasons to DO IT NOW Posted: 28 Jul 2014 04:00 AM PDT  Here are four great reasons to consider buying a home today, instead of waiting. 1. Prices Will Continue to RiseThe Home Price Expectation Survey polls a distinguished panel of over 100 economists, investment strategists, and housing market analysts. Their most recent report projects appreciation in home values over the next five years to be between 30.8% (most optimistic) and 9.4% (most pessimistic).The bottom in home prices has come and gone. Home values will continue to appreciate for years. Waiting no longer makes sense. 2. Mortgage Interest Rates Are Projected to IncreaseAlthough the Primary Mortgage Market Survey shows that interest rates for a 30-year mortgage are currently around 4.2%, Freddie Mac is projecting that rates will increase to 5.2% by this time next year.An increase in rates will impact YOUR monthly mortgage payment. Your housing expense will be more a year from now if a mortgage is necessary to purchase your next home. 3. Either Way, You are Paying a MortgageAs a research paper from the Joint Center for Housing Studies at Harvard University explains:“Households must consume housing whether they own or rent. Not even accounting for more favorable tax treatment of owning, homeowners pay debt service to pay down their own principal while households that rent pay down the principal of a landlord plus a rate of return. That’s yet another reason owning often does—as Americans intuit—end up making more financial sense than renting.” 4. It’s Time to Move On with Your LifeThe ‘cost’ of a home is determined by two major components: the price of the home and the current mortgage rate. It appears that both are on the rise.But, what if they weren’t? Would you wait? Look at the actual reason you are buying and decide whether it is worth waiting. Whether you want to have a great place for your children to grow up, you want your family to be safer, or you just want to have control over renovations, maybe it is time to buy. If the right thing for you and your family is to purchase a home this year, buying sooner rather than later could lead to substantial savings. _______________________________________________________________  ATTENTION: If you are a real estate agent looking for more information to simply and effectively explain to your buyers why now is a great time to purchase, sign up for a Free 14 Day Trial of KCM and download the Summer Edition of our 11-page eGuide, Things to Consider When Buying A Home. ATTENTION: If you are a real estate agent looking for more information to simply and effectively explain to your buyers why now is a great time to purchase, sign up for a Free 14 Day Trial of KCM and download the Summer Edition of our 11-page eGuide, Things to Consider When Buying A Home. |

NAR's June Existing Home Sales Report [INFOGRAPHIC]

July 25, 2014

| NAR's June Existing Home Sales Report [INFOGRAPHIC] Posted: 25 Jul 2014 04:00 AM PDT ![NAR's June Existing Home Sales Report [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2014/07/Slide22.jpg) |

What is holding back the Real Estate Market?

July 24, 2014

| What is holding back the Real Estate Market? Posted: 24 Jul 2014 04:00 AM PDT  Though the housing market is recovering nicely, it is not doing quite as well as some analysts had predicted. There has been no shortage of excuses offered as to why this is: the rise in interest rates, more stringent lending standards, the weather. However, we feel that there is one factor that is most responsible for curtailing the number of houses sold – the number of houses available for sale! Inventory Levels are BELOW Historic NormsIn a recent economic forecast, Freddie Mac addressed this exact issue:“Including newly built homes in the inventory count, the total number of homes offered for sale relative to the number of households in the U.S. has been running at the lowest level in more than 30 years, as shown in the second exhibit. The relatively low for-sale inventory reflects several features of today’s market.” “A supply-constrained market (holding other factors constant) will result in a decline in the volume of sales and an increase in real transaction prices.” NAR Report Confirms Inventory ConstrictionHistory shows us that a balanced real estate market requires a six month supply of available housing inventory. The National Association of Realtors released their Existing Homes Sales Report earlier this week. The report revealed that we are still only at a 5.5 month supply of homes for sale. We have not reached the 6 month mark in over two years.The recent increase in buyers now looking will again put a strain on this number. That is why today at 2PM EST, we are hosting a special webinar for real estate professionals; The 4 Keys to Prospecting for Listings that Sell. Agents can reserve their seat here. Bottom LineWhile inventory levels remain below historic norms, it will remain a seller’s market. This being the case, if you are considering selling your home, now may be the time to list it for sale. |

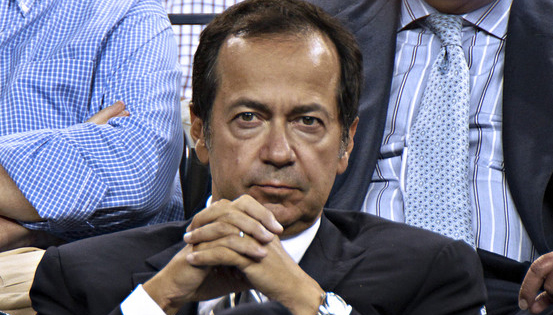

Billionaire says Real Estate is Best Investment Possible

July 23, 2014

| Billionaire says Real Estate is Best Investment Possible Posted: 23 Jul 2014 04:00 AM PDT  Billionaire money manager John Paulson was interviewed last week at the Delivering Alpha Conference presented by CNBC and Institutional Investor. He boldly stated: "I still think, from an individual perspective, the best deal investment you can make is to buy a primary residence that you're the owner-occupier of.” Who is John Paulson?Paulson is the person who, back in 2005 & 2006, made a fortune betting that the subprime mortgage mess would cause the real estate market to collapse. He understands how the housing market works and knows when to buy and when to sell. What do others think of Paulson?According to Forbes, John Paulson is: “A multibillionaire hedge fund operator and the investment genius.” According to the Wall Street Journal, Paulson is: “A hedge fund tycoon who made his name, and a fortune, betting against subprime mortgages when no one else even knew what they were.” Why does he believe homeownership is such a great investment?Paulson breaks down the math of homeownership as an investment:"Today financing costs are extraordinarily low. You can get a 30-year mortgage somewhere around 4.5 percent. And if you put down, let's say, 10 percent and the house is up 5 percent, which is the latest data, then you would be up 50 percent on your investment." How many are seeing a 50% return on a cash investment right now? Paulson goes on to compare the long term financial benefits of owning verses renting: “And you’ve locked in the cost over the next 30 years. And today the cost of owning is somewhat less than the cost of renting. And if you rent, the rent goes up every year. But if you buy a 30-year mortgage, the cost is fixed.” Bottom LineWhenever a billionaire gives investment advice, people usually clamor to hear it. This billionaire gave simple advice – if you don’t yet live in your own home, go buy one.____________________________________________________________________  Agents: Do you have clients who are on the fence about homeownership? How can you help them feel confident about their decision to purchase a home now? Agents: Do you have clients who are on the fence about homeownership? How can you help them feel confident about their decision to purchase a home now?Start your 14-day free trial of KCM and allow us to help you simply & effectively explain today's complex housing market. |

The Cost of Waiting a Year [INFOGRAPHIC]

July 18, 2014

| The Cost of Waiting a Year [INFOGRAPHIC] Posted: 18 Jul 2014 04:00 AM PDT  Freddie Mac: http://www.freddiemac.com/finance/pdf/June_2014_public_outlook.pdf Home Price Expectation Survey: https://pulsenomics.com/Q2_2014_HPE_Survey.php |

Home Mortgage Rates: Where are They Headed?

July 15, 2014

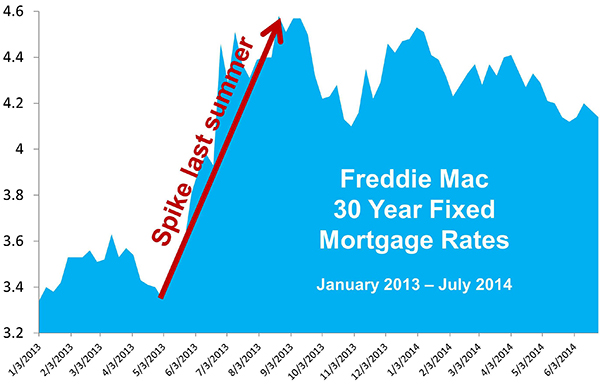

| Home Mortgage Rates: Where are They Headed? Posted: 15 Jul 2014 04:00 AM PDT  Many of our readers ask us where interest rates are headed over the next several months. While no one has a crystal ball, we did want to share what some experts are saying on the subject. HSH.com“For now, and likely through the summer, we may see data-driven bumps and dips in rates. Although we managed a slight dip presently, a bump is in order before long.”Freddie Mac“In the next few months, mortgage rates are likely to remain at their current, low level, but will not remain there for long. As the Federal Reserve is expected to ‘taper’ its purchases of long-term Treasuries and mortgage-backed securities, and as economic growth picks up, long-term yields will gradually rise. Fixed-rate mortgages are expected to be higher in six months, and may even approach 5 percent a year from now.”National Association of Realtors“Mortgage rates could move suddenly higher in anticipation of rate increases, much as they did last summer when refinance and transaction activity was high. Steady purchase transaction volume and lower refinance volume could mean that mortgages rates may adjust in a more gradual fashion. In either case, as the economy improves—and today’s data clearly suggests it is improving—the overall trend for mortgage rates is up, not down.”Fannie MaeProjects the 30 year fixed mortgage rate to be 4.3% by the end of the year.Mortgage Bankers AssociationProjects the 30 year fixed mortgage rate to be 4.7% by the end of the year._____________________________________________________________________  Members: Do you have the powerful visuals you need to share this information with your clients? Download the Summer Buyer & Seller Guides today to show your clients where interest rates & home prices are projected to go in the near future. Members: Do you have the powerful visuals you need to share this information with your clients? Download the Summer Buyer & Seller Guides today to show your clients where interest rates & home prices are projected to go in the near future.Not a Member Yet? Start your 14-day free trial today to download the guides! |

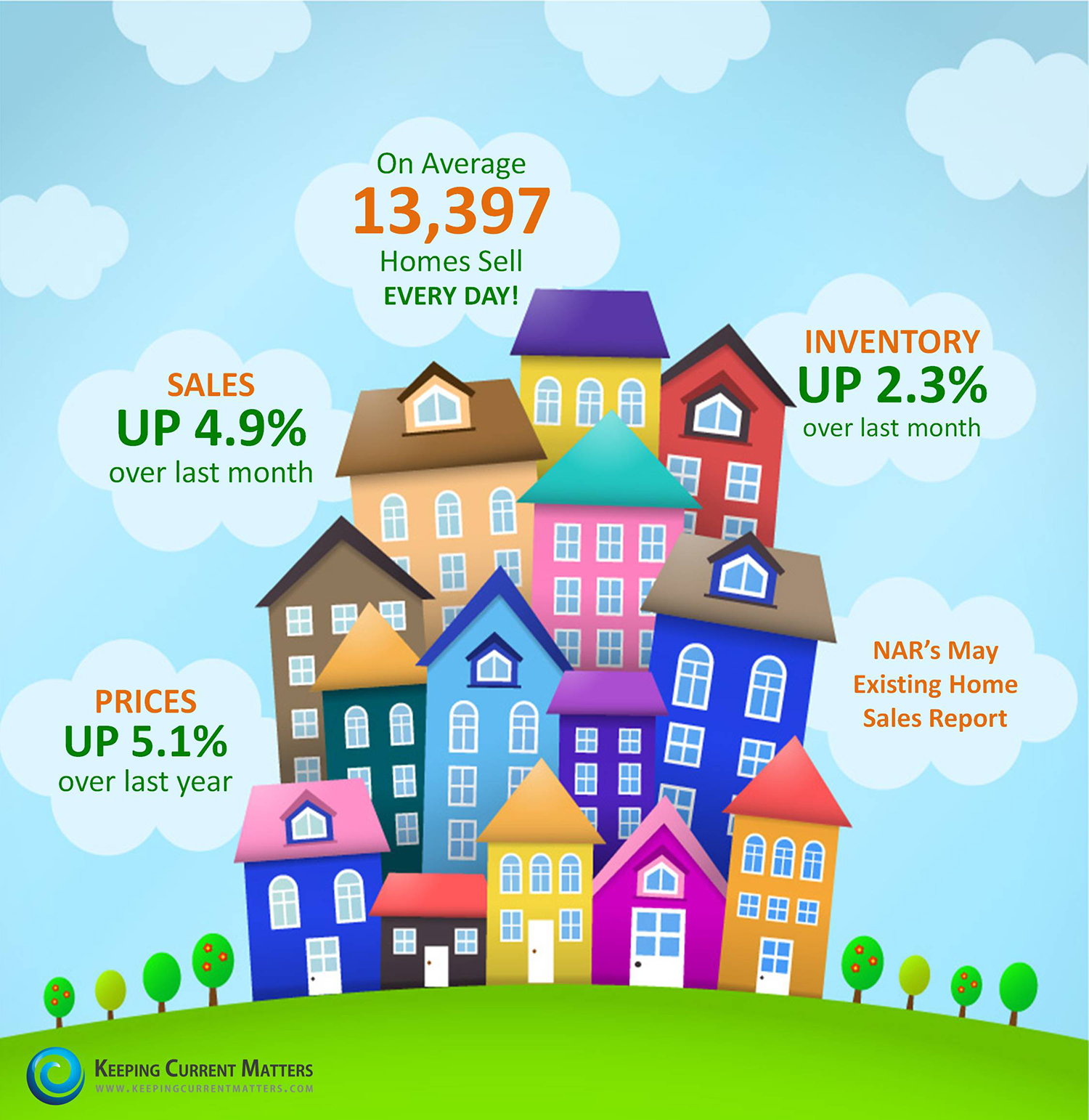

NAR's Existing Home Sales Report [INFOGRAPHIC]

July 11, 2014

| NAR's Existing Home Sales Report [INFOGRAPHIC] Posted: 11 Jul 2014 04:00 AM PDT  |

When Character is More Valuable than Competence

July 10, 2014

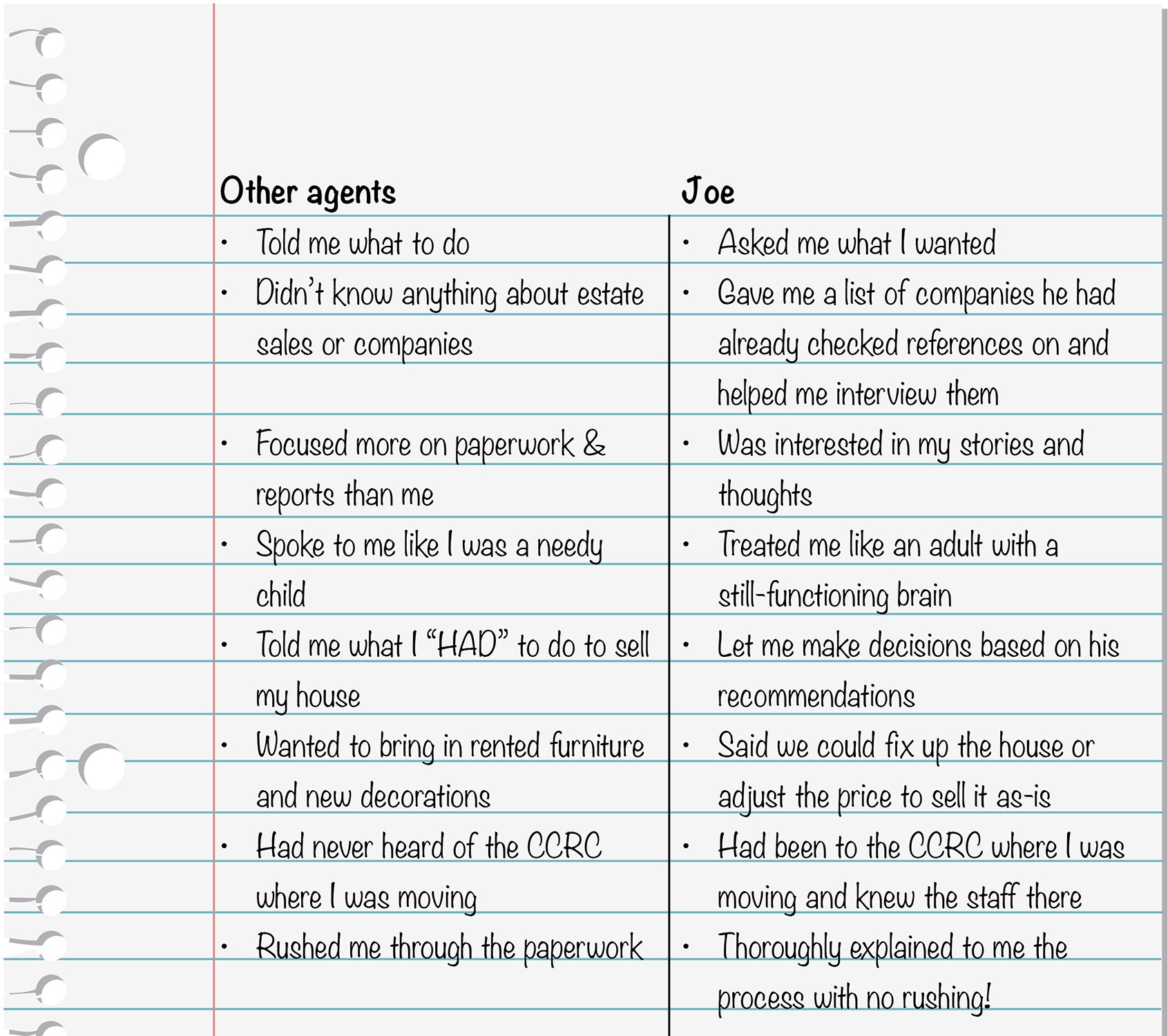

| When Character is More Valuable than Competence Posted: 10 Jul 2014 04:00 AM PDT

Today we are pleased to have Nikki Buckelew back as our guest blogger. Nikki is considered a leading authority on seniors real estate and housing. Enjoy! - The KCM CrewIt was her 80th birthday and as Sue's family gathered around in celebration, she announced a major decision. After years of toying with the idea, she had come to the conclusion that now - yes, now - was the proper time for her to move into a continuing care retirement community (CCRC).Although they were a bit surprised, Sue's two adult children (both seniors themselves) nodded to each other and expressed relief that their mother would have access to the support and care she needed. Both admitted to a bit of worry about her living alone since their dad died, especially as they both traveled extensively and were not available to see her or care for her on a regular basis. But, of course, they all realized that such a move would require a massive commitment of time and energy, with the first necessary step being to find a good real estate agent to help sell the longtime family home. Sue mentioned that she was acquainted with an agent she had met at church and who regularly sent her mailings. The agent seemed quite nice and professional, had won numerous awards, was active in the community, and owned a variety of impressive-looking credentials. You know, she had a whole bunch of letters and acronyms at the end of her name. Sue and her children arranged for a meeting with the agent, and while she was clearly competent and well-educated in her field, Sue just couldn't get past a nagging feeling that something was amiss. The agent was nice enough, but throughout Sue's entire life, she had tended to gravitate toward doing business only with those to whom she felt some sort of connection. Perhaps it was something she had learned from her father, a man who valued relationships in business dealings as much or more than mere competence. Not only did she want help, but she also wanted to feel a special sort of bond and trust. The practice had served her well throughout life and now - with such an important transaction - she wasn't about to change her approach. Sue scanned the yellow pages, spoke on the phone with a few agents, and even met with another over coffee, but still she couldn't find the sensation of trust and comfort she desired. She even did a couple of quick internet searches leaving her feeling confused and frustrated. It occurred to Sue's daughter that perhaps the CCRC that was to be Sue's new home would be able to provide a recommendation for a good agent. Indeed, they did, and that's when she met Joe. Joe was differentHe arrived at her home and immediately the two hit it off. Sue hired Joe to list and sell her house and as he began to take his leave, Sue touched him gently on the arm and said "Thank you, Joe. You are different than other agents I've met with," she smiled. "I don't know exactly what it is, but I feel I can truly trust you to help me make this move."Sue's home sold quickly, and with Joe's help, she arranged for an estate liquidator to sell the belongings she no longer needed. He also arranged for a moving company to pack and transport what was needed to Sue's new apartment at the retirement community, and made sure she was content in her new home. A few days later, Sue's children visited their mother, breathed a sigh of relief that everything seemed under control, that a large project was complete and that - most importantly - Mom was happy, healthy, and safe. Her daughter (who admittedly had been a bit annoyed at Sue's "pickiness" in choosing an agent) smiled and remarked that Sue had made a fine decision in choosing Joe to spearhead the sale and move. "But Mom," Sue's son asked. "How did you make your decision? Why did you choose him?" Sue dug into her purse and drew out the list of notes she had made while interviewing Joe:  As her daughters looked at the list, Sue remarked "I felt 'OK' with the other agents. They were undoubtedly good at their jobs. But I wanted someone who was good for ME too." And thus ends the happy story of Sue, a senior whose outlook on doing business mirrors that of most of her generation, nearly all of whom value a firm handshake and "good vibes" as much as they do hard numbers and competency. Bottom LineAs real estate professionals serving seniors, it's important that we understand that what makes for a great partnership, truly is in the eyes of our clients. |

Is Residential Real Estate Really a ‘Crapshoot’?

July 9, 2014

| Is Residential Real Estate Really a ‘Crapshoot’? Posted: 09 Jul 2014 04:00 AM PDT  Our founder, Steve Harney, occasionally asks to do a personal post on what he sees as important to our industry. Today is one of those days. Enjoy! – The KCM Crew That is what a headline announced in a CNNMoney post Monday. They were quoting Karl Case “an economist whose name is synonymous with home prices. He is co-creator of the much watched S&P/Case-Shiller home price indexes with Bob Shiller, who won the Nobel Prize in economics last year.” Case did explain that the commonly held belief that housing prices could ‘never’ depreciate was corrected over the last decade. And it is true that Case referenced a home he bought during that time had lost almost half its value. However, there were other comments attributed to Case in the article:

Give me the dice and get out of my way.Last week, John Maxfield, in a The Motley Fool blog post, wrote:“Over the past year, [home prices] are up by 8.9%. Over the past two years, they're up by 19.7%. Over the past three years, they're up by 23%. And there's little evidence that this trend is coming to an end anytime soon… [It] should be obvious why now is such an opportunistic time to buy a house. Of course, if you want to wait, that's up to you. But doing so could very well be a source of regret later on down the road.” Give me the dice and get out of my way.If buying residential real estate is actually a crapshoot (as the headline claimed), it seems the odds are in the shooter’s hand.PLEASE give me the dice and get out of my way. I really want to roll. |

Thinking of Selling? New Construction Will Soon Be New Competition

July 8, 2014

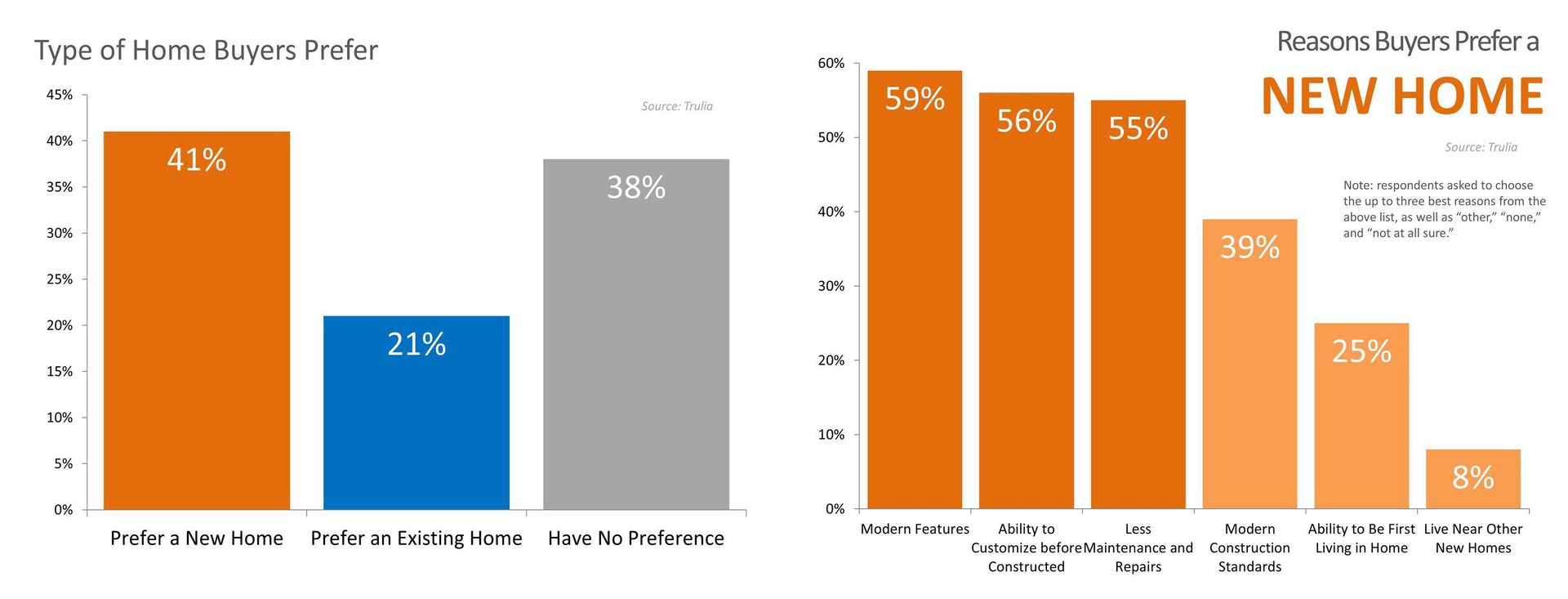

| Thinking of Selling? New Construction Will Soon Be New Competition Posted: 08 Jul 2014 04:00 AM PDT  For the last several years, home sellers had to compete with huge inventories of distressed properties (foreclosures and short sales). The great news is that the supply of these properties is falling like a rock in the vast majority of housing markets. Many homeowners are now thinking of selling as the impact of this substantially discounted competition has disappeared. However, every seller of an existing residential property must realize that there is a new form of competition about to hit the market: newly constructed homes. As the economy improves, builders will again be bringing their housing developments to the market. Trulia recently reported that the purchaser, given a choice, actually prefers new construction. Here are two charts showing the results of the Trulia survey:

Bottom LineIf you are thinking of selling, perhaps you should do it now to avoid the additional competition that will come to the market later this year. |

"Moving Up: Was it Worth Waiting?" and more

July 7, 2014

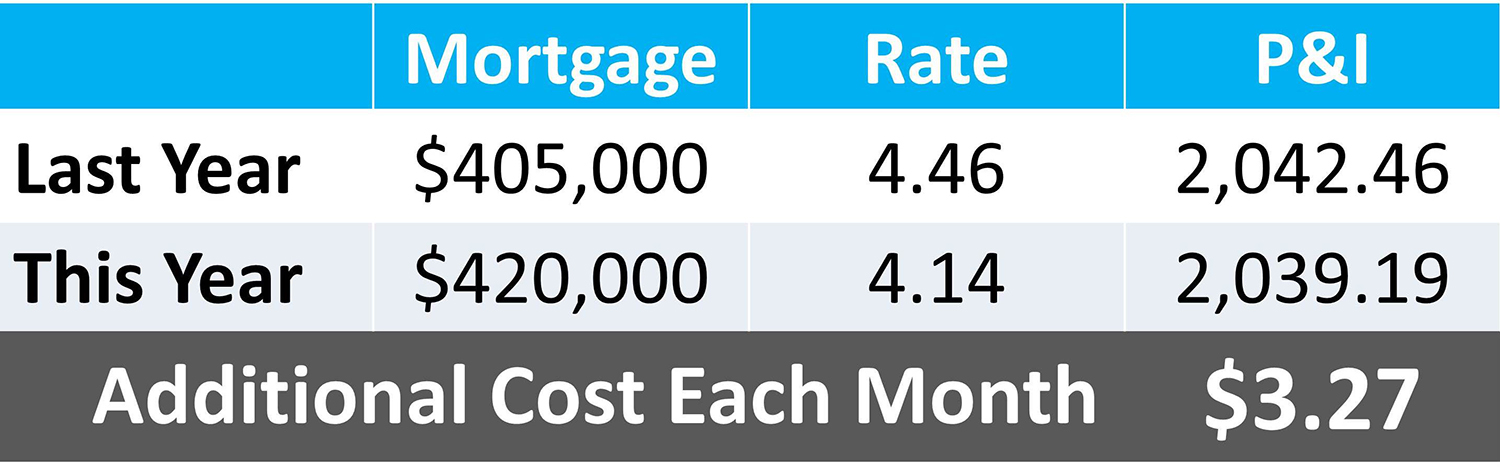

| Moving Up: Was it Worth Waiting? Posted: 07 Jul 2014 04:00 AM PDT  New reports are revealing that the number of months’ inventory of existing homes available for sale is increasing. Some of these sellers are moving up, some are downsizing and others are making a lateral move. There is no way for us to predict the future but we can look at what happened over the last year. Let’s look at buyers that considered moving up last year but decided to wait instead. Assume, last year, they had a home worth $300,000 and were looking at a home for $450,000 (putting 10% down they would get a mortgage of $405,000). By waiting, their house appreciated by approximately 10% over the last year (national average based on the Case Shiller Pricing Index). Their home would now be worth $330,000. But, the $450,000 home would now be worth $495,000 (requiring a mortgage of $420,000 assuming the original $45,000 down plus the additional $30,000 from the sale of their home). Here is a table showing what the difference in monthly cost (principal and interest) would be if a purchaser had waited:  3 dollars and 27 cents. Was it worth waiting a year to move up to the home of your dreams? Only you can answer that question. Moving Up?If your family plans on moving up in the next twelve months, it may make sense to move now rather than later. Prices are definitely still appreciating and, unlike the last year, interest rates are also projected to increase. Agents: Do you have the visuals you need to be able to properly explain the cost of waiting to your clients? Start your 14-day free trial of the KCM Membership today to access the most recent Market Reports. Agents: Do you have the visuals you need to be able to properly explain the cost of waiting to your clients? Start your 14-day free trial of the KCM Membership today to access the most recent Market Reports. |

Buying a Home? Know ALL Your Options

July 2, 2014

| Buying a Home? Know ALL Your Options Posted: 02 Jul 2014 04:00 AM PDT  In a post earlier this week, we suggested that the Millennial generation’s struggles with student debt and the overarching concept of homeownership are not the reasons for so many first time buyers hesitating to move forward with the purchase of their first home. Now there is another firm suggesting the same. The asset management company, Nomura, came out with strong guidance to their investors. According to an article in Housing Wire last week: “Nomura’s note to clients has a take few have offered: The first time homebuyers are holding out and it’s not student debt, a shift away from homeownership as a choice by Millennials, or any of that.” Instead, they think it is a lack of a full understanding of the mortgage process. The article explains: “Analysts say it’s not that Millennials and other potential homebuyers aren’t qualified in terms of their credit scores or in how much they have saved for their down payment. It’s that they think they’re not qualified or they think that they don’t have a big enough down payment.” (emphasis added) This comes off the heels of a survey by Zelman & Associates that revealed that 38% of those between the ages of 25-29 years old and 42% of those between the ages of 30-34 years old believe that a minimum of 15% is required as a down payment to purchase a home. In actually, a purchaser may be able to put down far less. The Reality of the SituationAccording to Christina Boyle, Freddie Mac’s VP and Head of Single-Family Sales & Relationship Management, in a recent Executive Perspectives piece:

“Letting more consumers know how down payments are determined could bring more qualified borrowers off the sidelines. Depending on their credit history and other factors, many borrowers can expect to make a down payment of about 5 or 10 percent.” Bottom LineIf you have considered purchasing a house or moving-up to a new dream home, know all of your options. Reach out to a real estate and/or mortgage professional in your marketplace to get the best, most up-to-date information available. You may be surprised to learn what you and your family are capable of achieving.Agents: Would powerful visuals showing the opportunities available to buyers (first-time & move-up) help your business? Start your free 14-day trial of Keeping Current Matters today! |

Buying a Home: The Cost of Waiting

July 1, 2014

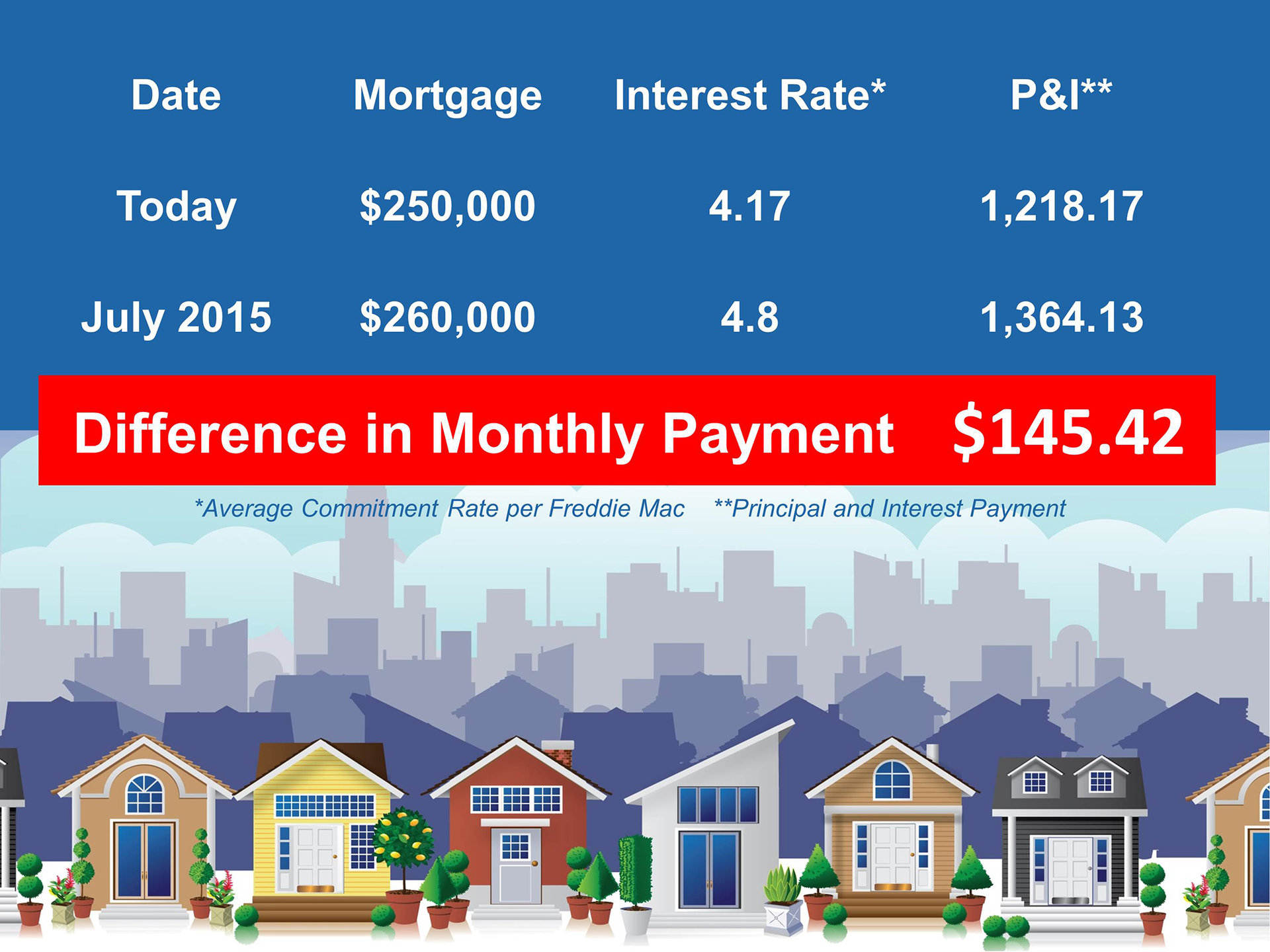

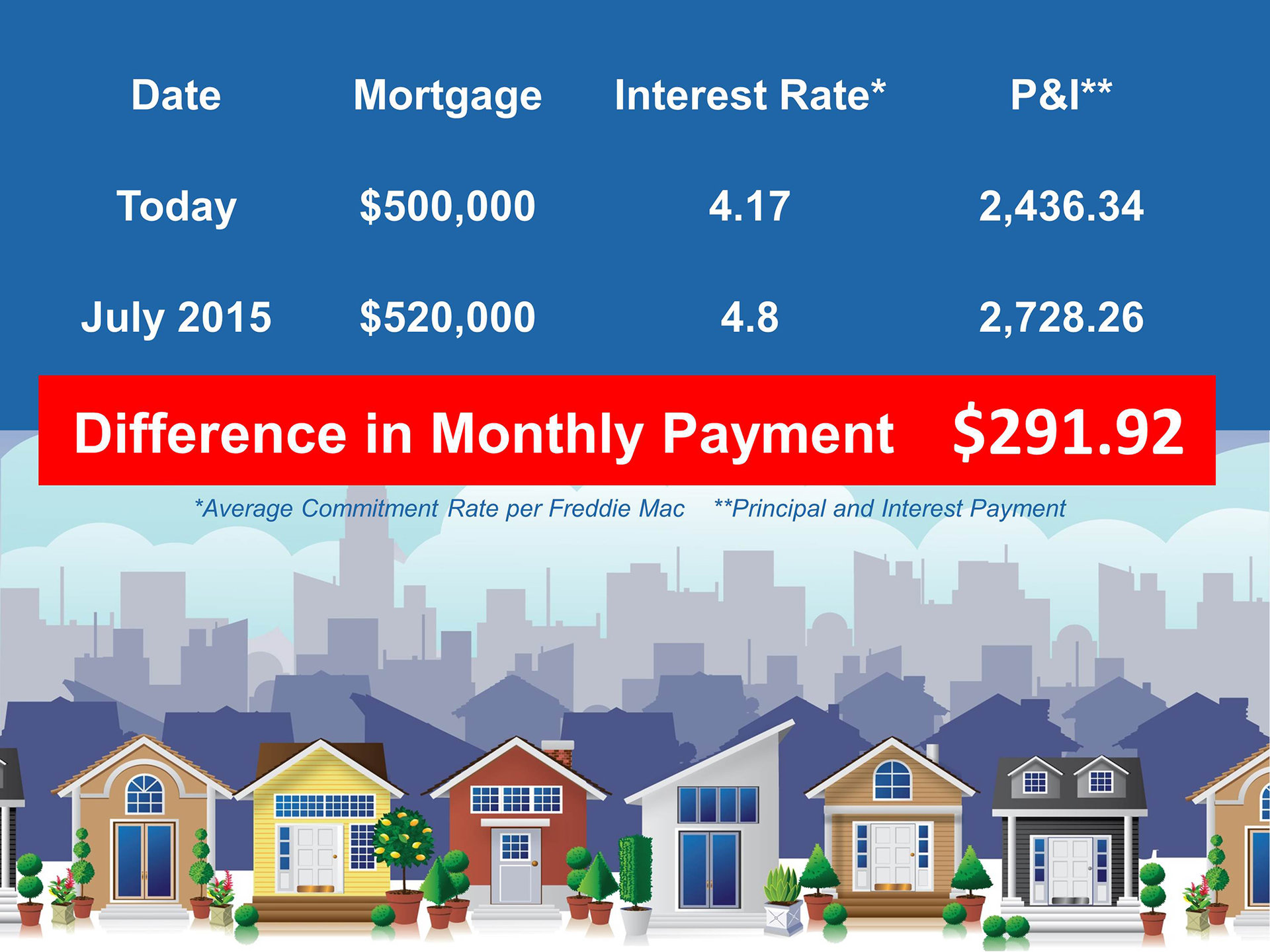

| Buying a Home: The Cost of Waiting Posted: 01 Jul 2014 04:00 AM PDT  Whether you are a first time buyer or a move-up buyer, you should look at the projections housing experts are making in two major areas: home prices and mortgage rates. PRICESOver 100 economists, real estate experts and investment & market strategists were recently surveyed. They were asked to project where home prices were headed. The average value appreciation projected over the next twelve month period was approximately 4%.MORTGAGE INTEREST RATESIn their last Economic & Housing Market Outlook, Freddie Mac predicted that 30 year fixed mortgage rates would be 4.8% by this time next year. As of last week, the Freddie Mac rate was 4.14%.What does this mean to you?If you are a first time buyer currently looking at a home priced at $250,000, this is what it could cost you on a monthly basis if you wait to buy next year: If you are a move-up buyer currently looking at a home priced at $500,000, this is what it could cost you on a monthly basis if you wait to buy next year:

Bottom LineWith both home prices and interest rates projected to increase, buying now instead of later might make sense.__________________________________________________________________  ATTENTION: If you are a real estate agent looking for more information to share with your buyers as to why now is a great time to purchase, sign up for a Free 14 Day Trial of KCM and download the Summer Edition of our 11-page eGuide,Things to Consider When Buying A Home. ATTENTION: If you are a real estate agent looking for more information to share with your buyers as to why now is a great time to purchase, sign up for a Free 14 Day Trial of KCM and download the Summer Edition of our 11-page eGuide,Things to Consider When Buying A Home. |

© All Rights Reserved