Phil's Blog

Millennials and Student Debt: We Knew They Were Wrong!

June 30, 2014

| Millennials and Student Debt: We Knew They Were Wrong! Posted: 30 Jun 2014 04:00 AM PDT  For almost a year now, we have been trying to debunk the myth that student debt is keeping the vast majority of Millennials from purchasing a home. We explained that Millennials have purchased more homes over a recent twelve month period than any other generation as was reported by the National Association of Realtors). We explained that the homeownership rate of people currently between the ages of 25-29 is 34.3%. That is higher than the 33.6% rate members of the previous generation (people currently between the ages of 45-49) achieved when they were that age (as per John Burns Consulting). We explained that a recent survey showed that almost three out of every four (74%) young adults between the ages of 18-34 plan to buy a home in the next five years with 32% planning to do it in the next twelve months. However, no matter how hard we tried, the same recourse was trumpeted back at us – What about student debt? The good news is that the real facts about student debt are coming to light. Last week, The New York Times posted an article titled The Reality of Student Debt Is Different from the Clichés. This article went into great depth regarding the findings of a new study just released by the Brookings Institution, Is a Student Loan Crisis on the Horizon? which looked at data through 2010. The NYT article quoted key elements of the report:

The authors of the actual study put it simply in their conclusion: “Despite the widely held belief that circumstances for borrowers with student loan debt are growing worse over time, our findings reveal no evidence in support of this narrative. In fact, the average growth in lifetime income among households with student loan debt easily exceeds the average growth in debt, suggesting that, all else equal, households with debt today are in a better financial position than households with debt were two decades ago. Furthermore, the incidence of burdensome monthly payments does not appear to have become more widespread over the last two decades.” |

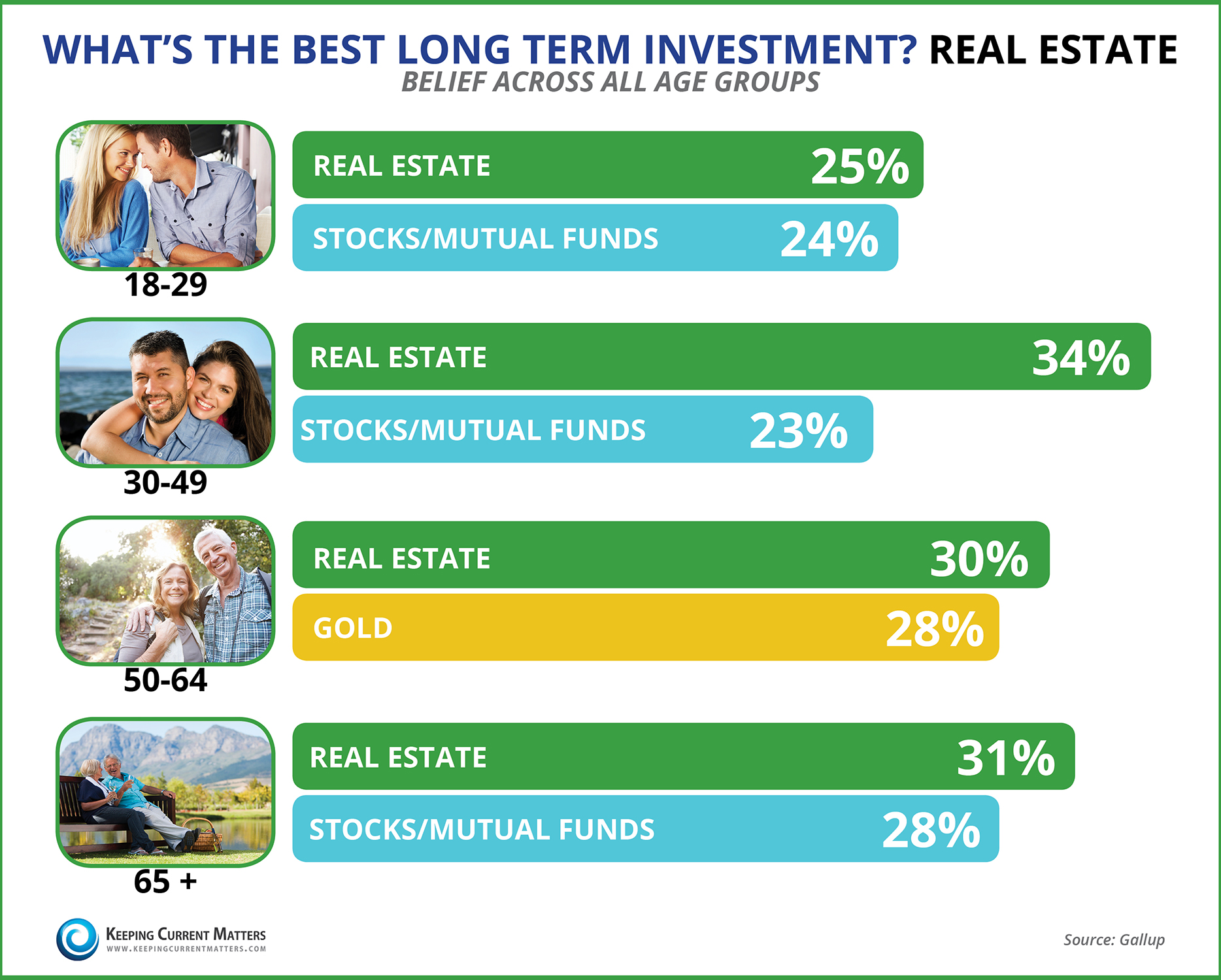

What is the Best Long Term Investment? Real Estate [INFOGRAPHIC]

June 27, 2014

| What is the Best Long Term Investment? Real Estate [INFOGRAPHIC] Posted: 27 Jun 2014 04:00 AM PDT  |

Celebrate National Homeownership Month: Reason #3 to Own

June 25, 2014

| Celebrate National Homeownership Month: Reason #3 to Own Posted: 25 Jun 2014 04:00 AM PDT  |

Celebrate National Homeownership Month: Reason #8 To Own

June 24, 2014

| Celebrate National Homeownership Month: Reason #8 To Own Posted: 24 Jun 2014 04:00 AM PDT  |

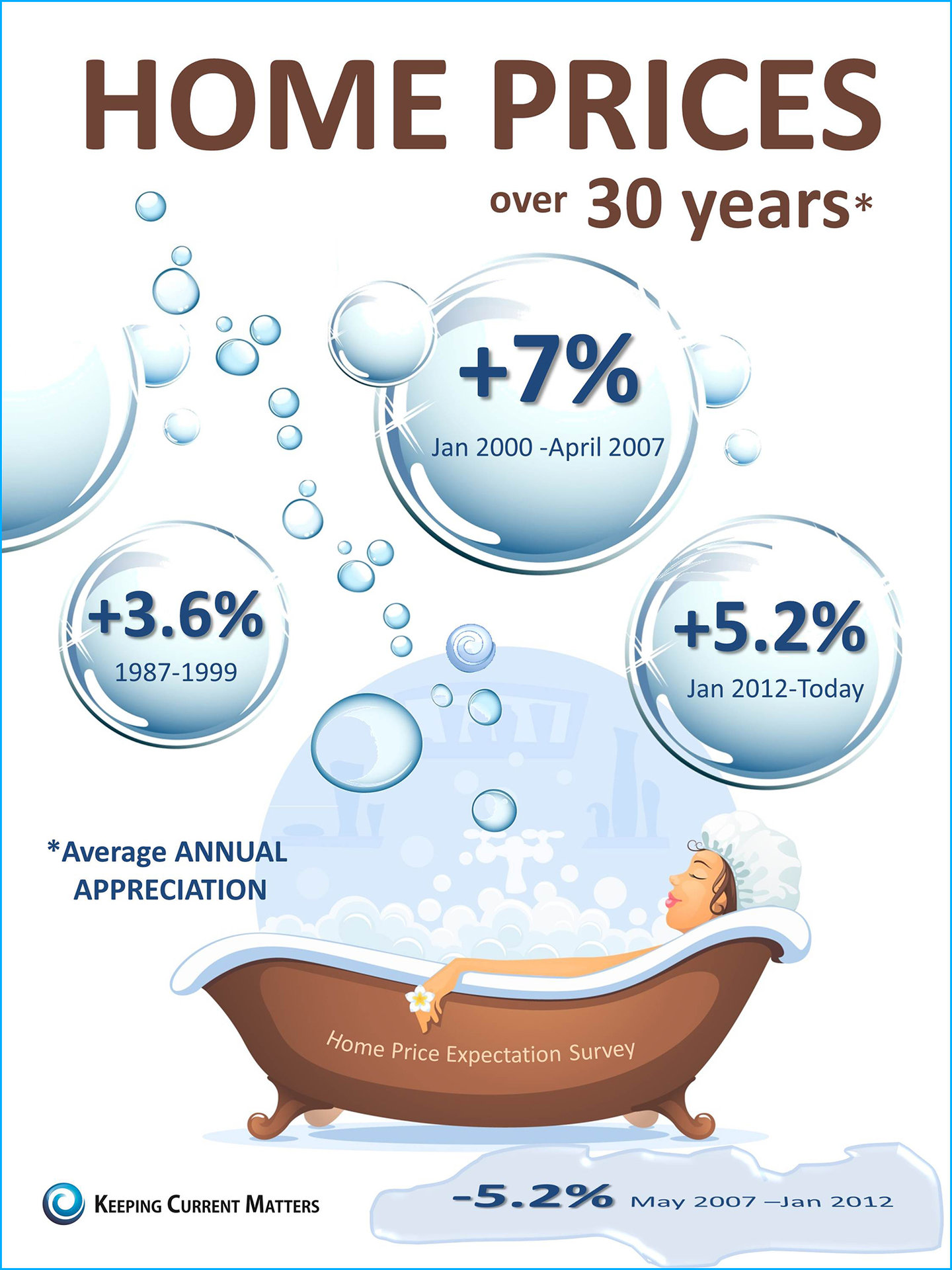

Home Prices over 30 Years [INFOGRAPHIC]

June 20, 2014

| Home Prices over 30 Years [INFOGRAPHIC] Posted: 20 Jun 2014 04:00 AM PDT  |

4 Demands to Make on Your Real Estate Agent

June 18, 2014

| 4 Demands to Make on Your Real Estate Agent Posted: 18 Jun 2014 04:00 AM PDT  Are you thinking of buying a home? Are you dreading having to walk through strangers’ houses? Are you concerned about getting the paperwork correct? Hiring a professional real estate agent can take away most of the challenges of buying. A great agent is always worth more than the commission they charge just like a great doctor or great accountant. You want to deal with one of the best agents in your marketplace. To do this, you must be able to distinguish the average agent from the great one. Here are the top 4 demands you need to make of your Real Estate Agent when buying a home: 1. Tell the truth about the priceToo many agents just take your offer at any price and then try to ‘work’ both the seller and you while negotiating later. Demand that the agent prove to you that they have a belief in the price you are offering. Make them show you their plan to get both the seller - and the bank - to accept that price. Every house in today’s market must be sold two times – first to you and then to your bank.The second sale may be more difficult than the first. The residential appraisal process has gotten tougher. A recent survey showed that there was a challenge with the appraisal on 24% of all residential real estate transactions. It has become more difficult to get the banks to agree on the contract price. A red flag should be raised if your agent is not discussing this with you at the time of the original offer. 2. Understand the timetable with which your family is dealingYou will be moving your family into a new home. Whether the move revolves around the start of a new school year or the start of a new job, you will be trying to put the move to a plan.This can be very emotionally draining. Demand from your agent an appreciation for the timetables you are setting. You agent cannot pick the exact date of your move, but they should exert any influence they can, to make it work. 3. Remove as many of the challenges as possibleIt is imperative that your agent knows how to handle the challenges that will arise. An agent’s ability to negotiate is critical in this market.Remember: If you have an agent who was weak negotiating with you on parts of the purchase offer, don’t expect them to turn into a super hero when they are negotiating with the seller for you and your family. 4. FIND the right house!There is a reason you are putting yourself and your family through the process of moving.You are moving on with your life in some way. The reason is important or you wouldn’t be dealing with the headaches and challenges that come along with purchasing. Do not allow your agent to forget these motivations. Constantly remind them that finding the right house is why you hired them. Make sure that they don’t worry about your feelings more than they worry about your family. If they discover something needs to be done to attain your goal (i.e. rethinking price), insist they have the courage to inform you. Good agents know how to deliver good news. Great agents know how to deliver tough news. In today’s market, YOU NEED A GREAT AGENT!______________________________________________________ ATTENTION: If you are a real estate agent looking for more information to share with your buyers as to why now is a great time to purchase, sign up for a Free 14 Day Trial of KCM and download our 10 page eGuide, Things to Consider When Buying A Home. ATTENTION: If you are a real estate agent looking for more information to share with your buyers as to why now is a great time to purchase, sign up for a Free 14 Day Trial of KCM and download our 10 page eGuide, Things to Consider When Buying A Home. |

Getting a Mortgage: Why SO MUCH Paperwork?

June 17, 2014

| Getting a Mortgage: Why SO MUCH Paperwork? Posted: 17 Jun 2014 04:00 AM PDT  We are often asked why there is so much paperwork mandated by the bank for a mortgage loan application when buying a home today. It seems that the bank needs to know everything about us and requires three separate sources to validate each and every entry on the application form. Many buyers are being told by friends and family that the process was a hundred times easier when they bought their home ten to twenty years ago. There are two very good reasons that the loan process is much more onerous on today’s buyer than perhaps any time in history.

The friends and family who bought homes ten or twenty ago experienced a simpler mortgage application process but also paid a higher interest rate (the average 30 year fixed rate mortgage was 8.12% in the 1990’s and 6.29% in the 2000’s). If you went to the bank and offered to pay 7% instead of <5%, they would probably bend over backwards to make the process much easier. Bottom LineInstead of concentrating on the additional paperwork required, let’s be thankful that we are able to buy a home at historically low rates.____________________________________________________ Agents: Do you have the visuals and insights you need to be able to present what's TRULY going on in the market to your clients? Start your 14-day free trial of KCM today to download the most recent Market Reports. |

5 Reasons to Sell Now!

June 16, 2014

| 5 Reasons to Sell Now! Posted: 16 Jun 2014 04:00 AM PDT  Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? Can buyers qualify for a mortgage? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are five of those reasons. 1. Demand is StrongThere is currently a pent-up demand of purchasers as many home buyers pushed off their search this past winter & early spring because of extreme weather. According to the National Association of Realtors (NAR), the number of buyers in the market, which feel off dramatically in December, January and February, has begun to increase again over the last few months. These buyers are ready, willing and able to buy…and are in the market right now!2. There Is Less Competition NowHousing supply is still under the historical number of 6 months’ supply. This means that, in many markets, there are not enough homes for sale to satisfy the number of buyers in that market. This is good news for home prices. However, additional inventory is about to come to market.There is a pent-up desire for many homeowners to move as they were unable to sell over the last few years because of a negative equity situation. Homeowners are now seeing a return to positive equity as prices increased over the last eighteen months. Many of these homes will be coming to the market in the near future. Also, new construction of single-family homes is again beginning to increase. A recent study by Harris Poll revealed that 41% of buyers would prefer to buy a new home while only 21% prefer an existing home (38% had no preference). The choices buyers have will continue to increase over the next few months. Don’t wait until all this other inventory of homes comes to market before you sell. 3. The Process Will Be QuickerOne of the biggest challenges of the 2014 housing market has been the length of time it takes from contract to closing. Banks are requiring more and more paperwork before approving a mortgage. As the market heats up, banks will be inundated with loan inquiries causing closing timelines to lengthen. Selling now will make the process quicker and simpler.4. There Will Never Be a Better Time to Move-UpIf you are moving up to a larger, more expensive home, consider doing it now. Prices are projected to appreciate by over 19% from now to 2018. If you are moving to a higher priced home, it will wind-up costing you more in raw dollars (both in down payment and mortgage payment) if you wait. You can also lock-in your 30 year housing expense with an interest rate in the low 4’s right now. Rates are projected to be over 5% by this time next year.5. It’s Time to Move On with Your LifeLook at the reason you decided to sell in the first place and determine whether it is worth waiting. Is money more important than being with family? Is money more important than your health? Is money more important than having the freedom to go on with your life the way you think you should?Only you know the answers to the questions above. You have the power to take back control of the situation by putting your home on the market and pricing it so it sells. Perhaps, the time has come for you and your family to move on and start living the life you desire. That is what is truly important. ____________________________________________________  For more great information you can share with your clients about the opportunities available this spring, start your 14-day free trial of KCM and download our 10 page eGuide, "Things to Consider When Selling Your House". |

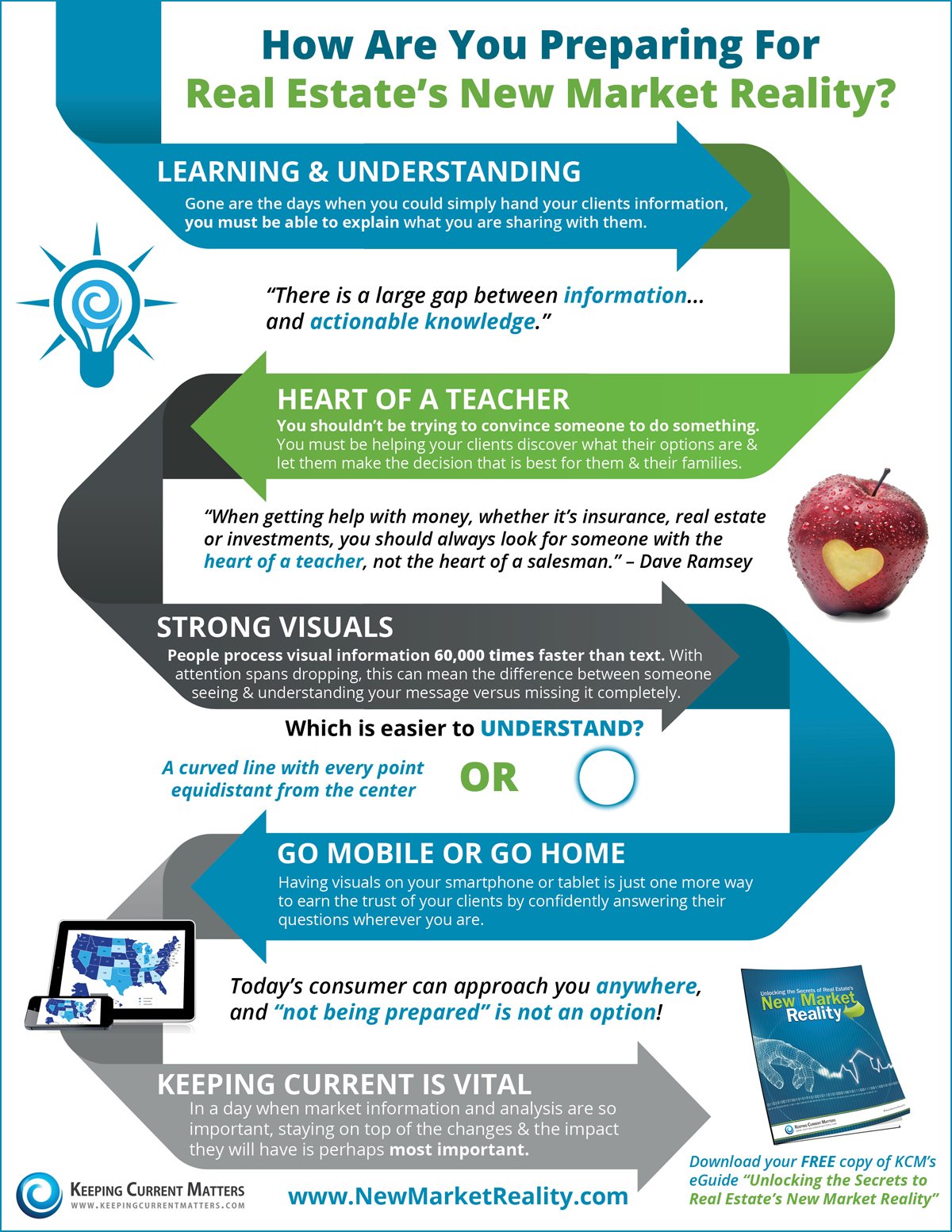

Real Estate's New Market Reality [INFOGRAPHIC]

June 13, 2014

| Real Estate's New Market Reality [INFOGRAPHIC] Posted: 13 Jun 2014 04:00 AM PDT  Download your FREE copy of KCM's eGuide, "Unlocking the Secrets to Real Estate's New Market Reality" |

5 Reasons to Hire a Real Estate Professional [INFOGRAPHIC]

June 6, 2014

| 5 Reasons to Hire a Real Estate Professional [INFOGRAPHIC] Posted: 06 Jun 2014 04:00 AM PDT  |

Real Estate Listings:You Can’t Sell What You Don’t Have

June 5, 2014

| Real Estate Listings:You Can’t Sell What You Don’t Have Posted: 05 Jun 2014 04:00 AM PDT  Some housing experts are concerned that the housing recovery seems to be stalling. Some are blaming the one percent increase in mortgage interest rates since the first quarter of last year. Others are pointing at an economy that is improving but only at a snail’s pace. Still, others are questioning whether homeownership is even considered by some to still be part of the American Dream. However, there is great evidence that the true reason home sales aren’t stronger is because we lack inventory in the vast majority of markets across the country. Here are a few reasons why we believe this to be true: Buyers Are Searching the Internet for Homes in Record NumbersTrulia, a major online residential real estate site for home buyers that lists properties for sale, recently reported that it is experiencing record levels of traffic as the spring buying season kicks into high gear. The site reached a record number of unique visitors in April with nearly 50 million.Buyers Are Physically Out ShoppingThe number of potential home buyers physically looking at homes is increasing. The National Association of Realtors (NAR) measures this each month in a data point they call “foot traffic”. Foot traffic measures the number of homes being shown by agents. That number has increased for each of the last three months and has doubled over that period of time.Inventory Levels are BELOW Historic NormsHistory shows us that a balanced real estate market requires a six month supply of available housing inventory. We have not reached that mark in over two years. Though inventory numbers are improving, the recent increase in buyers now looking will again put a strain on this number. That is why today at 2PM EST, we are hosting a special webinar for real estate professionals; The 5 Elements of the Perfect Listing Presentation. Agents can reserve their seat here.Bottom LineWhile inventory levels remain below historic norms, it will remain a seller’s market. This being the case, if you are considering selling your home, now may be the time to list it for sale. |

Pent-Up Buyer & Seller Demand about to be Released?

June 4, 2014

| Pent-Up Buyer & Seller Demand about to be Released? Posted: 04 Jun 2014 04:00 AM PDT  American consumers’ perception of the residential real estate market was revealed in a recent survey by Edelman Berland. They interviewed 2,500 Americans who are “in the market” to buy or sell a home. Respondents were between 25-64 years old with a household income of at least $50,000. Here are the key findings of the survey: BELIEF in the HOUSING MARKETThere is a strong belief among this segment of the population that the housing market is on the right track and that is committing almost 7 out of 10 to buy or sell a home this year. Millennials belief in real estate is actually higher than the overall population.

CHALLENGESThe extreme weather faced by much of the U.S. definitely delayed many real estate transactions. That pent-up demand is now being released causing price appreciation in many regions of the country. This rise in prices and the expected increase in interest rates is causing many purchasers to buy sooner than later.

Other interesting findings from the survey (broken down by buyers and sellers):Buyers

Sellers

Bottom LineThe real estate market will continue to gain ground through the summer as more and more people realize this is a great time to move. And, the vast majority (88%) of those surveyed realized that hiring a real estate professional is important to their home buying or selling success. |

June is National Homeownership Month!!

June 3, 2014

| June is National Homeownership Month!! Posted: 03 Jun 2014 04:00 AM PDT  National Homeownership Month actually started as a week-long celebration of homeownership during the Clinton administration in 1995. In 2002, President George W. Bush proclaimed June as the National Homeownership Month. Here is an excerpt from his proclamation: “Homeownership is an important part of the American Dream…A home provides shelter and a safe place where families can prosper and children can thrive. For many Americans, their home is an important financial investment, and it can be a source of great personal pride and an important part of community stability.” “Homeownership encourages personal responsibility and the values necessary for strong families. Where homeownership flourishes, neighborhoods are more stable, residents are more civic-minded, schools are better, and crime rates decline.” “During National Homeownership Month, I encourage all Americans to learn more about financial management and to explore homeownership opportunities in their communities. By taking this important step, individuals and families help safeguard their financial futures and contribute to the strength of our Nation.” Help celebrate National Homeownership Month by posting the above photo on your social media accounts, blogs and newsletters. |

© All Rights Reserved