Phil's Blog

Moving-Up? Do it NOW not Later

February 25, 2014

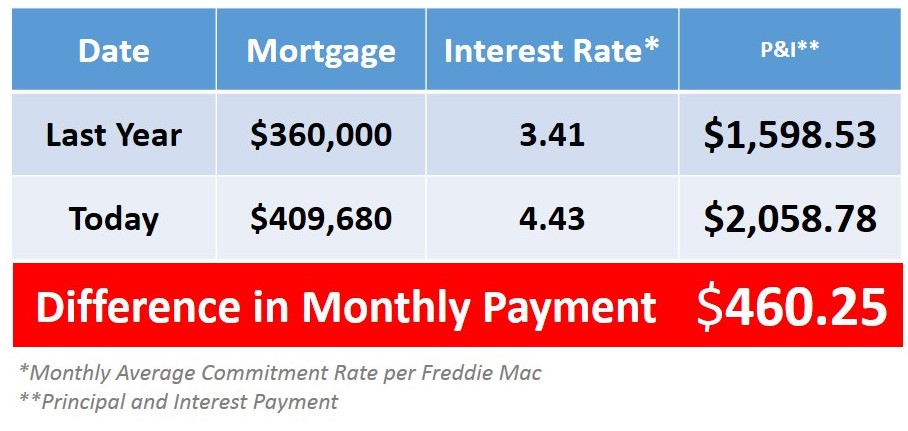

| Moving-Up? Do it NOW not Later Posted: 25 Feb 2014 04:00 AM PST  A recent study revealed that the number of existing home owners planning to buy a home this year is about to increase dramatically. Some are moving up, some are downsizing and others are making a lateral move. Another study shows that over 75% of these buyers will, in fact, be in that first category: a move-up buyer. We want to address this group of buyers in today’s blog post. A recent study revealed that the number of existing home owners planning to buy a home this year is about to increase dramatically. Some are moving up, some are downsizing and others are making a lateral move. Another study shows that over 75% of these buyers will, in fact, be in that first category: a move-up buyer. We want to address this group of buyers in today’s blog post.There is no way for us to predict the future but we can look at what happened over the last year. Let’s look at buyers that considered moving up last year but decided to wait instead. Assume they had a home worth $300,000 and were looking at a home for $400,000 (putting 10% down they would get a mortgage of $360,000). By waiting, their house appreciated by 13.8% over the last year (national average based on the Case Shiller Pricing Index). Their home would now be worth $341,400. But, the $400,000 home would now be worth $455,200 (requiring a mortgage of $409,680). Here is a table showing what additional monthly cost would be incurred by waiting:  Prices are projected to appreciate by over 4% and interest rates are also expected to rise by as much as another full percentage point. If your family plans to move-up to a nicer or bigger home this year, it may make sense to move now rather than later. ____________________________________________________________________ In the two most recent editions of KCM, we have broken down the Cost of Waiting for Move-Up Buyers. Members can login now to download this information today. If you're not a KCM Member yet, start your free trial to add materials like this to your business. |

© All Rights Reserved